Government/Policy

January 12, 2016

Brazil Hit with CVD and Critical Circumstances on Hot Rolled

Written by John Packard

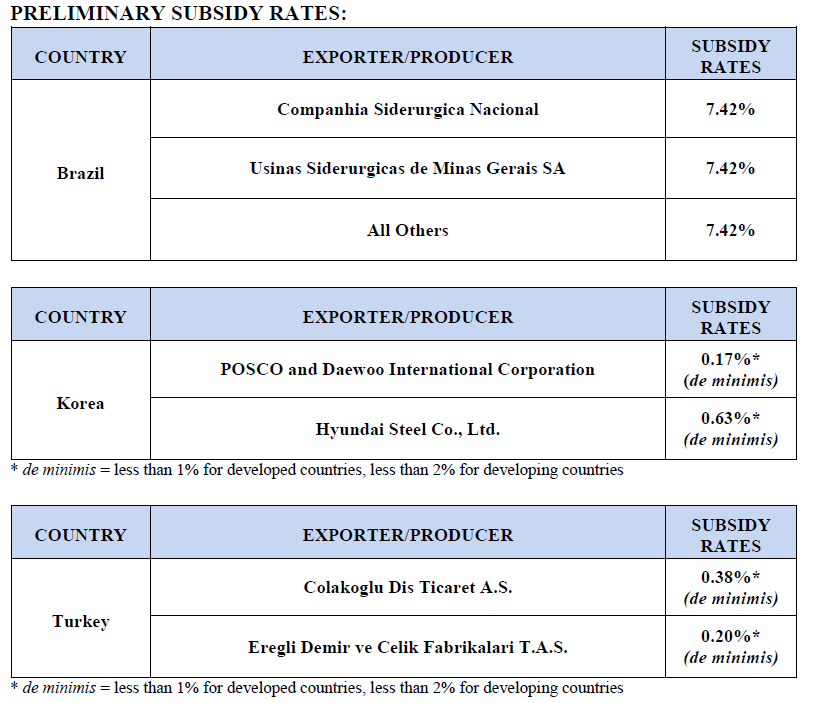

The U.S. Department of Commerce issued their Preliminary Determination on countervailing duties (CVD) of hot rolled coil from Brazil, Turkey and South Korea. Affirmative results were found against Brazil with CSN and Usiminas both receiving subsidy rates of 7.42 percent. All other Brazilian mills not named also received 7.42 percent subsidy rates. Turkey and South Korea received negative preliminary determinations meaning either no subsidies were found or they were at de minimis rates of less than 1 percent.

Brazil was also found to have surged exports to the United States and critical circumstances were found. This means that cash deposits will be due 90 days prior to the publishing of today’s results in the Federal Register. No critical circumstances were found for Turkey or Korea.

Here is a portion of the press release received this evening from the International Trade Administration:

On January 11, 2016, the Department of Commerce (Commerce) announced its affirmative preliminary determinations in the countervailing duty (CVD) investigation of imports of certain hot-rolled steel flat products from Brazil, and its negative preliminary determinations in the CVD investigations of imports of certain hot-rolled steel flat products the Republic of Korea (Korea), and the Republic of Turkey (Turkey).

• The CVD law provides U.S. business and workers with a transparent and internationally accepted mechanism to seek relief from the market distorting effects caused by injurious subsidization of imports into the United States, establishing an opportunity to compete on a level playing field.

• For the purpose of CVD investigations, countervailable subsidies are financial assistance from foreign governments that benefit the production of goods from foreign companies and are limited to specific enterprises or industries, or are contingent either upon export performance or upon the use of domestic goods over imported goods.

• In the Brazil investigation, Commerce preliminarily determined that mandatory respondents Companhia Nacional Siderurgica (CSN) and Usinas Siderurgicas de Minas Gerais SA (Usiminas) both received a subsidy rate of 7.42 percent. All other producers/exporters in Brazil have been assigned a preliminary subsidy rate of 7.42 percent.

• In the Korea investigation, Commerce preliminarily determined that mandatory respondents POSCO and Daewoo International Corporation and Hyundai Steel Co., Ltd. received subsidy rates of 0.17 percent and 0.63 percent, respectively, which are both de minimis. Because the preliminary determination is negative, no “all others” rate has been applied to any other producers/exporters in Korea.

• In the Turkey investigation, Commerce preliminarily determined that mandatory respondents Colakoglu Dis Ticaret A.S. and Eregli Demir ve Celik Fabrikalari T.A.S. received subsidy rates of 0.38 percent and 0.23 percent, respectively, which are both de minimis. Because the preliminary determination is negative, no “all others” rate has been applied to any other producers/exporters in Turkey.

• As a result of the preliminary affirmative determination for Brazil, Commerce will instruct U.S. Customs and Border Protection to require cash deposits based on the preliminary rates established for producers and exporters of certain hot-rolled steel flat products from Brazil. As a result of the negative preliminary determinations, no cash deposit will be required for imports of certain hot-rolled steel flat products from Turkey and Korea.

• Based on an allegation filed in the Brazil case, Commerce found that critical circumstances exist with regard to certain producers/exporters from Brazil of hot-rolled steel.

Where critical circumstances were found with respect to Brazil, CBP will be collect such cash deposits retroactively on entries of certain hot-rolled steel flat products up to 90 days prior to publication of the preliminary determination Federal Register notice.

• Critical circumstances are found when there has been a surge in imports over a relatively short period of time in anticipation of the possible imposition of antidumping or CVD duties. In the CVD context, a finding that exporters received subsidies that are inconsistent with the WTO Agreement on Subsidies and Countervailing Measures is also required.

• The petitioners for these investigations are AK Steel Corporation (OH), ArcelorMittal USA LLC (IL), Nucor Corporation (NC), SSAB Enterprises, LLC (IL), Steel Dynamics, Inc. (IN), and United States Steel Corporation (PA).

Here is a look at the subsidy rates as determined by the U.S. Department of Commerce in the countervailing duty complaint:

We remind our readers that trade attorney Lewis E. Liebowitz will address the flat rolled trade cases and what these decisions mean, what comes next for each and what companies can do to protect their interests. He will discuss these issues and more at our Leadership Summit Conference in Palm Beach Gardens, Florida on March 7-9, 2016. Details can be found on our website.