Prices

October 5, 2017

Cold Rolled, Coated Imports Continue to Surge

Written by Paul Lowrey

Despite the major flat rolled trade cases concluded in 2016, flat rolled steel imports continue to surge. Coated imports are at their highest levels ever and cold rolled imports are near record levels. This article, by Paul Lowrey of Steel Research Associates, provides some historical context to the current situation.

This analysis includes all products in coil form (hot rolled, cold rolled, all coated, and tin mill products), but excludes stainless grades. Some adjustments to the reported data are necessary. First, some of the hot rolled imports are feedstock to Western mills that convert it to cold rolled, coated and tin mill products. These imports have been excluded from “market” or “trade” imports on the same basis that imported semi-finished products are excluded from apparent supply. Second, in calculating the percentage of total supply, AISI reported domestic shipments were adjusted for non-reporters.

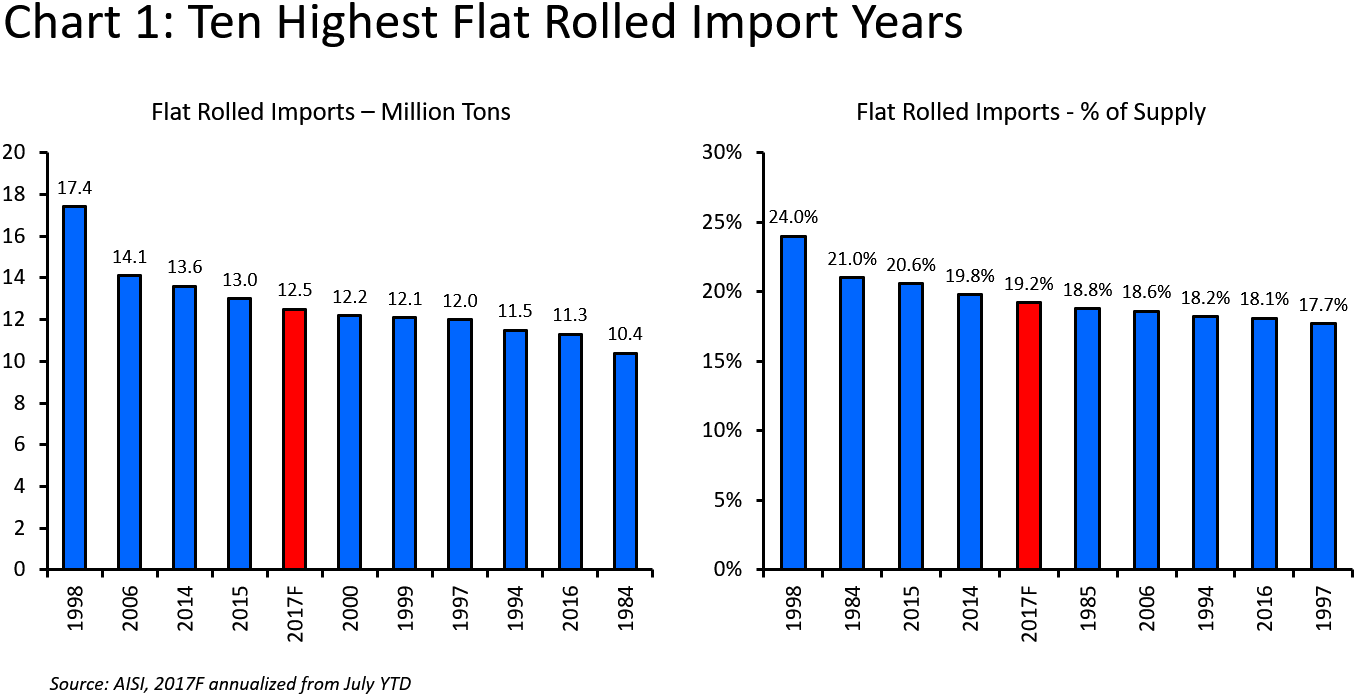

Chart 1 shows the 10 highest flat rolled import years – both in tons and as a percentage of apparent supply (please note the years are different in each of the bar charts). As shown, 2017F (annualized basis) would be the fifth highest year on record under both measurements. In fact, each of the last four years are in the top 10 years of highest import levels. While 1998 stands out as the all-time record, it requires some interpretation. Hot rolled was 10.7 million tons of the total 17.4 million tons of flat rolled imported in that year.

