Prices

July 30, 2015

Hot Rolled Futures: The Other Shoe

Written by Andre Marshall

The following article on the hot rolled coil (HRC), busheling scrap (BUS), iron ore and financial futures markets was written by Andre Marshall, CEO of Crunch Risk LLC and our Managing Price Risk I & II instructor. Here is how Andre saw trading over the past week:

Financial Markets:

Well we did indeed put in a new high on the S&P 500 (U.S. equity) as suspected at 2126, that on July 20th, and we put in a higher low following that on July 27th at 2056 zone. So, the market looks healthy chart wise. So far the market has shrugged off Grexit, and now some heavy bad news out of China re their stock market. We’re headed higher basis that, probably the next target is the 2225 zone before any retracement. We are last either side of 2103 on the active future.

Commodities have had some serious volatility as liquidity struggles in this uncertain environment (this has been true in our little futures market in steel as well). Copper from its May 5th recent high of $2.954/lb has lost 20% of its value to its recent low. Strong downward resistance channel has formed. We are last either side of $2.37/lb. on the September future. And Crude is a similar story since its May 6th recent high of $64.45/bbl. Crude has lost almost 27% of its value. The September future is either side of $ 48.50/bbl last. We probably will see a rebound in all these commodity markets before they attempt to move lower still as they have moved down so fast. See, it’s not just ferrous.

Steel:

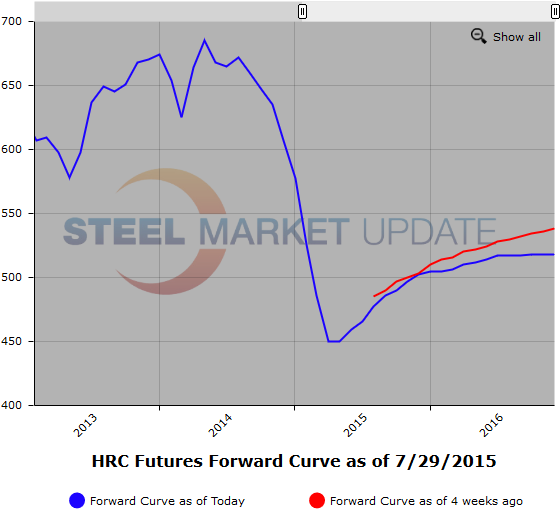

We had a decent week in HR futures with 1214 lots or 26,280 short tons (ST) trading. The Other Shoe finally dropped with the trade case announcement. Upon the announcement, the market took little time to react, shooting up approx. $15-$18/ST from prior trade levels on all months from Sep’15 through March’16. This puts September last @ $490/ST, Q4 last @ $495/ST, Q1 last @ $508/ST and Cal ’16 either side of $512/ST. Meanwhile CRU came out flat, down $1/ST at $467/ST. Although a much poorer fundamental story than HDG or CRC, HRC will most certainly get dragged up by its brethren in the coming weeks.

Below is a graphic of the HRC Futures Forward Curve. The interactive capabilities of the graph can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.

Iron Ore:

Big mover from yesterday from day prior, Iron Ore popped up in the front end of the curve about 6%, trading @ $55.30/dmt. It appears port stocks might be starting to get pinched. Everyone watching what Chinese steel mills do in a world that just doesn’t need their production. If actual real closure implied effect is bearish Iron Ore, but it could also be viewed as bullish if Iron Ore capacity cuts ultimately have to follow. This phenomenon will happen, but just not right now when port stocks are in need of replenishment. In Cal’16 market is last offered @ $44.75/MT and Cal’17 is last offered @ $44.25/MT. they are both up over a $1/MT from yesterday, but very close to their lows and demonstrating a healthy backwardation to the front end of the curve. Tone still bearish here despite the recent front end move.

Scrap:

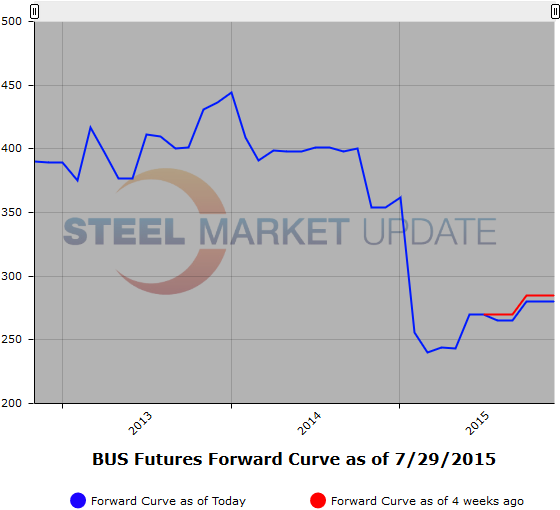

Latest Turkish CFR price reported @ $233/MT. This has been holding sideways the last few days after moving up from $227/MT. The front end of the CME BUS futures curve is currently quoted at mid settlement of $265/GT. Talk is scrap should be down in August, but opinion differs widely as to whether down big or more modest. Despite recent positive sentiment events, some are calling for down big, even on Shred. Summer schedules could have something to do with it while others think inventory was built up in anticipation of potential strikes, even though import data of slabs suggests otherwise. No one really seems to know however, uber bearishness continues, despite its poor track record the last couple of months.

Another graphic is below, to use it’s interactive features you must visit this page on our website.