Market Segment

February 15, 2018

Reliance Optimistic About 2018

Written by Sandy Williams

Reliance Steel and Aluminum Co. is seeing growing demand across all its product segments and expects that trend to continue through 2018.

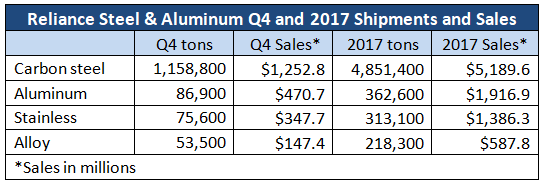

Reliance reported a strong fourth quarter with net sales up 15.3 percent year-over-year to $2.38 billion. Third-quarter sales were somewhat lower due to expected seasonality. Fourth-quarter shipments totaled 1,451,000 tons, up 6.3 percent from Q4 2016 and down 4.6 percent from Q3. Average selling price per ton increased 1.6 percent from the third quarter to $1,632 per ton.

Net income for the quarter totaled $301.4 million, up from to $61.7 million in Q4 2016 and $97.3 million in Q3 2017. Income includes a one-time income tax reform benefit of $207.3 million.

For full-year 2017, the company posted its second highest annual net sales at $9.72 billion, a 12.9 percent increase year-over-year. Shipments increased 3.8 percent from 2016 to 4.85 million tons. Net income attributable to Reliance was $613.4 million, up from $304.3 million in 2016. Excluding the impact of the fourth-quarter tax reform benefit, net income attributable to Reliance was $406.1 million for the year, up 33.5 percent from 2016, and the third highest net income in the company’s history.

Looking forward to first-quarter results, Reliance expects shipments to grow by 6-8 percent.

Reliance is planning about $225 million in capital expenditures for 2018 with about 59 percent of that going toward growth-related projects across the company and the rest toward maintenance. CEO Gregg Mollins said the company is seeing acquisition opportunities picking up as sellers line up for potential acquirers.

Carbon plate demand is looking good with a lot of price increases coming through, including a $50 increase yesterday. Mills are operating at a 74-75 percent capacity with demand strengthening.

CFO Karla Lewis noted that carbon toll processing has been solid and aluminum toll processing has increased significantly. The company’s new plant in Kentucky was in response to growing aluminum use in the region and customer requests for a closer processing facility.

Nonresidential construction demand has been increasing steadily over the past two or three years and any spending on infrastructure would be welcomed by Reliance. About one-third of the company’s business is in nonresidential, which includes infrastructure.

Said Mollins, “We are very optimistic. Certainly it would be very, very helpful if the administration got in bed and started throwing some cash at it [infrastructure], and gets the private sector to invest as well.”

The energy sector continues to pick up with Reliance contributions coming mostly in alloy products for the drilling and completion-end of the industry.

Reliance’s foreign investment in the semiconductor market is well timed, said Lewis. Reliance is not a new player in either South Korea or China and, although somewhat volatile, the semiconductor market was very strong last year. In South Korea, Reliance is basically doubling its production, said Mollins.

Regarding Section 232 and how presidential action or inaction may affect the steel industry, Mollins commented: “Let me tell you what I know about the 232 case—I don’t know anything. I’m confused by the son-of-a-gun,” he said. “We don’t run our company based on hope, we run it based on what we know.” What Reliance knows is that there is room for imports to decline further and prices to increase more. “We like prices higher than lower, but at the same time we hope the mills use some discipline so the spreads don’t become so great that more imports come in. If you want a really good answer to 232, you’d better call the White House.”