Market Data

July 9, 2020

Steel Mill Negotiations: It's a Buyer's Market

Written by Tim Triplett

The vast majority of steel buyers responding to Steel Market Update’s market trends questionnaire this week report that mills are willing to compromise on price to win orders as the economy and steel demand continue to battle the effects of the coronavirus crisis.

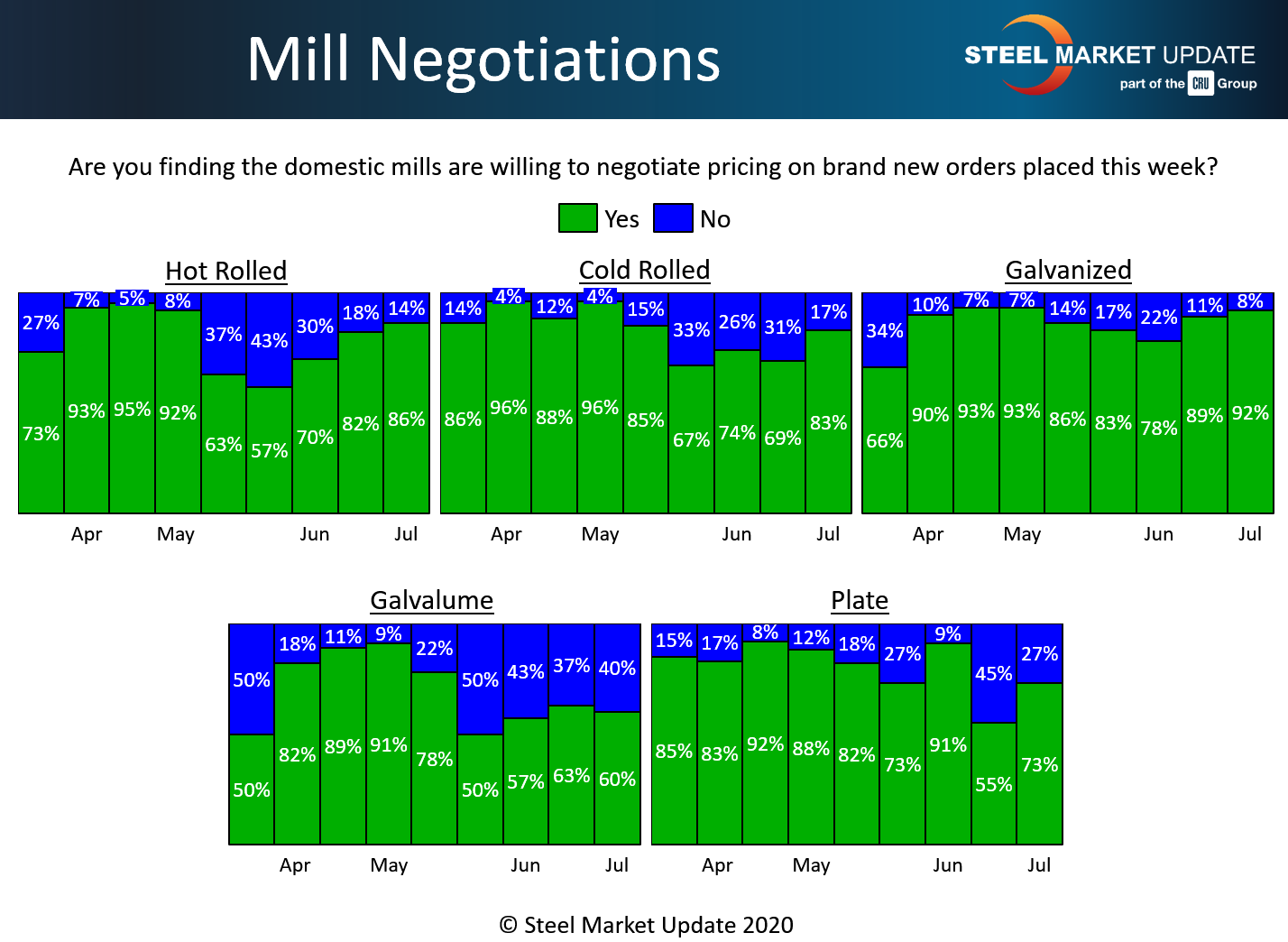

About 86 percent of hot rolled buyers said the mills are open to negotiation, while just 14 percent said the mills are standing firm on HR prices. That’s up 4 points from two weeks ago and up 16 points from this time last month.

In the cold rolled segment, 83 percent reported the mills willing to talk price, up from 69 percent two weeks ago.

In galvanized, 92 percent reported the mills open to price negotiation this week, up from 89 percent in SMU’s last canvass of the market. The majority, about 60 percent, have found the mills willing to compromise on Galvalume prices lately as well.

Negotiations have loosened in the plate market, where 73 percent said the mills are now willing to bargain to capture the sale, while just 27 percent reported the mills saying no to discounts. That’s up from 55 percent who said the mills were talking price two weeks ago.

Benchmark hot rolled steel prices have been trending downward since falling below the $500 per ton mark in the third week of May and currently average $475 per ton, based on SMU’s latest canvass of the market. Cold rolled and galvanized prices were flat at $665 per ton this week. With scrap prices declining by $20-40 for July, and steel demand still very questionable due to the surging COVID-19, SMU’s Price Momentum Indicator continues to point lower.

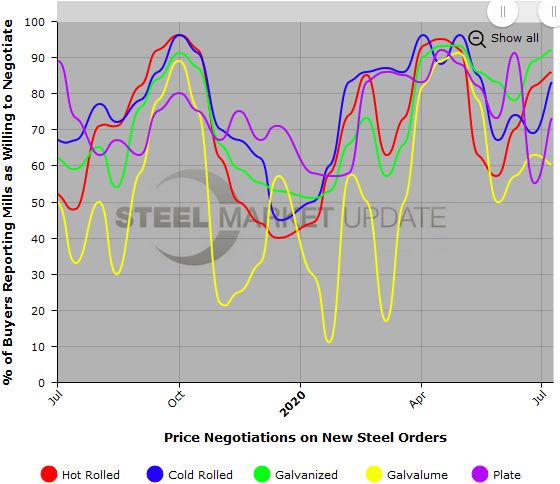

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data (second example below), visit our website here.