Prices

November 19, 2019

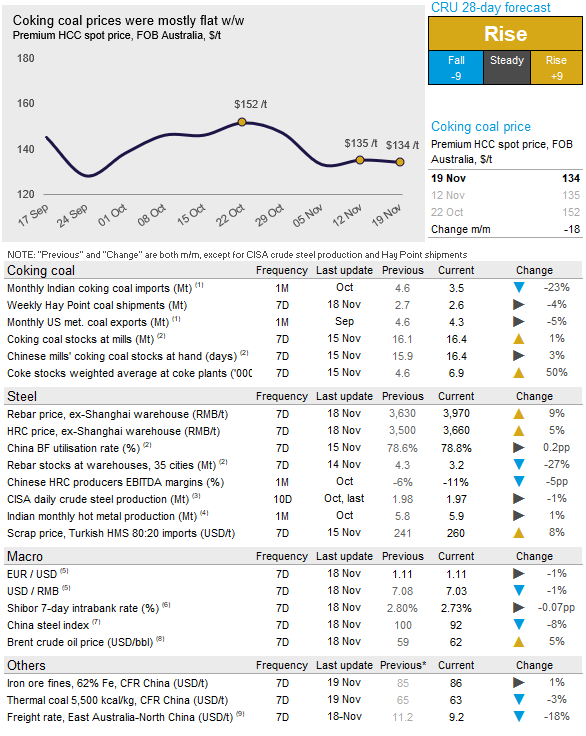

CRU: Coking Coal Prices Flat But Upside Risks Emerge

Written by Josh Spoores

By Senior Analyst Manjot Singh, from CRU’s Steelmaking Raw Materials Monitor

The past week was characterized by improving sentiment in the Chinese and Indian steel industry. Chinese HRC and rebar prices increased substantially w/w (see data below) on the back of higher demand. Even the HRC prices in India witnessed a $7 /t increase w/w, although rebar prices were mostly unchanged.

In China, coking coal inventory at coking plants has now reached slightly below last year’s levels for the first time in 2019. However, we do not think the coal stocks are low enough to cause panic buying in the Chinese market, for now. But there has been a major accident in one of the coking coal mines in Shanxi, the Chinese province with the largest coking coal reserves, which has resulted in numerous casualties. We are hearing unconfirmed news from our sources that because of this accident, some coal mines in Shanxi have been ordered to suspend production and a campaign of mine safety inspections will be launched in the coming days. This supply disruption poses upside risks for domestic Chinese coking coal prices, especially since coal import restrictions at various Chinese ports are already in place.

In India, we expect buyers to restock in the coming days as October coking coal imports were extremely weak and we are currently seeing some improvement in Indian steel demand. Buying interest from Europe on the other hand, is still very weak and we are hearing that there is no demand for spot cargoes from Europe currently.

In Australia, shipments from Hay Point and Gladstone ports have been relatively weak in the last month due to a combination of maintenance activities and reduced output from certain mines. This void is currently being filled by increased exports from Russia.

On Nov. 19, CRU assessed the Premium HCC $1 /t lower w/w at $134 /t, FOB Australia. We hold our view of a slight improvement in seaborne coking coal prices in the next month on expectations of restocking demand from India, coupled with weak shipments from Australia and mine safety inspections in China.