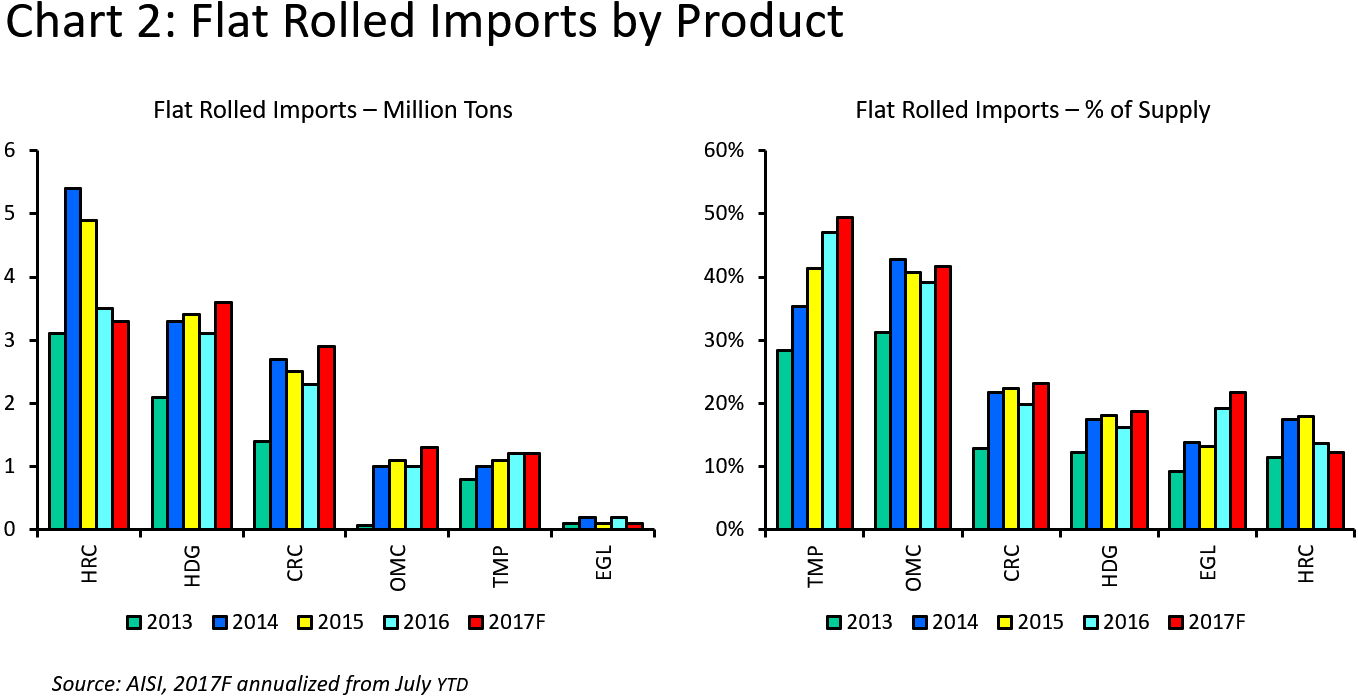

Hot rolled, cold rolled and hot-dipped galvanized make up about 90 percent of the total flat rolled market. Accordingly, the imported tons are concentrated in these three product categories. Chart 2 shows flat rolled imports by product type for the last five years. Again, the data is expressed in both tons and percentage of apparent supply.

As shown, hot rolled imports have been trending down due to weak market conditions for this product (energy, off-highway equipment, etc.). Cold rolled and all coated products are trending up. Hot-dipped galvanized (HDG), other metallic coated (OMC), and tin mill products (TMP) are trending to their highest import levels ever in 2017. Cold rolled, while not at record levels, is also trending up.

