Market Data

May 5, 2016

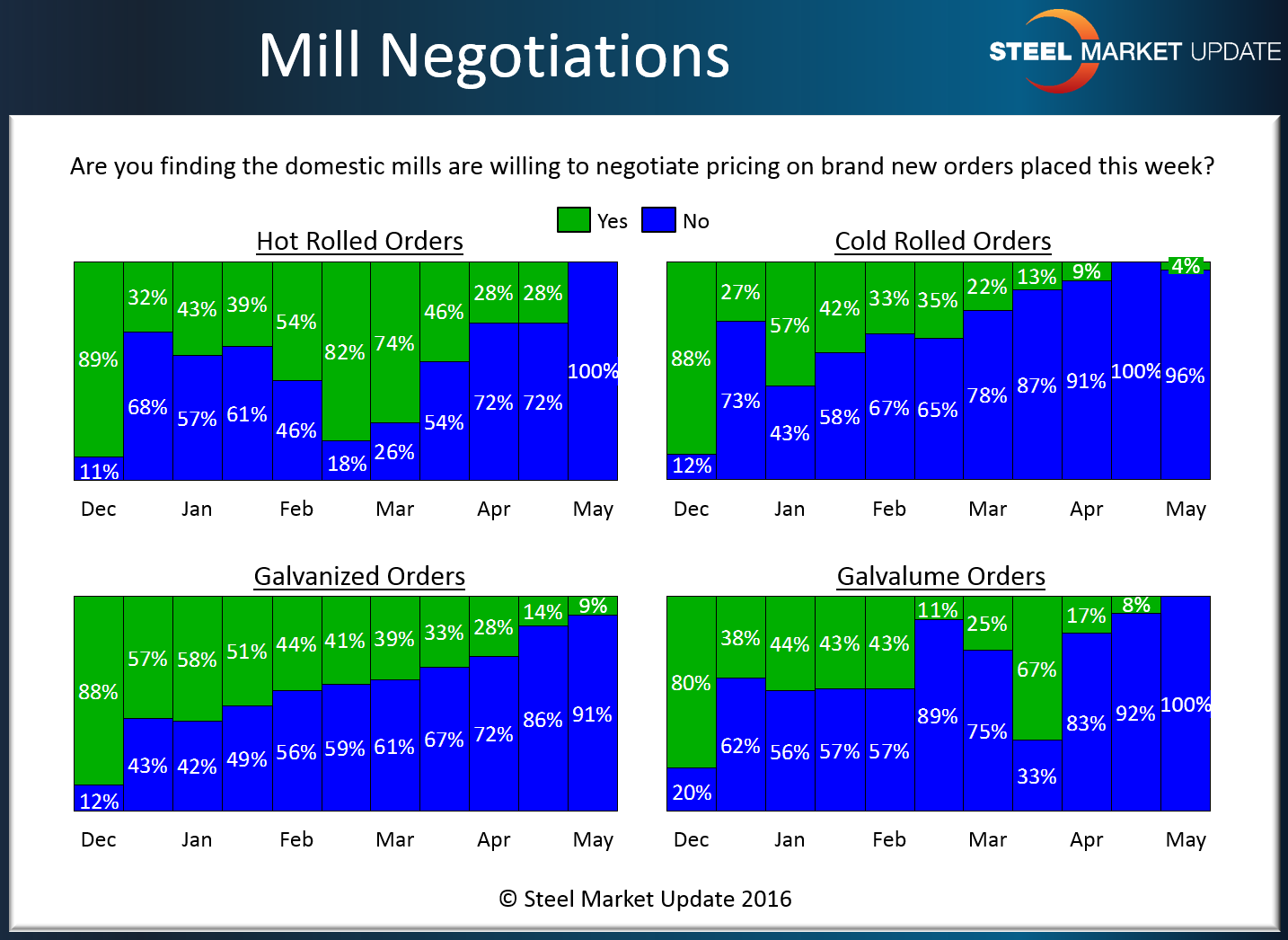

Steel Mill Negotiations: The Graphic Says it All...

Written by John Packard

Steel Market Update asks our flat rolled steel market trends analysis participants to comment on the status of negotiations between their company and their steel mill suppliers. We want to know how stringent are the mills being when it comes to collecting the announced or original quoted steel price and are they able to collect pricing without negotiation?

The dark blue bars on these four items covered (hot rolled, cold rolled, galvanized and Galvalume price negotiations) during our flat rolled steel survey process tell the story:

Hot rolled: we did not have one recipient report the mills as being negotiable. The same can be said of Galvalume. Cold rolled at 4 percent and galvanized at 9 percent were not very far from being unanimous. The domestic mills don’t need to negotiate pricing in order to collect their orders and keep their sheet mills running.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.