Market Data

May 20, 2018

SMU Market Trends: Demand Slowing, But Supplies Tightening and Prices Hanging On

Written by Tim Triplett

Steel demand has remained surprisingly strong in 2018, even as prices have escalated and trade disputes have made purchasing riskier. But Steel Market Update data suggests that demand may be weakening.

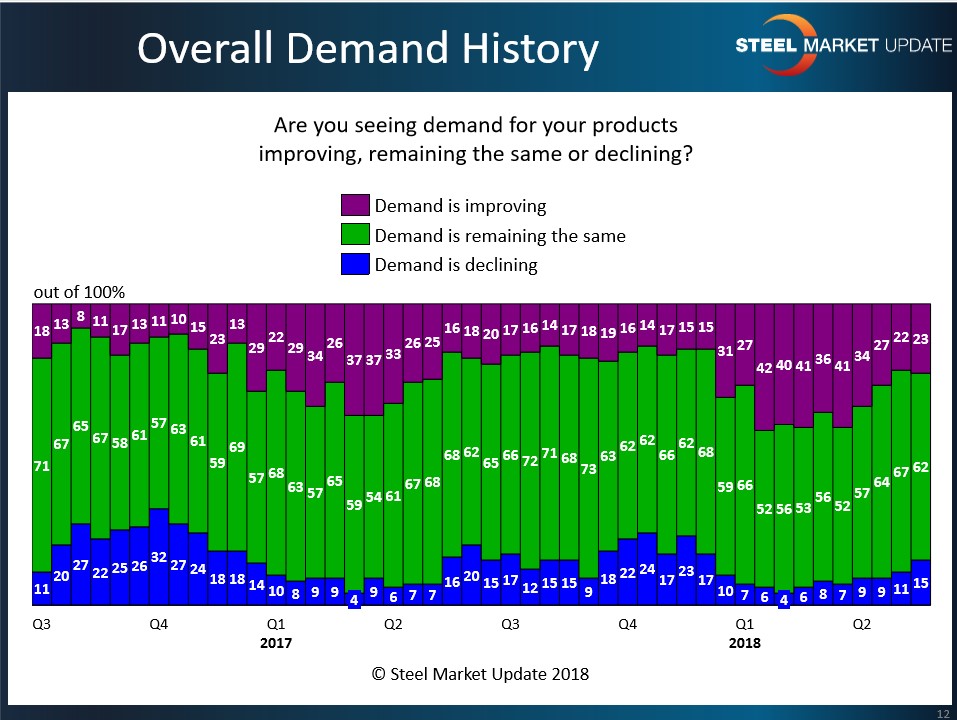

SMU canvasses the flat rolled steel market every two weeks. A clear majority (62 percent) of the respondents to the May 14 questionnaire indicated that demand appears unchanged in their sector. About 23 percent still see demand improving. The remaining 15 percent said they see declining demand for their products and services.

But a look at SMU’s data for the year so far shows a clear trend toward slowing demand. In mid-January, 42 percent of the steel executives responding to SMU’s questionnaire said demand was improving, while only 6 percent saw declining demand. In other words, nearly half as many see demand improving and more than twice as many see demand declining today as compared with the market four months ago.

Most respondents’ comments reflect the changing perception of demand:

- “Inquiries are down.”

- “Job shops are mostly claiming it is slow. Some OEM’s appear to be trying to push back and wait for better pricing. Things have slowed these past couple of weeks.”

- “Construction is up, auto is down, but demand is flat overall.”

- “Spot buyers are buying only what is needed and waiting to see what is going to happen. Contract demand is solid through the balance of the first half.”

- “I expect prices will impact demand unless there is a correction, but this will take another three months. Demand will remain the same in the short term.”

- “Demand is steady while customers are reporting record sales, mainly due to higher prices.”

- “Demand may be the same, but supply has shifted to offshore.”

- “Section 232…”

- “Seasonal?”

