Prices

March 2, 2017

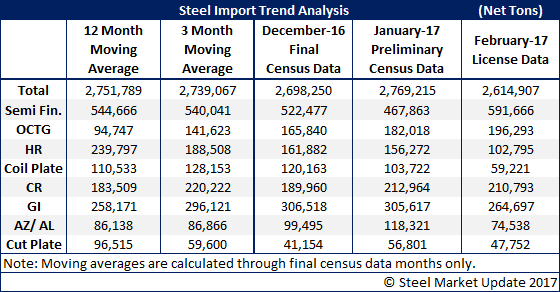

January Imports 2.8 Million Tons, February 2.6 Million Tons

Written by John Packard

On Tuesday, the U.S. Department of Commerce released Preliminary Census Data for January showing steel imports were just shy 2.8 million net tons for the month (2,769,215 tons). The February license data, which was also updated through the last day of February was down slightly from the January levels at 2,614,907 net tons.

Of interest in the numbers is how hot rolled imports have dropped, coming in at 156,272 tons in January and 102,795 tons in February. When you consider there are a couple of domestic steel mills that import hot rolled as feed stock for their mills, the February number is quite extraordinary.

We also saw significant declines in coiled plate, cut to length plate and the numbers were down slightly on “other metallic” (most being Galvalume).

Items that are still higher than expected considering the number of trade suits on these products are cold rolled (212,964 tons in January and 210,793 tons in February). SMU is of the opinion that the cold rolled and galvanized tonnages are higher than what would be expected due to the higher than normal spread between hot rolled and cold rolled/coated base prices. CR and GI are approximately $100 per ton higher than normal and the extra spread allows foreign steel to come in at competitive numbers that would, in normal times, be not so competitive with the $100 removed.