Market Data

December 19, 2019

Steel Mill Negotiations: Tighten a Bit More

Written by Tim Triplett

Negotiations between steelmakers and steel buyers continue to tighten. Responses to Steel Market Update’s market trends questionnaire this week indicate the mills are slightly less flexible on price for most products as they work to collect four increases announced since late October totaling $150 per ton.

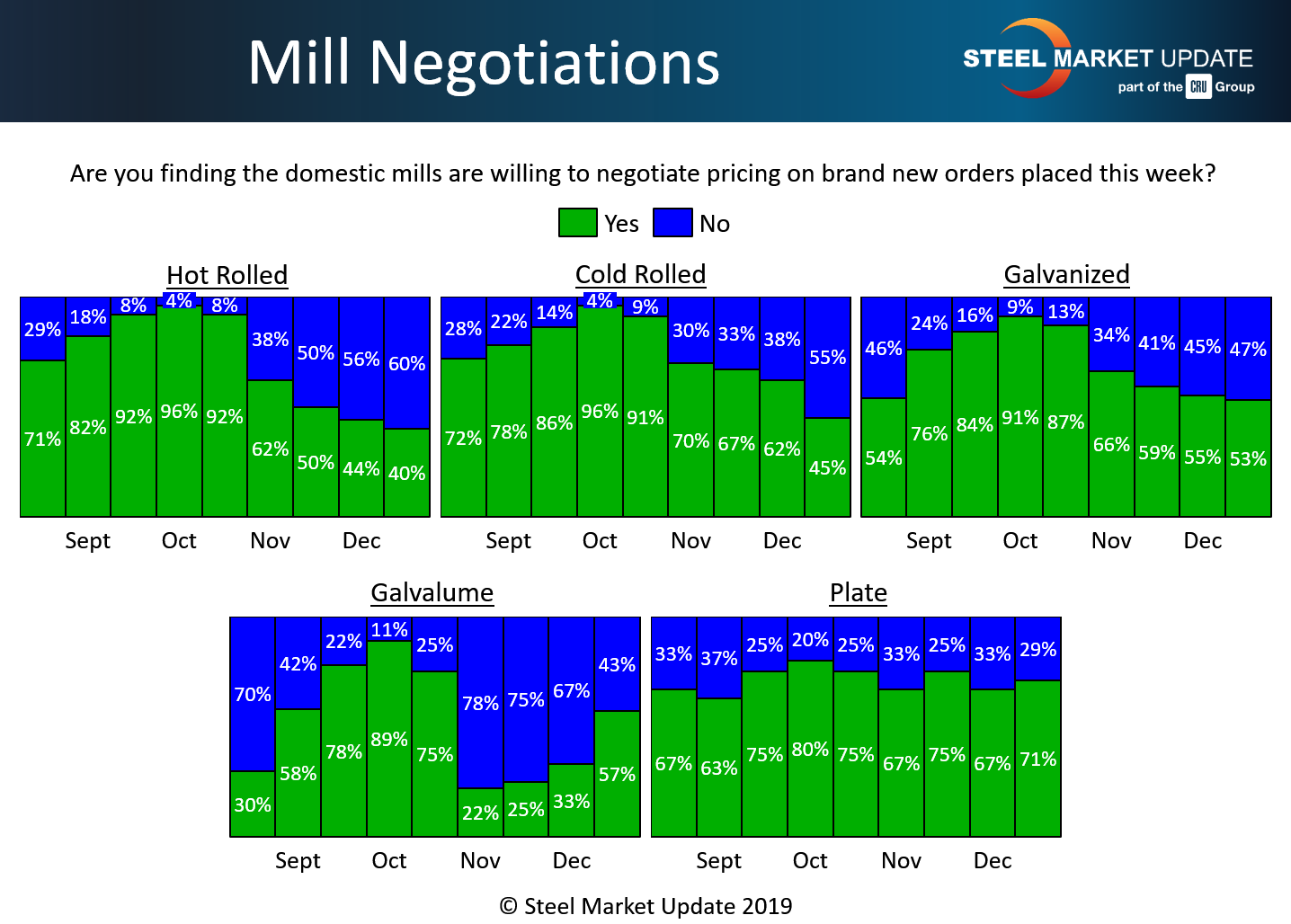

In the hot rolled segment, the majority of buyers (60 percent) said the mills are no longer willing to negotiate prices on HR. The other 40 percent said the mills were still open to price talks. A month ago, finding a mill that was willing to discount was a 50-50 proposition. In the cold rolled segment, the majority (55 percent) said spot prices are now non-negotiable.

In galvanized, a slight majority of buyers (53 percent) still report the mills as flexible when it comes to pricing galv orders. There has been little change in the tone of galvanized negotiations since mid-November. Considerably more Galvalume buyers (57 percent vs. 33 percent in early December) now report mills willing to deal.

Despite the series of price increase announcements, there’s been little movement in negotiations over plate in the past two months. More than 70 percent of buyers responding to SMU’s poll said the mills are still discounting prices to win spot orders of plate steel.

Benchmark hot rolled steel prices have increased by more than 20 percent in the past eight weeks. SMU data shows the current HR price at $570 per ton, up from $470 in mid-October. Price increases by the mills don’t necessarily curtail negotiations, but rather set a new, higher starting point from which the negotiations begin.

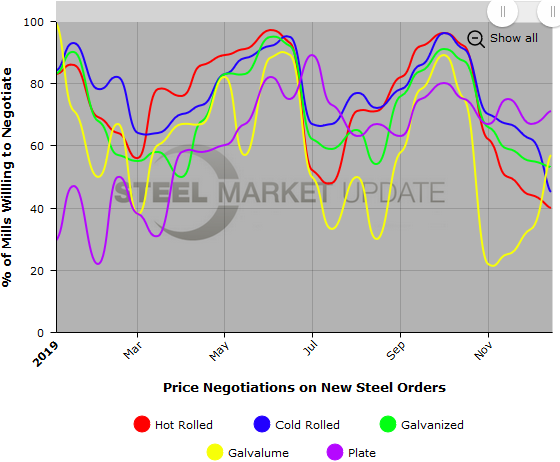

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data (example below), visit our website here.