Market Data

May 17, 2018

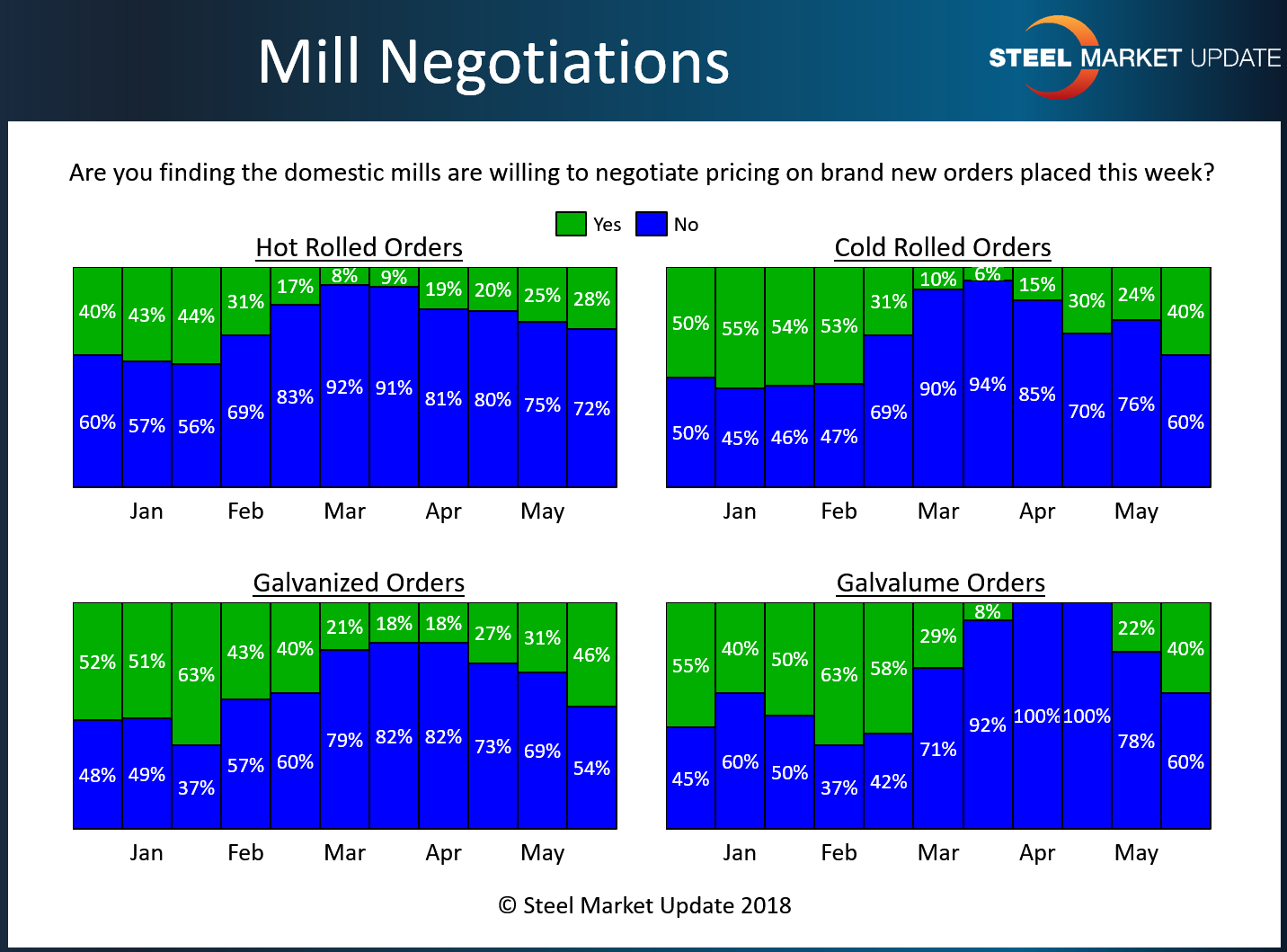

Steel Mill Negotiations: More Room to Talk Price?

Written by Tim Triplett

Steel mills appear slightly more willing to negotiate spot prices on hot rolled, cold rolled and coated steel than a month ago, according to respondents to this week’s Steel Market Update market trends questionnaire. “They will negotiate, but from a high number,” commented on service center executive. “It depends on the mill, but most are still holding firm,” added another.

Every two weeks, in a proprietary poll, SMU tracks how buyers and sellers of flat rolled steel represent the mill negotiation position. The latest data shows some mills may be somewhat more willing to talk price, though the majority continue to hold the line.

By market segment, 28 percent of hot rolled buyers said they have found mills willing to negotiate, compared with just 20 percent a month ago. But most, 72 percent, said the hot rolled mills are still standing firm.

In the cold rolled segment, 40 percent said they have found some mills willing to talk price. That’s up significantly from 30 percent one month ago and just 6 percent in mid-March. Still, 60 percent of respondents reported mill prices on cold rolled as non-negotiable.

In the galvanized sector, 46 percent reported that mills were sometimes willing to talk price on coated products, up significantly from 27 percent one month ago. But the majority, 54 percent, say the galvanized mills are still holding the line. The mix is nearly the same for Galvalume, where 40 percent say there is now room to talk price and 60 percent say price is off the table.

SMU data also shows that lead times are no longer extending as they were earlier in the year, which suggests the mills may not be quite as busy and may be looking to fill their order books for the slower summer months.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.