Direction of Steel Mill Spot Prices

Demand is a function of pricing. When prices get too high, demand wanes. SMU data shows the current benchmark price for hot rolled steel at around $880 per ton, up more than 40 percent since last fall. That may at least partly explain the apparent slowdown in demand reported by SMU respondents. So, is it likely the mills will begin lowering their prices? Not yet, say steel buyers.

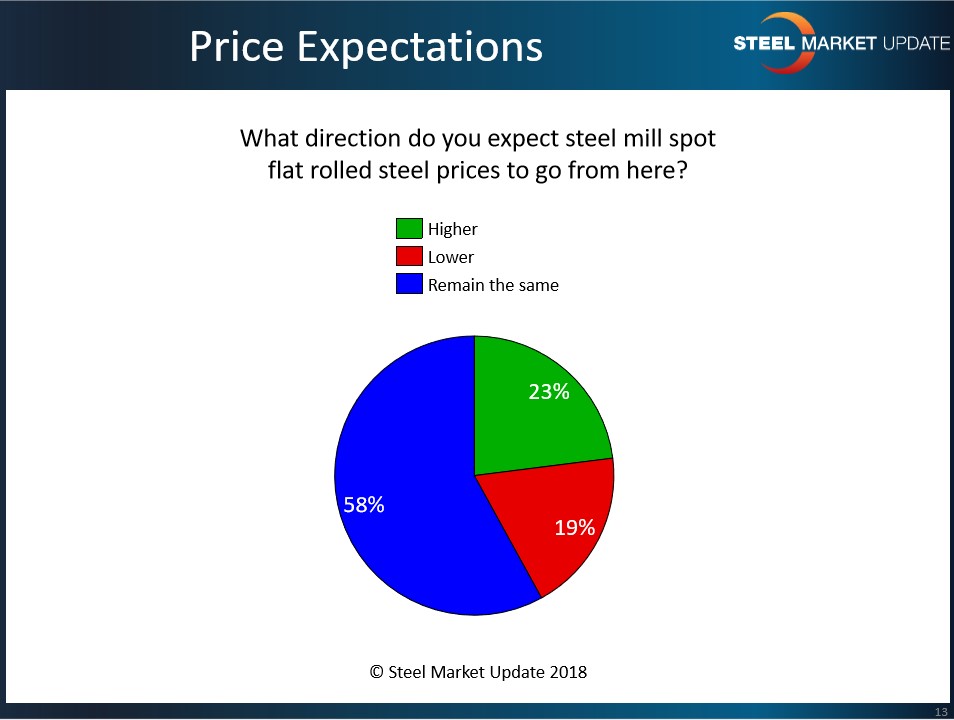

Where do respondents expect spot prices on flat rolled steel to go from here? Most (58 percent) expect prices to remain about the same. Only 19 percent expect prices to decline. The remaining 23 percent see steel prices going even higher.

Respondents’ comments show no consensus on the price direction:

- “Who knows?”

- “It depends on when we get clarity on Section 232 quotas.”

- “There’s still some upside risk due to Section 232’s uncertainty.”

- “There is nothing on the near horizon to indicate steel prices will fall in the same manner as prior peaks and valleys.”

- “Domestic mills will try to keep increasing prices, but it will be harder and harder for them to book spot tons this way and they will make more spot deals. Eventually prices could adjust downward.”

- “We’re expecting some weakening in the short term.”

- “Things seem to be softening.”

- “The price levels today are unsustainable. Within three months, either price levels drop or demand wanes.”

- “If prices do not come down, the profits will not be there to remain in business.”

- “I think the domestics would like to push pricing further; however, we are approaching the summer months.”

- “Cold rolled and galvanized have pressure to move lower due to imports still inbound even with the tariff applied; price points are good. I expect hot rolled to inch higher; there are no imports inbound and domestic production cannot keep pace with demand.”

- “The wild card on pricing will be slab exclusions. If slab is excluded from quotas and tariffs, I think we have hit peak pricing.”

- “Any attempt at an increase by the mills is only to prevent prices from dropping further and to get customers to place orders.”

- “I expect one more increase by the June 1 deadline for Section 232.”

