Market Segment

November 18, 2016

US Flat Rolled Distributors Inventories 20.2% Lower Than Year Ago

Written by John Packard

Earlier this week the Metals Service Center Institute (MSCI) released end of October shipment and inventories data for the U.S. steel service centers.

Total steel shipments (all products) were 3,073,400 net tons which was 8.6 percent lower than October 2015 levels. The distributors shipped 146,400 tons per day which was an improvement over the 145,000 tons per day shipped during the month of September 2016. Year to date the domestic service centers have shipped 31,616,900 tons which is 7.0 percent lower than what we saw this time last year.

Inventories were reported by the MSCI to be 7,260,100 tons which is 18.4 percent lower than the same month one year ago. The number of months supply is now 2.4 months, down from the 2.5 months reported at the end of September.

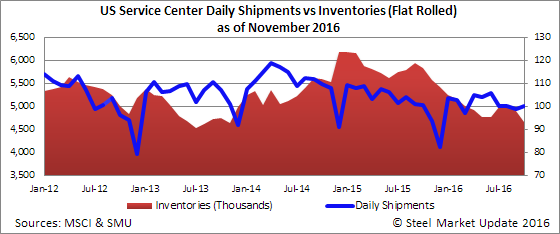

Carbon Flat Rolled

U.S. steel distributors shipped a total of 2,099,300 tons of flat rolled steel during the month of October. Shipments were slightly better than the 2,070,400 tons reported at the end of September but, were 5.1 percent lower than year ago levels. The daily shipment rate was 100,000 tons of flat rolled, an improvement of 1,400 tons per day over September 2016 and the same daily rate as what was reported for the months of July and August 2016.

Distributors inventories stood at 4,653,400 tons of flat rolled by the end of the month of October. This is 20.2 percent lower than the 5,574,600 tons reported by the MSCI for the end of October 2015. The number of months supply dropped from September’s 2.4 months to 2.2 months.

Carbon Plate

Carbon plate shipments totaled 261,100 tons during October and were 20.1 percent below year ago levels. The daily shipment rate came in at 12,400 tons per day a small improvement over the 12,200 tons per day shipped during the month of September 2016. Year to date plate shipments out of the domestic service centers totaled 2,755,300 tons which is 22.3 percent below what was reported by the MSCI for the first 10 months 2015.

Closing inventories for October were 719,600 tons and are now 22.7 percent lower than year ago levels (931,000 tons). The number of months supply as of the end of October stood at 2.8 months down from 3.0 months reported at the end of September.

Carbon Pipe & Tube

The U.S. service centers shipped a total of 179,000 tons of pipe and tube products during the month of October, down 19.0 percent from year ago levels. The shipment rate was 8,500 tons per day which was lower than the 8,900 tons per day shipped during the month of September. Year to date the U.S. distributors of pipe and tube have shipped 1,960,300 tons which is 12.0 percent lower than year ago levels.

Pipe and tube inventories stood at 459,600 tons at the end of October and were a whopping 28.8 percent lower than year ago levels (645,300 tons). The number of months supply remained at 2.6 months according to the MSCI.