Market Segment

September 19, 2017

MSCI: Carbon Flat Rolled Down to 2.0 Months of Supply

Written by John Packard

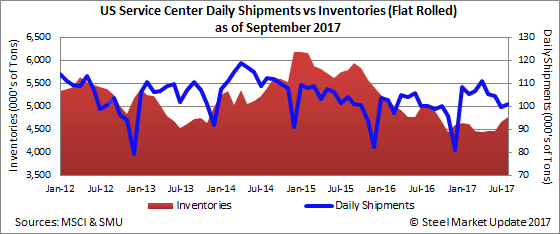

The Metals Service Center Institute (MSCI) reported carbon flat rolled steel inventories as growing in August compared to the end-of-July 2017 data, but still below August 2016 levels. MSCI data shows the number of months of flat rolled supply at very low levels.

This week, MSCI reported total steel shipments (all products) during August out of U.S. service centers at just under 3.5 million tons. This represents a 2.7 percent improvement over August 2016 shipment levels. The daily shipment rate was 1,200 tons per day higher than what was reported for the month of July.

Both August 2017 and August 2016 had 23 shipping days.

Total steel inventories in August increased above end-of-July levels by 157,300 tons to 7.7 million tons. The number of months of supply on hand at the end of August was calculated by MSCI as 2.2 months. This is down from the 2.5 months of supply reported as of the end of July (non-seasonally adjusted).

Carbon Flat Rolled Months of Supply Down to 2.0 Months

MSCI reported carbon flat rolled shipments during August at 330,800 tons higher than July and approximately 21,000 tons above August 2016 levels. Shipments were 0.90 percent better than a year ago. The daily shipment rate was 900 tons a day better than year-ago levels.

For the year, total carbon flat rolled shipments were 2.4 percent above the first eight months 2016. There has been a steady decline in year-over-year shipment comparisons, which began the year at 9.7 percent above 2016 levels.

Flat rolled inventories rose by approximately 108,000 tons, yet are 5.3 percent below year-ago levels. The number of months of supply dropped on a non-seasonally adjusted basis to 2.0 months.

Carbon plate shipments were reported by MSCI at just below 300,000 tons for the month of August. The daily shipment rate at 13,000 tons per day was the same as the prior month and just 100 tons per day above year-ago levels. For the first eight months 2017, plate shipments were 5.7 percent above year-ago levels.

Inventories of plate stood at 832,900 tons, which is 0.30 percent above year-ago levels. The number of months of supply dropped to 2.8 months on a non-seasonally adjusted basis.

Carbon Pipe and Tube

MSCI reported pipe and tube shipments as 31,000 tons higher than July, but just slightly below 2016 levels. The daily shipping rate was 100 tons per day lower than August 2016 levels.

Inventories remained essentially unchanged and were 9.5 percent lower than 2016 levels. The number of months of supply dropped to 2.3 months on a non-seasonally adjusted rate.