- “This is almost impossible to answer right now. Will NLMK get an exemption? What’s the impact of the automotive outages due to the supplier fire? Does anyone know what the process is for Section 232 exemptions?”

Shortage of Supply Coming?

Demand is also a function of supply. When supplies tighten, competition for whatever product is available drives up demand and bids up pricing.

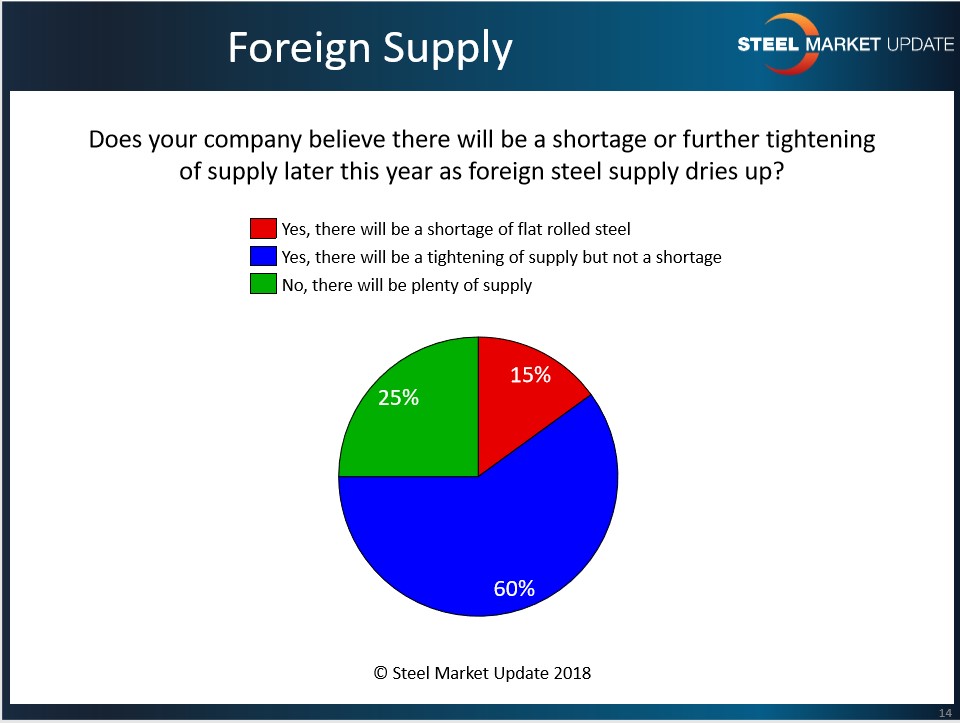

The majority (60 percent) of SMU’s respondents expect steel supplies to tighten later this year, but not to the point of an actual shortage. Twenty-five percent expect steel to remain readily available. Of those who source outside the U.S., 88 percent say they will continue to buy foreign steel despite the tariffs “whenever it makes economic sense to do so.” But 15 percent say the current market dynamics, with government restrictions on imports, will lead to a shortage of supply and possible market disruption.

Following are steel buyers’ comments on supply:

- “Supply will tighten as demand drops.”

- “Late June and July will be tight, but OK by August.”

- “It depends on when we get clarity on the Section 232 quotas.”

- “I do think a shortage is possible, especially if hard quotas are established.”

- “There’s zero foreign steel coming in June/July/August.”

- “I don’t think imports will slow down any more. I think we’re close to finding ‘normal’ again.”

- “Foreign steel is not drying up. There will be an increase in third-quarter arrivals.”

- “Imports will find their way into the U.S. market eventually.

- “Foreign sources are quoting September arrivals. I think the shortage may come sooner rather than later.”

- “I’m seeing a very tight galvanized market, and I’m starting to take action by moving the steel I source for our Mexico-based manufacturing plants to Brazil from the USA. I’d expect a tight market for the next six months as further Section 232 details get finalized and buyers adjust their supply chain accordingly.”

- “Greed [in mill pricing] invites imports and increased supply.”