Prices

May 19, 2020

CRU: Coking Coal Prices Steady, But Uncertainty Persists

Written by Manjot Singh

By CRU Senior Analyst Manjot Singh, from CRU’s Metallurgical Coal Market Outlook

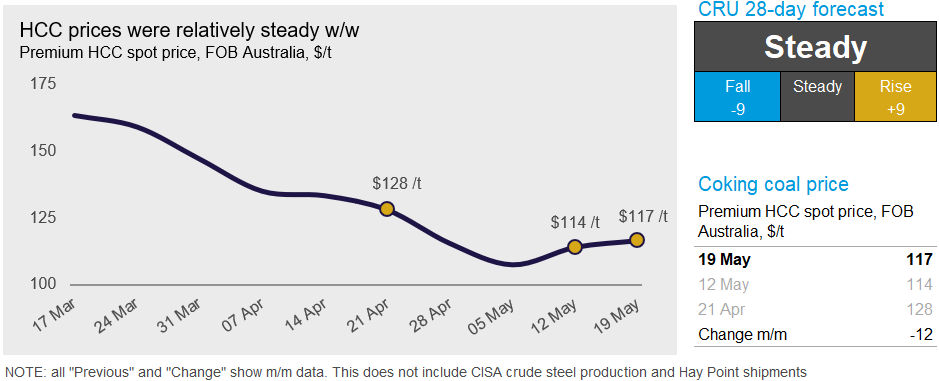

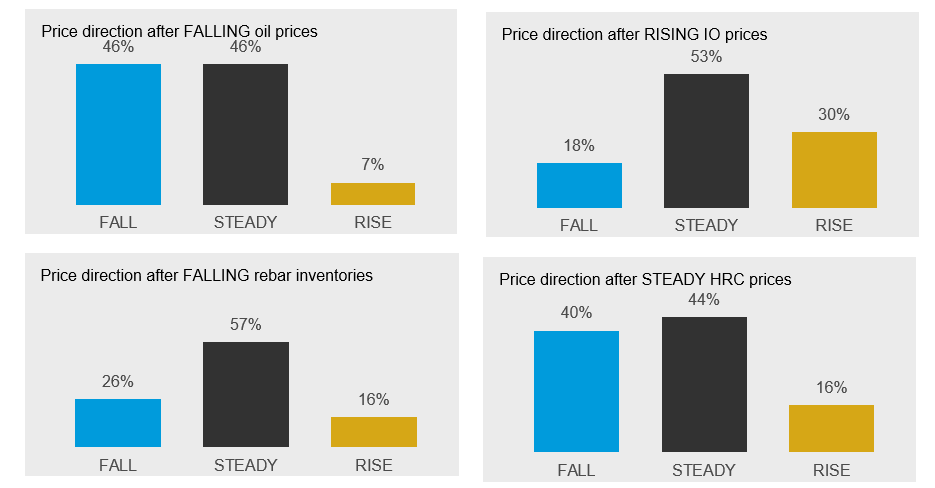

Seaborne coking coal prices were steady last week as market participants adopted a “wait-and-see” approach due to the ongoing uncertainty in the coal market. There are upside risks to seaborne prices in the form of relatively strong demand in China, and ease of restrictions in India, but downside risks due to restrictions on Chinese coal imports and the recommencement of operations at some U.S. coal mines.

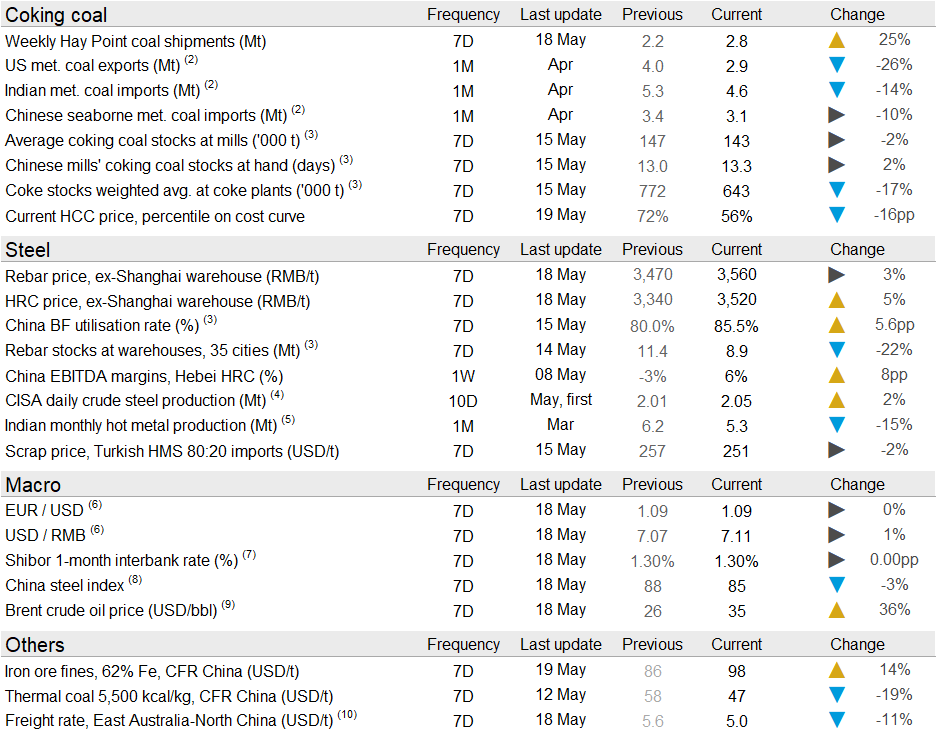

In China, the current sentiment in the steel industry is quite positive. The steel inventory destocking accelerated last week and BF capacity utilization remains high. Also, steel mills exhibited higher demand for coke on the spot market, causing a slight uptick in Chinese coke prices. According to our sources, the capacity utilization of the merchant coke producers is currently more than 80 percent, the highest levels since August last year. However, coal stocks at mines remain quite high and thus the upward pressure did not get translated into domestic coal prices. Separately, there were a few unconfirmed reports suggesting some utilities and steel producers in China have received verbal notices that import restrictions, especially on Australian coal, could increase in the coming weeks.

In India, the government announced a $265bn special economic package last week to boost the domestic economy. But some market participants believed that there might not be major implications on the steel industry in the very short term. Having said that, manufacturing activity in India continues to improve moderately, but coal stocks at ports remain high. Elsewhere, we noticed that European coal intakes this month have lifted after 12 weeks of consecutive yearly declines.

On the supply side, shipments from Hay Point port totaled 2.8 Mt, up 0.6 Mt w/w, suggesting that Australian supply is still relatively strong. However, the low prices currently are starting to impact producers, even in Australia. We heard that the Carborough Downs coking coal mine, operated by Fitzroy Resources, was implementing strict cost control measures like reducing its contract workforce and scaling back operations. In the U.S., Contura Energy has resumed mining operations at all its coking coal mines, after several mines suspended operations in early-April due to the Covid-19 outbreak. The miner stated that nearly all of their previously furloughed employees have now returned to work.

On May 19, CRU assessed the Premium HCC $2.5 /t higher w/w at $116.5 /t, FOB Australia. We expect coking coal prices to consolidate around current levels for another couple of weeks.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com