Prices

April 7, 2020

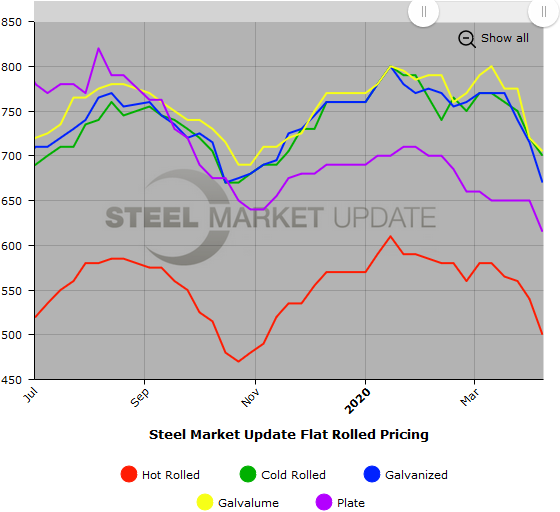

SMU Price Ranges & Indices: Downturn Continues

Written by Brett Linton

Buyers are not purchasing much steel these days as they work to keep inventories in line with declining demand due to the coronavirus, making it more challenging than usual for Steel Market Update to track steel prices. By SMU estimates, flat rolled and plate prices declined a further $15-45 per ton this week. Not surprisingly, Steel Price Momentum remains Lower.

Here is how we are seeing prices this week:

Hot Rolled Coil: SMU price range is $480-$520 per ton ($24.00-$26.00/cwt) with an average of $500 per ton ($25.00/cwt) FOB mill, east of the Rockies. The lower end of our range declined $20 per ton compared to one week ago, while the upper end decreased $60. Our overall average is down $40 per ton over last week. Our price momentum on hot rolled steel is Lower, meaning we expect prices to decline over the next 30 days.

Hot Rolled Lead Times: 3-8 weeks

Cold Rolled Coil: SMU price range is $680-$720 per ton ($34.00-$36.00/cwt) with an average of $700 per ton ($35.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end decreased $40 per ton. Our overall average is down $20 per ton over one week ago. Our price momentum on cold rolled steel is Lower, meaning we expect prices to decline over the next 30 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU base price range is $32.00-$35.00/cwt ($640-$700 per ton) with an average of $33.50/cwt ($670 per ton) FOB mill, east of the Rockies. The lower end of our range declined $40 per ton to one week ago, while the upper end declined $50. Our overall average is down $45 per ton over last week. Our price momentum on galvanized steel is Lower, meaning we expect prices to decline over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $709-$769 per net ton with an average of $739 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 6-8 weeks

Galvalume Coil: SMU base price range is $33.50-$37.00/cwt ($670-$740 per ton) with an average of $35.25/cwt ($705 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to last week, while the upper end declined $20. Our overall average is down $15 per ton over one week ago. Our price momentum on Galvalume steel is Lower, meaning we expect prices to decline over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $961-$1,031 per net ton with an average of $996 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-8 weeks

Plate: SMU price range is $600-$630 per ton ($30.00-$31.50/cwt) with an average of $615 per ton ($30.75/cwt) FOB delivered to the customer’s facility. The lower end of our range declined $20 per ton compared to one week ago, while the upper end decreased $50. Our overall average is down $35 per ton over last week. Our price momentum on plate steel is Lower, meaning we expect prices to decline over the next 30 days.

Plate Lead Times: 4-5 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. Note that plate prices are not yet available on our website, but we are in the process of adding that dataset. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.