Market Data

March 20, 2016

SMU Survey: Widening Spreads in US vs Foreign Steel Pricing

Written by John Packard

Last week Steel Market Update conducted our second flat rolled steel market trends analysis for the month of March. We commit four days to canvass buyers and sellers of flat rolled steel. Then we put the vast majority (but not all) of the results into a Power Point presentation which we share with our Premium level members as well as those who participated in our questionnaire.

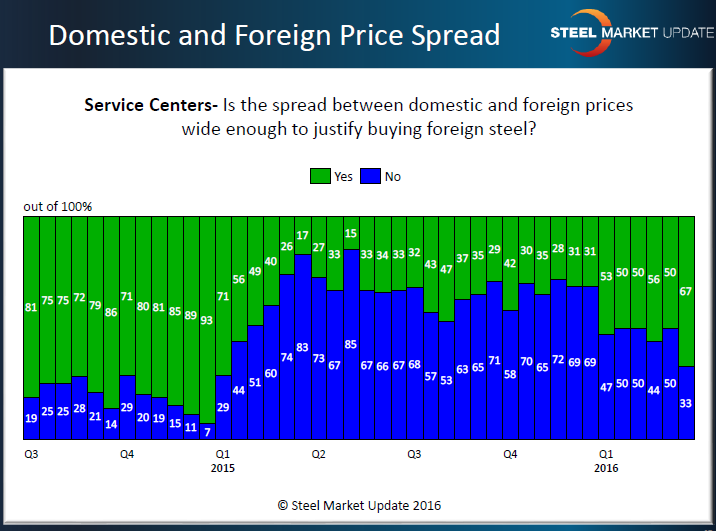

We tend to not report on the data we collect from trading companies, as well as OEM and service center steel buyers, about the status of foreign steel in the U.S. market. With the spreads expanding between domestic and foreign steel pricing, we thought it might be a good time to remind the market that even with trade suits underway there are still many foreign options available. Whether there will be another flood of imports will depend on how comfortable buyers are with the price spread and where they think domestic prices will be in the coming months.

When asked about the spread between domestic and foreign steel a majority of manufacturing company respondents (52 percent) as well as a large majority of distributors (67 percent) reported the spread wide enough to justify buying foreign steel.

We thought our Executive level readers might be interested in seeing what this looks like graphically and in a historical perspective. Here is a look at how service centers are feeling about the price spread right now:

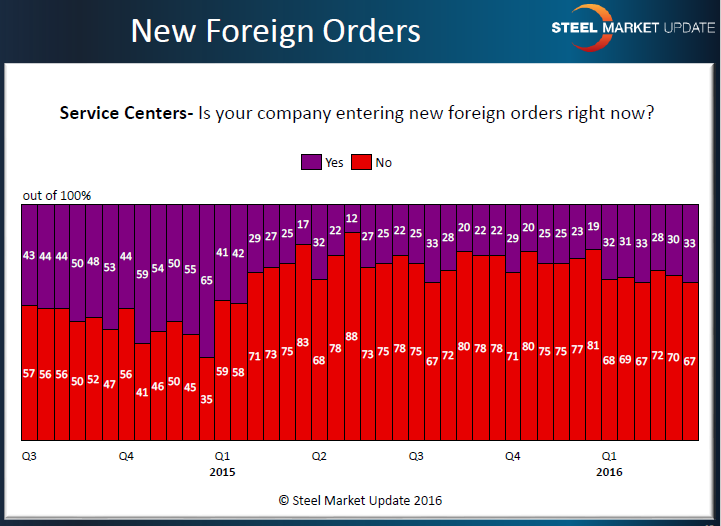

Even though the price spread has been widening recently our respondents aren’t necessarily jumping on the foreign steel bandwagon (yet). We asked our respondents if their company was entering new foreign steel orders right now and only 33 percent of the service centers responded “yes” while 30 percent of the end users reported placing new foreign orders.

Here is what that looks like from a historical perspective using the service centers as the example.

We also work with the trading companies to see how they are seeing the domestic steel markets and their ability to be successful selling foreign steel at this point in time.

Trading companies reported foreign steel pricing as rising compared to one month ago (86 percent rising prices vs. 14 percent remaining the same).

Trading companies are seeing more requests for quotes from North American buyers as 57 percent of the traders reported more quotes.

71 percent of the traders reported foreign pricing as being made at levels where business can be transacted.

There is some confusion as to whether the trade cases will impact the ability of trading companies to conduct business and service their customers in the coming months. Seventy-one percent of our respondents reported the trade suits as having affected their ability to quote and service their U.S. customers. Even so, they were unsure whether the changes in trade and enforcement legislation would impact their ability to sell foreign steel into the U.S. (83 percent did not know yet while the balance did not believe the regulations would negatively impact their business).