Market Data

May 23, 2018

ABI Healthy in April

Written by Sandy Williams

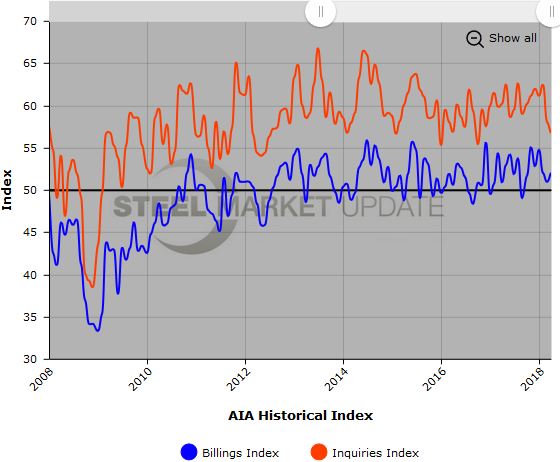

The Architecture Billings Index rose modestly in April posting a score of 52.0, indicating a seventh consecutive month of growth and a one point gain from March.

New project inquiries, an indicator for future billings, fell to 56.7 from the March score of 58.1, reported the American Institute of Architects. Labor shortages, higher prices for building materials, and rising interest rates continue to be challenges for the construction industry, but business continues to be healthy for architecture firms.

“While there was slower growth in April for new project work coming into architecture firms, business conditions have remained healthy for the first four months of the year,” said AIA Chief Economist Kermit Baker. “Although growth in regional design activity was concentrated at firms in the sunbelt, there was balanced growth so far this year across all major construction sectors.”

• Regional averages: West (55.1), Midwest (49.6), South (51.8), Northeast (50.3)

• Sector index breakdown: multi-family residential (50.7), institutional (52.0), commercial/industrial (52.7), mixed practice (50.6)

• Project inquiries index: 56.7

• Design contracts index: 50.1

The Architecture Billings Index (ABI), produced by the American Institute of Architects, is considered a leading economic indicator of construction activity, and reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The survey panel asks participants whether their billings increased, decreased, or stayed the same in the month that just ended. The regional and sector categories are calculated as a three-month moving average, whereas the national index, design contracts and inquiries are monthly numbers. The monthly ABI index scores are centered on the neutral mark of 50, with scores above 50 indicating growth in billings and scores below 50 indicating a decline.

Below is a graph showing the history of the AIA Billings Index and Inquiries Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact Brett at 706-216-2140 or Brett@SteelMarketUpdate.com.