Market Data

January 4, 2018

Lead Times Dip Despite Mill Price Hikes

Written by Tim Triplett

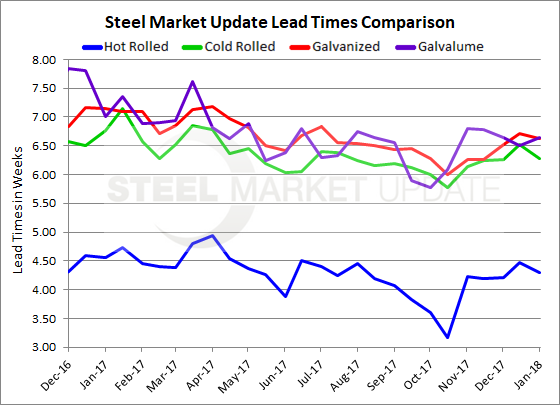

Mill lead times on flat rolled steel extended a bit last month, but defied expectations and returned to prior levels despite mill price hikes in December and January, according to the latest data from Steel Market Update’s market trends questionnaire. Lead time for hot roll remains slightly over four weeks, for cold roll slightly over six weeks, and for galvanized and Galvalume slightly over six and a half weeks.

One of the key indicators tracked by SMU, lead times reflect the activity at the mills and the order levels they are seeing from their customers. At a time when mills are raising prices, one would expect lead times to lengthen, reflecting stronger demand. That does not appear to be the case, at least not yet, as the market moves past the holiday period and shakes out the new mill prices.

Hot rolled lead times averaged 4.29 weeks, down from 4.47 weeks in mid-December. Except for the brief uptick last month, lead times on hot roll have seen little change in the past two months, remaining at about 4.2 weeks since early November.

Cold-rolled lead times averaged 6.27 weeks, down from 6.53 weeks in mid-December, also at about the same level as the past two months.

Galvanized lead times moved down to 6.63 weeks from 6.72 weeks last month. GI lead times have not been this extended since early July. Galvalume lead times, at 6.64 weeks, are up slightly from 6.50 weeks in December.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.