Market Data

August 8, 2017

Market Sends Mixed Signals on Demand

Written by Tim Triplett

Flat rolled steel buyers are fairly optimistic about their chances for success in the current market, though the various metrics Steel Market Update uses to gauge future demand are sending mixed signals. One likely cause is the uncertainty injected into the market by the Trump administration’s now-delayed Section 232 investigation.

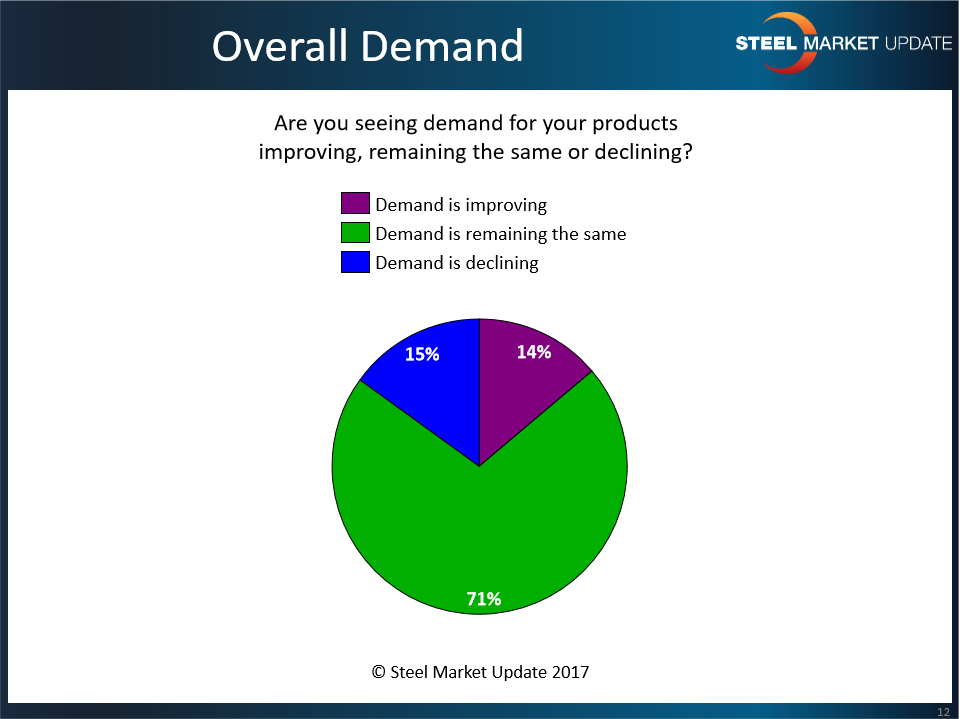

According to the latest SMU Flat Rolled Market Trends Analysis, steel demand has been generally flat since the early second quarter. About 70 percent of respondents to the early August questionnaire report that demand remains about the same. An equal and offsetting number say they see demand improving or declining.

Noted one service center executive, some customers have already purchased the steel they will need through the end of the year. “Quoting activity is very soft right now,” he said. “People don’t want to buy now. If they thought the next price move was up, they would belly up to the table to buy steel. I can’t imagine prices going anywhere but down from here.” Added another, “The market is somewhat of a mixed bag. Many customers bought heavily in anticipation of a Section 232 ruling in July and now have retreated to the sidelines, which means reduced order activity over the next 30-60 days.”

One gauge of market demand is the willingness of mills to negotiate on pricing. The stronger the demand, the less likely steel producers are to talk price. Only 10 percent of respondents to SMU’s questionnaire say order books are firm and mills are not willing to negotiate at all. Nearly 90 percent say that at least some mills, if not most, are open to price discussions. That suggests some weakness in steel demand heading into the third and fourth quarters.

“The perceived market varies from mill to mill,” commented one steel buyer. “The quoted price can vary wildly depending on whether the mill believes you’re just shopping, or if you have legitimate tons to place. There are a lot of ‘price-check’ quotes out there as people try to determine market direction since the announced Section 232 delay.”