As you all know, three major trade cases (hot rolled, cold rolled and coated) were completed in 2016. So, what happened? As mentioned, hot rolled imports have been trending down probably due more to weak market conditions, but also the impact of the trade case. Cold rolled and coated continue to surge. In some cases, producers in the subject countries have simply absorbed the duties. In most cases, however, the imports have switched to other countries that were not included in the trade case. Also, some of the imports are also probably in anticipation of a Section 232 action.

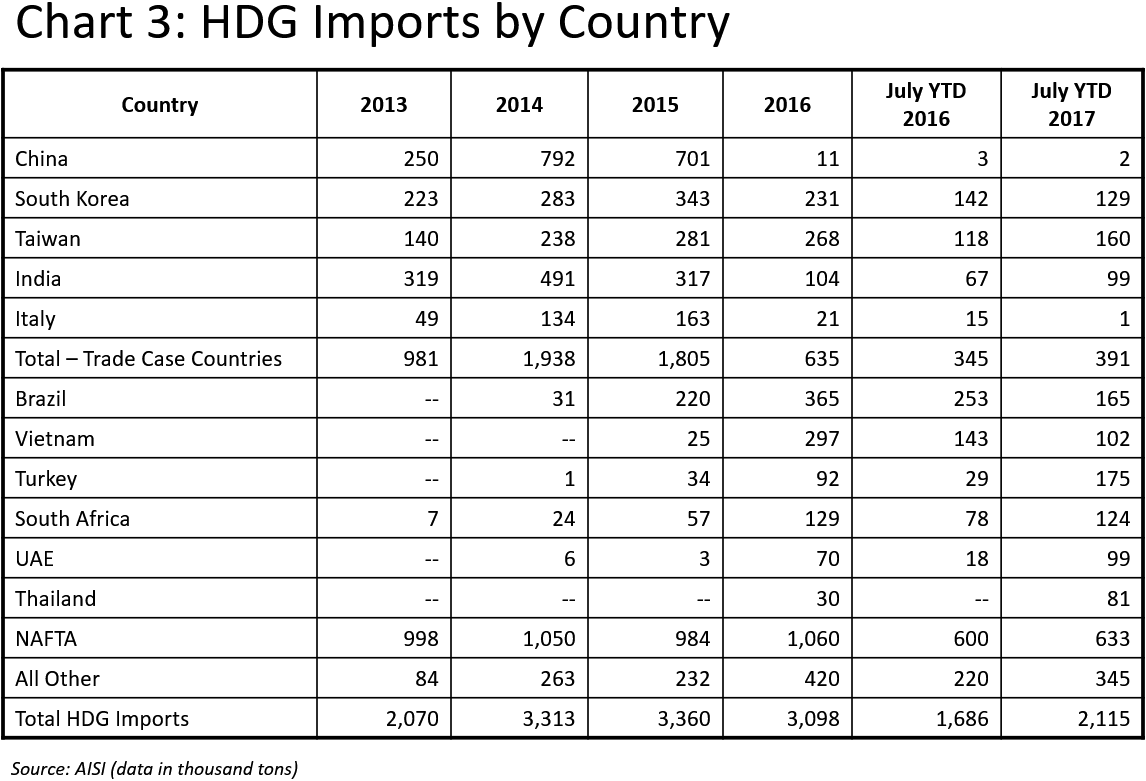

Let’s take hot-dipped galvanized as an example. Chart 3 shows HDG imports by country over the last couple of years.

Total imports from the subject countries has dropped significantly, but not equally due to the different tariffs. For example, Taiwan was assessed a dumping margin of 10.34 percent and no subsidy rate. China, on the other hand, was assessed a dumping margin of 209.97 percent plus subsidy rates ranging from 39.05 percent to 241.07 percent. While imports from the subject countries have declined, imports from several other countries have grown dramatically. This includes Brazil, Vietnam, Turkey, South Africa, UAE, and Thailand. Of these countries, Vietnam is the subject of a circumvention suit with a preliminary determination due in several weeks.