Logistics

December 16, 2017

Logistics Report Mid-December

Written by Sandy Williams

As the year winds down, shipping in the United States is moving along with minor complications in December. River traffic has encountered reoccurring problems with aging infrastructure as record grain harvests put pressure on capacity. Ocean freight volume is improving and rates are strong. Truckers are rushing to meet electronic logging device mandates, and the rail industry mourns the passing of a CEO.

Seaborne Shipping

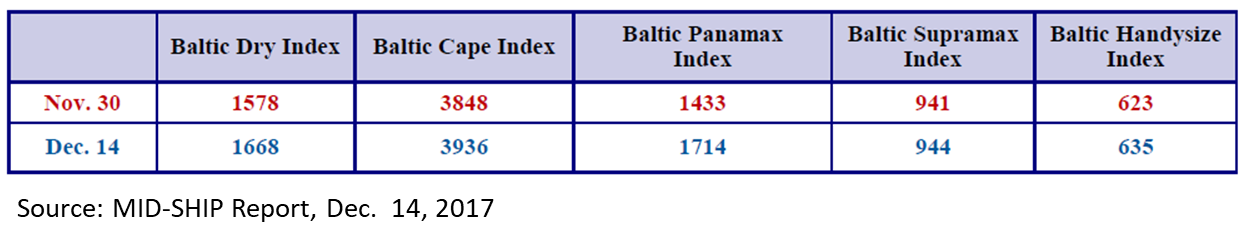

MID-SHIP continues to be “cautiously optimistic” about improvement in the dry bulk market for 2018. Cargo volume is slowly improving and addition of new vessels to the market in 2017 has eased. MID-SHIP expects even fewer new ships arriving in 2018 and 2019, which should help keep the market balanced. Freight rates are currently the best the market has seen in three years. MID-SHIP says vessel owners remain bullish, but a correction in the spot market may be on the horizon for 2018.

China is leading the strength in vessel demand with imports of coal and iron. China’s push to better air quality should lead to continued imports of higher quality ore from Australia and elsewhere.

The Baltic Dry Index closed at 1619 on Friday, on a generally upward trend since mid-year. Baltic has proposed changing the weighting of vessel types from the 25 percent equal distribution used currently. A recent study showed utilization rates between vessel types as: Cape 40 percent, Panamax 25 percent, Supramax 25 percent, and Handysize 10 percent. Baltic wants to drop the Handysize from the composite and change the weighting to 40 percent Capesize, 30 percent Panamax and 30 percent Supramax. If market feedback is positive, the changes will go into effect Jan. 2, 2018.

Barge

Barge traffic on the Ohio River was snarled from September through December due to a missing section of dam that caused shutdowns and delays. An aging lock system is in dire need of repair, says MID-SHIP. Record harvests of soybean and corn have added to congestion on the rivers. The frequent back-ups of barges have bumped up grain prices at export terminals at the Gulf Coast, says MID-SHIP, giving global competitors an advantage.

“2018 barge rates are a bit all over the place compared to 2017….some slightly up, some down and some sideways,” says MID-SHIP. “Overall, pretty flat for 2018 with no foreseeable issues with availability unless more barges are laid up. Then that could have an impact.”

Other than infrastructure problems, river conditions are good, without significant fog at the Gulf or ice in the North.

Trucking

The biggest news in the trucking industry is the electronic logging device regulation that goes into effect on Dec. 18. The devices are supposed to increase safety and regulatory compliance, as well as providing a means to determine challenges that drivers face. Smaller fleets are having difficulty meeting the requirements in time.

Truck capacity is still tight in the South and Southeast, but freight rates are relatively flat. MID-SHIP expects truck shortages and rate increases due to holiday demand and implementation of the ELD.

During the week of Dec. 3 through Dec. 9, the flatbed load-to-truck ratio decreased 9 percent to 27.9 loads per truck. Spot rates for flatbeds remain high for this time of year with rates increasing 2 percent during the period to a national average of $2.31 per mile. DAT Trendlines notes the rate is just 3 cents lower than the peak of Hurricane Irma recovery. National averages per mile were $3.91 in the Northeast, $2.90 in the Midwest, $2.48 in the Southeast, $2.55 in the South, and $1.65 in the Southwest. Diesel fuel averaged $2.910 per gallon as of Dec. 11.

American Trucking Association reports the turnover rate at large truckload fleets rose 5 percent to an annualized rate of 95 percent in the third quarter, increasing fears of a driver shortage.

“Since bottoming out at the end of 2016, the turnover rate at larger fleets has steadily risen – a function of an improving economy, rising demand for freight transportation and fierce competition for drivers,” ATA Chief Economist Bob Costello said. “The tightening of the driver market has raised fears about the driver shortage, which will hit an all-time high this year.”

“Fleets continue to tell us that competition for good, safe and experienced drivers is fierce, pushing wages higher in hopes of attracting the best talent,” Costello said. “However, unless steps are taken to make it easier for individuals to pursue careers in trucking, demand for drivers will continue to outstrip supply – eventually even leading to supply chain disruptions.”

Rail

Rail traffic for the week ending Dec. 9 totaled 560,756 carloads and intermodal units, a 4 percent increase year-over-year, according the Association of American Railroads. Carloads increased 3.4 percent to 267,963 and intermodal volume was 292,793 containers and trailers, an increase of 4.6 percent. Metallic ores and metals increased 2,311 carloads to 22,081.

CSX railroad announced Dec. 15 the death of President and CEO E. Hunter Harrison, 73, after a recent illness. In a statement acknowledging Harrison’s passing as a major loss, CSX wrote, “Hunter was a larger-than-life figure who brought his remarkable passion, experience and energy in railroading to CSX.”

Great Lakes

The Lake Carrier’s Association reports U.S. Great Lakes freighters moved 8.5 million tons of cargo in November, an increase of 1.3 percent from a year ago. Iron ore cargoes totaled 4.2 million tons, a decrease of 10 percent from November 2016. Coal loadings were up 30,000 tons to 1,269,589 tons.

Year-to-date iron ore shipments increased 5.4 percent to 41.5 million tons, while coal has increased 1.9 percent to 12 million tons.

Ice covered 5.2 percent of the Great Lakes as of Dec. 16, compared to 1.8 percent at this time in 2016 and zero percent in 2015. NOAA Great Lakes Environmental Research Laboratory is forecasting a maximum 26 percent ice coverage this winter, approximately half of the long-term average of 55 percent.