Market Data

August 4, 2016

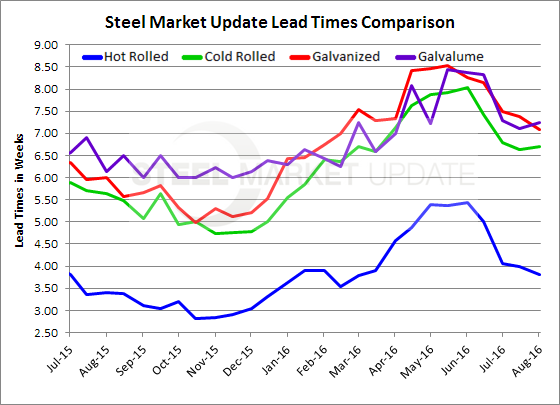

Domestic Mill Lead Times: HR Weakens, Other Products Relatively Firm

Written by John Packard

Earlier this week we began our early August flat rolled steel market trends analysis. The process began with invitations going out to approximately 570 steel executives in the manufacturing, service center/wholesaler, trading company, steel mill and toll processing communities. The invitations are purposely heavily weighted toward manufacturing and service center/wholesalers as those two segments purchase the vast majority of the flat rolled steel in North America.

One of the subject areas posed to the manufacturing and distribution segments of the industry (steel mills, trading companies and toll processors do not get these questions) are about domestic mill lead times and negotiations.

The data pulled on lead times are displayed to our readers as an “average” and are not to be construed as specific to any one steel mill. Our goal is to see what the trend is regarding the length of time it takes for a buyer to place an order and then be promised a delivery date. Lead times shown are referencing the number of weeks it takes to produce a brand new order with a domestic steel mill.

Hot rolled lead times continue to trend lower with this week results indicating that the average is now just under 4 weeks (3.80 weeks). This is down from the 4.0 weeks reported during the month of July and well below what we were seeing for lead times during the middle of May and into June when we reported 5.36 and 5.43 weeks, respectively. One year ago lead times on HR averaged 3.41 weeks. At 3.80 weeks and trending lower, we believe HR is the weakest of the flat rolled products and the one that will have the most pricing volatility over the short term.

Cold rolled lead times remained stable at just under 7 weeks (6.71 weeks) which is where they have been over the past three survey cycles going back to the beginning of July (6.79 weeks). In mid May and into early June CR lead times were at 8.0 weeks (7.92 & 8.04). One year ago CR lead times were running close to 5.5 weeks (5.65 weeks). Current lead times show the cold rolled market as still relatively firm.

Galvanized lead times were close to 7.0 weeks this week (7.08 weeks) which is down about one half a week from early July and down 1.5 weeks going back to mid-May and early June. One year ago GI lead times averaged 6.0 weeks. So, at 7.0 weeks GI as a product is still relatively firm in the market.

Galvalume lead times were reported to be averaging 7.25 weeks which is up slightly from the 7.11 weeks reported during the middle of July although, essentially unchanged from early July. The mid-May lead times were just under 8.5 weeks (8.44) while one year ago AZ lead times were averaging 6.14 weeks. Based on our analysis AZ appears to still be relatively firm in the market.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.