Prices

November 17, 2015

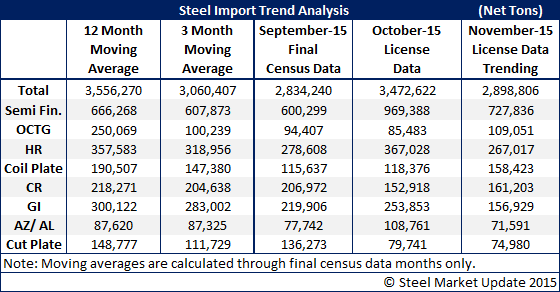

November Imports Trending Toward 2.9 Million Tons

Written by John Packard

Late Tuesday afternoon the U.S. Department of Commerce released import license data through the 17th of the month. Based on the licenses received during the first 17 days of the month, November is trending toward a similar month, September, at approximately 2.8 million net tons. Remember, this is only a trend based on the license data and not a prediction of the final end of the month census data.

As you can see from the table provided below, we are seeing reductions in all of the flat rolled products named in trade suits. hot rolled is trending toward being 100,000 tons lower than the 12 month moving average, cold rolled about 50,000 tons lower, galvanized almost 150,000 tons lower and Galvalume about 70,000 tons lower.

What still appears to be on the high side are semifinished imports which all go to the domestic steel mills. In October we saw semi’s at almost 1 million net tons. The 12 month moving average is 666,000 tons per month and the trend for November semi’s is about 700,000 tons.

If you wish to explore this data in more detail, visit the Imports History page on the Steel Market Update website here. If you have any questions you may reach us at info@SteelMarketUpdate.com or at (800) 432 3475. If you would like to become a Steel Market Update subscriber you can do so by clicking here and if you would like to trial our newsletter/website you can do so by clicking here.