Prices

May 1, 2016

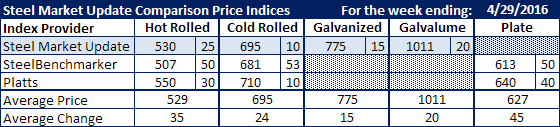

Comparison Price Indices: Flying High and Going Higher

Written by John Packard

Double digit flat rolled steel price moves seem to be a weekly occurrence over the past few weeks. Steel mills are controlling their flat rolled steel order books and restricting spot tons. Those buyers who did not recognize things were changing back in the fall when Steel Market Update began pointing out the changes in demand trends, service center inventories and Steel Buyers Sentiment, are probably having difficulties dealing with current market conditions. And yet, we still hear from some service centers that there are companies out there who don’t believe things have changed…

All of the steel indexes followed by Steel Market Update reported double digit gains for all flat rolled and plate products. SteelBenchmarket, which only produces prices twice per month, led the way with $50 or greater increases in hot rolled (+$50), cold rolled (+$53) and plate (+50) and they still lag SMU and Platts that report either weekly or daily.

For a moment during this past week, Steel Market Update and Platts were sitting at $530 per ton ($26.50/cwt) on benchmark hot rolled coil. By the end of the week Platts had taken their HRC index average to $540 per ton ($27.00/cwt) and we expect further movement higher in the coming days as buyers are telling SMU mill offers have reached the $600 per ton level.

The spread between the indexes is closer for cold rolled with SteelBenchmarker taking the more conservative position at $681 per ton with SMU ($695) and Platts ($710) leading the way.

SMU had galvanized up $15 and Galvalume up $20 on .060” G90 and .0142” AZ50, Grade 80 respectively.

Plate prices are also surging with Platts moving to $640 per ton up $40 and SteelBenchmarker moving up $50 to $613 per ton.

Hold on to your seats, prices will be moving higher from here…

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.