Prices

August 6, 2020

Hot Rolled Futures: Summer Months Bring Lower Implied Volatility, Lower Trading Volumes

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

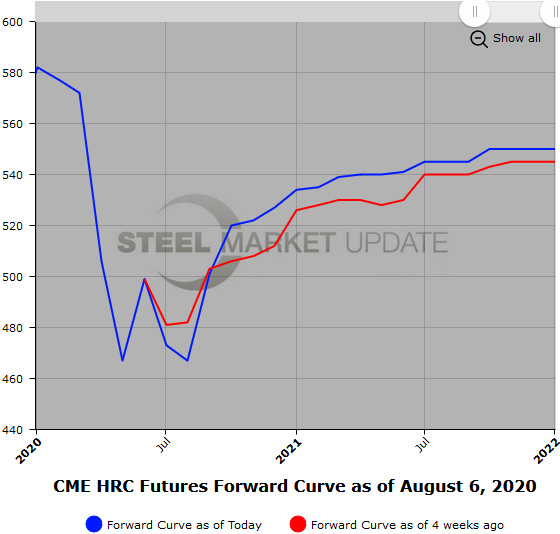

Hot rolled futures volumes have been a bit uneven as forecast uncertainty remains while businesses continue to navigate through a difficult summer due to a strong surge of Covid infections, which appear to have hampered the recovery of operations during the typically slower summer period. It seems that ramping production back up is taking longer than expected, which is reducing forecasted futures needs. In the last month, implied volatilities have moved lower. With the exception of the nearby futures months, the HR futures curve has remained relatively stable from Oct’20 HR through Jun’21 HR futures with about $10/ST separating the quarters ($535-$545/ST). For example : The Q1’21 HR versus Q2’21 HR futures spread traded at 6 contango mid-week in some decent volume ($538/$544).

While most of the curve has been stable, the HR spot has declined a little over $40/ST from approximately $480/ST to $440/ST during the last month, which has left a very steep upward sloping line in the front end of the forward curve and a relatively flatter forward curve for the Q4’20 through Q2’21 period futures.

A number of mills are bringing more production online as forecasts for automotive production are pretty healthy for the balance of the year to make up for the soft 1H’20 sales. The expectation is that this will create enough demand to drive prices higher.

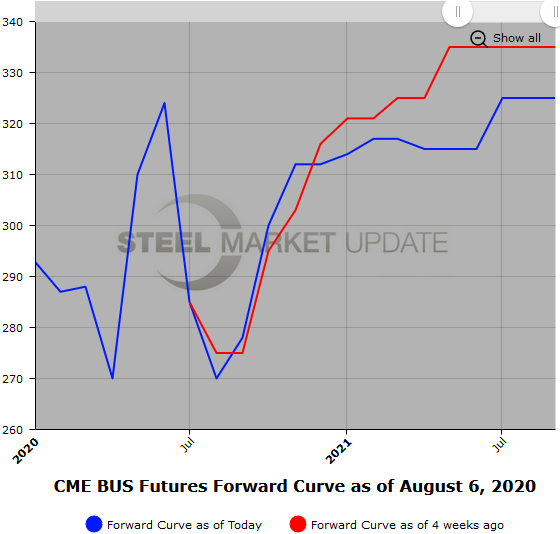

Scrap

Very strong export scrap markets have created some regional hotspots along the mid-Atlantic states. The chatter in scrap markets suggests there is potentially a strong divergence of opinion on where August BUS will settle even as the mills place their bids for scrap. Recent reports are that BUS will be down $10-20/GT from the Jul’20 $278/GT level, but recent Aug’20 BUS futures prices suggest that the price drop might be less. Today, Aug’20 settlement value was $270/GT.

The futures curve in BUS has about a $40 contango from spot out to the end of Q1’21 BUS. The curve remains relatively flat in the farther out futures months, which currently does not reflect much anticipated volatility. Reports are that Midwest shred will be likely sideways to last month for the upcoming August settlement. Strong export price pull for shred is partly offset by current tepid demand.

In the next month or two, stronger auto demand should improve prices demanded