Market Data

February 2, 2017

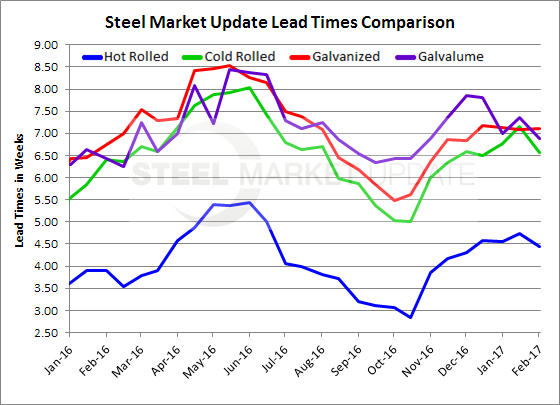

Steel Mill Lead Times Flat to Slightly Shorter

Written by John Packard

Flat rolled lead times at the domestic steel mills were essentially flat to slightly shorter based on the respondents to the Steel Market Update (SMU) flat rolled market trends survey completed earlier today. Steel buyers are quick to react to shorter lead times by requesting spot price reductions in their negotiations with the steel mill suppliers.

Hot rolled lead times dropped from 4.73 weeks to 4.45 weeks. This is not a major move but it is the first time in many months where we have seen a drop of 0.25 weeks or greater. One year ago HRC lead times out of the domestic steel mills averaged 3.90 weeks.

Cold rolled lead times dropped even more moving from the 7.15 weeks reported in mid-January to 6.57 weeks. This is a change of a half a week (.58) and, like HR, it is the first major drop in many months. Last year CRC lead times were reported by SMU to average 6.41 weeks (or about the same as what we are seeing today).

Galvanized lead times were essentially unchanged at just over 7 weeks (7.10). Last year GI lead times averaged 6.74 weeks, one quarter of a week less than what we are reporting today.

Galvalume lead times also dropped from the 7.36 weeks recorded in our mid-January survey to 6.89 weeks today. This is essentially one half a week shorter than mid-January (0.47). One year ago AZ lead times were reported to average 6.43 weeks.

The shorter lead times may well be affecting the spot price negotiations the mills are having with their customers.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.