SMU is also hearing from more steel buyers advising that we should expect a new price increase out of the domestic mills, possibly as soon as this week. More mixed messages when comparing some of the comments being made in our daily contacts compared with what we gathered last week from well over 100 active buyers and sellers of steel.

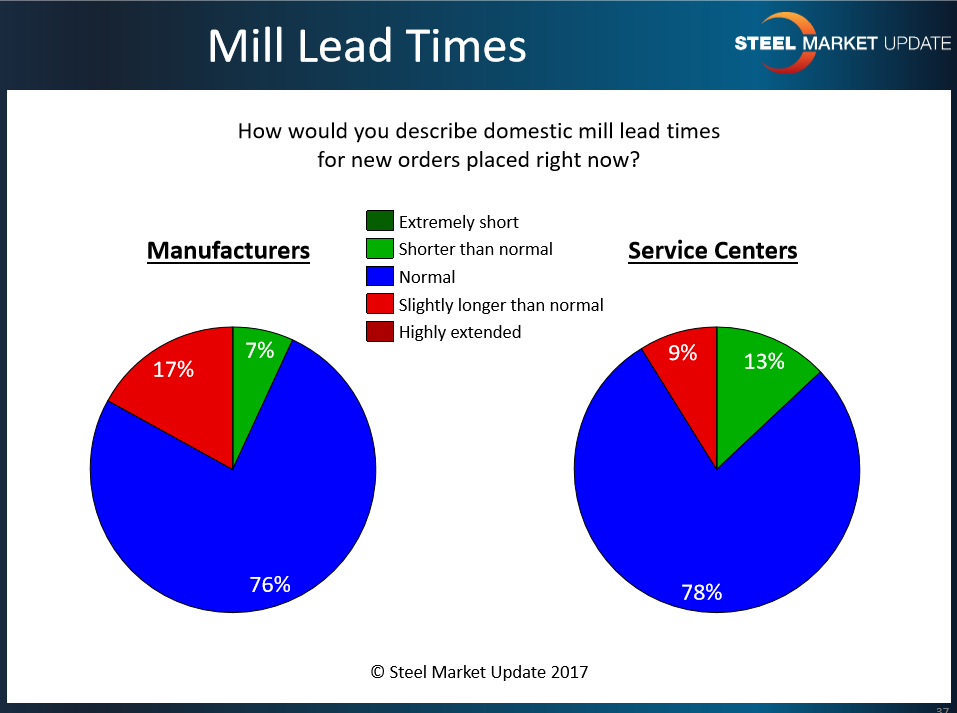

Service centers generally describe mill lead times as normal for this time of year. Manufacturers say lead times have been slightly longer than normal for the past two months but are shortening, which also points to a possible easing in demand.

Inventory levels are another indicator of demand. Few service centers say they need to build inventories at this point. Most, about 73 percent, say their inventory levels are fine. About 23 percent say they have too much material and are looking to reduce stock levels. Destocking by some distributors could further ease demand in the coming months. “Inventory is too high, and with a lack of clarity on market direction, we’re inclined to work it down until we see some end-of-year deals,” said one service center executive. We have more about inventories at the service centers in today’s issue of Steel Market Update.

Ninety percent of the manufacturers responding expect demand for their products to remain the same or increase marginally in the next three to six months. Most are satisfied with their current stock levels, but about 17 percent are planning to reduce flat roll inventories, which could add to a slackening in demand. As one manufacturer said, “We were building inventory and pulling future demand ahead due to Section 232, so I’m expecting in the fall we will have to reduce orders accordingly to bring inventory back down.”

Meanwhile, the Trump administration appears to be in no hurry to make a decision on Section 232, which would restrict steel imports on national security grounds. The mere threat of new tariffs or quotas is inhibiting imports and giving support to domestic steel prices. But many find the lingering uncertainty troubling.

“For months, we’ve said that if we only knew what was happening with 232, we’d be in a better position to manage our business and help our customers,” said one service center executive. “Now that we know it’s delayed, we don’t feel any less confused in the short-term. In the medium-term, we don’t see any change from the fundamentals of early 2Q when the market began to drift downward.”

By Tim Triplett Tim@SteelMarketUpdate.com.