Market Data

December 7, 2017

Steel Mill Negotiations: Talks Tightening?

Written by Tim Triplett

Buyers of flat rolled steel report that domestic steel mills are tightening up negotiations a bit on spot pricing, especially on cold rolled and coated products, as would be expected following the price increases announced two weeks ago. But the majority report that mills are still generally open to price discussions as the year comes to a close.

About 18 percent of respondents to SMU’s latest steel market questionnaire say order books are firm and there’s no negotiation. About the same percentage have found order books weaker than advertised and mills willing to negotiate. Most, about 64 percent, report mixed responses from mills in price talks. “Deals are there to be made, not drastic deals, but prices are not as advertised,” said one buyer. It depends on the product, added another. “HRC is more stable on the West Coast. CRC and coated are dependent on buyer and quantity.”

It is SMU’s opinion that some of the “mixed” feelings about negotiations are due to whether a particular mill has “holes” in its November or December order books that it is trying to fill (thus willing to negotiate pricing on that hole).

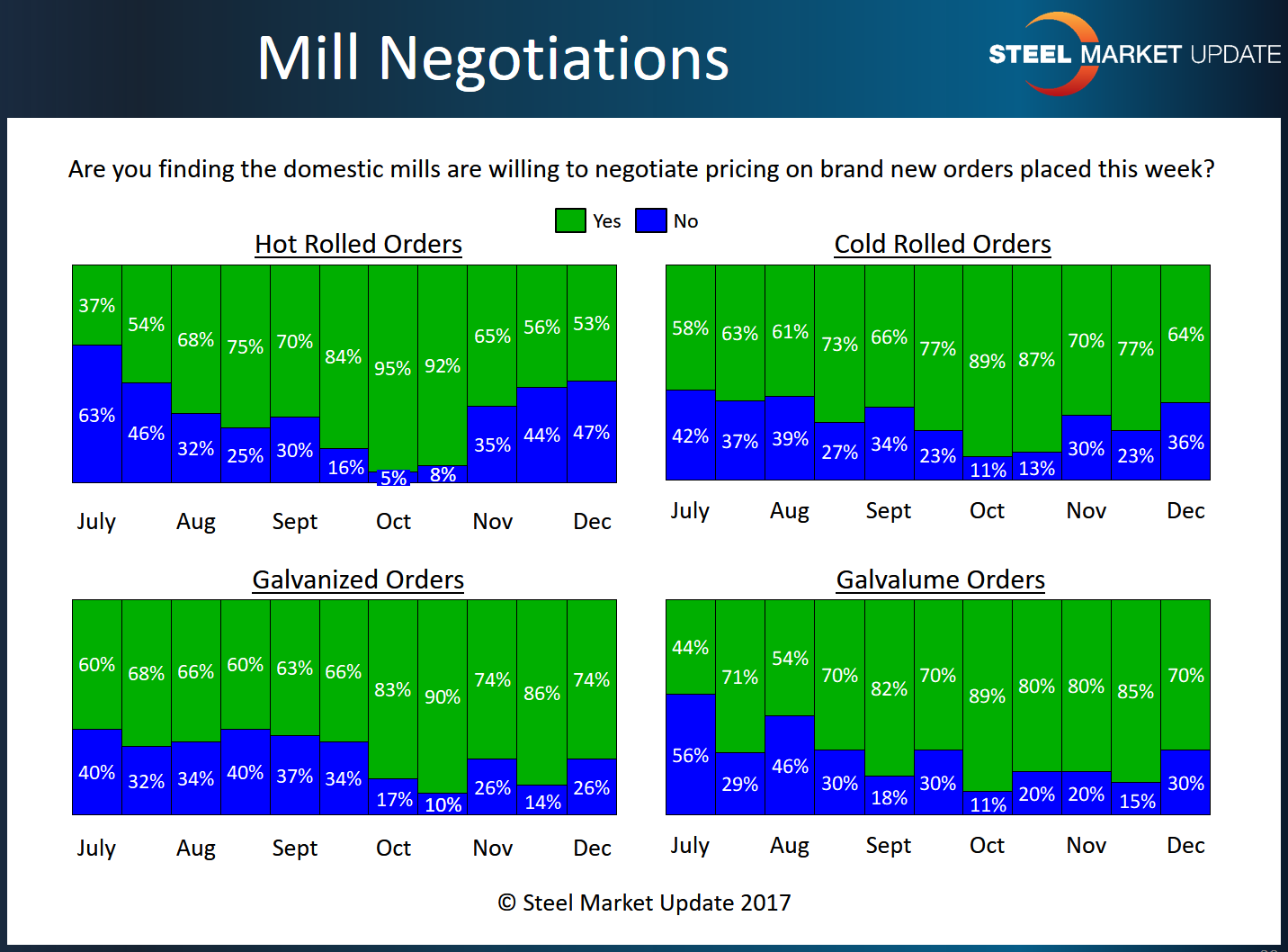

Demand for hot rolled steel appears to have been strengthening for the past two months as the percentage of respondents reporting mills willing to negotiate on HRC declined to 53 percent this week from 65 percent a month ago and 92 percent in October.

The trend toward more mills holding the line in price negotiations is more pronounced in cold roll. About 64 percent of buyers said they have found cold mills willing to negotiate prices, down from 77 percent two weeks ago. In galvanized, the percentage decreased to 74 percent from 86 percent in the last questionnaire. Likewise, 70 percent of Galvalume buyers said their suppliers were willing to talk price, down from 85 percent two weeks ago.

Looked at it from the opposite perspective, nearly half (47 percent) of hot roll buyers say the mills are unwilling to negotiate pricing on new orders today, about a third (36 percent) of cold roll buyers and a third (30 percent) of Galvalume buyers report mills holding the line, while only about a quarter (26 percent) of galvanized buyers report that the mills just say no.

The wiggle room that remains in spot price negotiations could dissipate further if the steel mills first quarter order books gets off to a strong start.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.