Prices

March 20, 2018

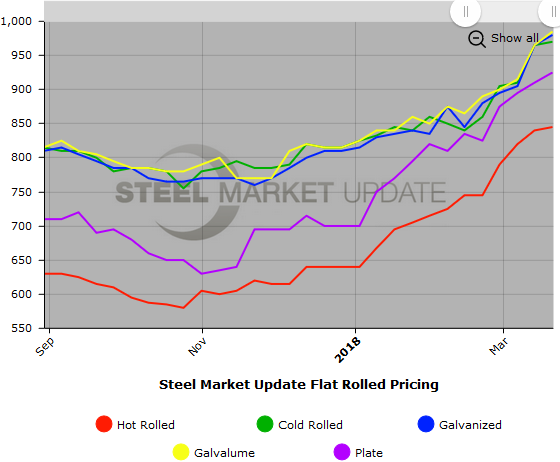

SMU Price Ranges & Indices: The March Higher Continues

Written by John Packard

Flat rolled steel prices continue to March higher and are expected to continue to do so for weeks, if not months, due to the Section 232 tariffs on foreign steel and the tightening of supply. Most domestic steel mills are operating on an inquire or controlled order entry basis. Mills like California Steel and NLMK USA are caught in the 232 trap as semi-finished steels (slabs), which are only bought by domestic steel mills, were included in the 232 tariffs. In many cases, the prices referenced below do not fully appreciate the strength of the high end of the pricing markets. We are seeing price offers at, or above, the high end of the range listed in this week’s pricing. (We just haven’t confirmed actual orders being placed at those numbers from the sources we rely upon).

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $830-$860 per ton ($41.50/cwt-$43.00/cwt) with an average of $845 per ton ($42.25/cwt) FOB mill, east of the Rockies. The lower end of our range rose $30 per ton compared to one week ago, while the upper end declined $20 per ton. Our overall average is up $5 compared to last week. Our price momentum on hot rolled steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Hot Rolled Lead Times: 3-8 weeks

Cold Rolled Coil: SMU price range is $930-$1,010 per ton ($46.50/cwt-$50.50/cwt) with an average of $970 per ton ($48.50/cwt) FOB mill, east of the Rockies. The lower end of our range rose $10 per ton compared to last week, while the upper end remained the same. Our overall average is up $5 per ton compared to one week ago. Our price momentum on cold rolled steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Cold Rolled Lead Times: 5-9 weeks

Galvanized Coil: SMU base price range is $47.50/cwt-$50.50/cwt ($950-$1,010 per ton) with an average of $49.00/cwt ($980 per ton) FOB mill, east of the Rockies. The lower end of our range rose $30 per ton compared to one week ago, while the upper end remained the same. Our overall average is up $15 compared to last week. Our price momentum on galvanized steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,036-$1,096 per net ton with an average of $1,066 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-11 weeks

Galvalume Coil: SMU base price range is $47.00/cwt-$51.50/cwt ($940-$1,030 per ton) with an average of $49.25/cwt ($985 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $20 per ton compared to last week. Our overall average is up $20 per ton compared to one week ago. Our price momentum on Galvalume steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,231-$1,321 per net ton with an average of $1,276 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-9 weeks

Plate: SMU price range is $900-$950 per ton ($45.00/cwt-$47.50/cwt) with an average of $925 per ton ($46.25/cwt) FOB delivered. The lower end of our range increased $30 per ton compared to one week ago, while the upper end remained the same. Our overall average is up $15 per ton compared to last week. Our price momentum on plate steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days. Be aware that our sources are advising us that June offers out of the plate mills begin at $960 per ton and go as high as $1025 per ton delivered to plate customers.

Plate Lead Times: 6-8 weeks (Note: June opening at $960-$1,025)

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. Note that plate prices are not yet available on our website, but we are in the process of adding that dataset. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.