Market Data

September 8, 2016

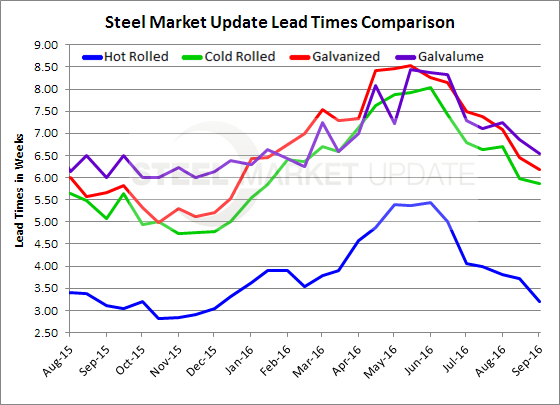

Domestic Mill Lead Times Slip Across the Board

Written by John Packard

The following information comes from our flat rolled steel market trends survey which began last Friday and concluded earlier today. Do not confuse our survey results with actual lead time sheets produced by individual steel mill locations. Based on what our respondents shared with SMU, lead times on hot rolled, cold rolled, galvanized and Galvalume all shrunk since our last analysis conducted during the middle of August 2016.

Even with the shrinkage in lead times, every product average for this week was still better than what we saw one year ago.

Hot rolled lead times were averaging more than 4 weeks as of the first week of July (4.07). HRC lead times are now averaging 3.19 weeks. In mid-August they were 3.73 weeks while one year ago the lead times on hot rolled coil averaged 3.11 weeks.

Cold rolled lead times also slipped. The new average for CRC is 5.87 weeks down almost one week compared to the beginning of August (6.71 weeks). One year ago cold rolled lead times averaged 5.08 weeks.

Galvanized lead times are averaging 6.19 weeks which is lower than the 6.45 measured during the middle of August and well below the 7.50 reported at the beginning of July. One year ago galvanized lead times averaged 5.66 weeks.

Galvalume lead times dropped to 6.55 weeks and are well below the 7.29 weeks reported at the beginning of July. One year ago AZ lead times were at 6.0 weeks.

As lead times retreat this puts pressure on the domestic steel mill order books. Shorter lead times are a signal of weaker spot prices in the flat rolled markets and that is what we have seen going back to early july.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.