Prices

September 16, 2020

Regional Imports Through July: Hot Dipped Galvanized

Written by Peter Wright

National level import reports do a good job of measuring the overall market pressure caused by the imports of individual products. The downside is that there are huge regional differences. This report examines hot-dipped galvanized imports by region through July 2020.

![]()

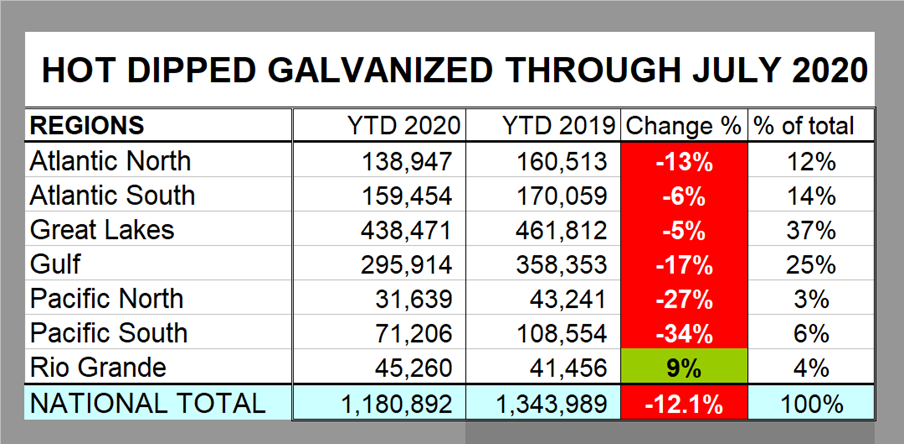

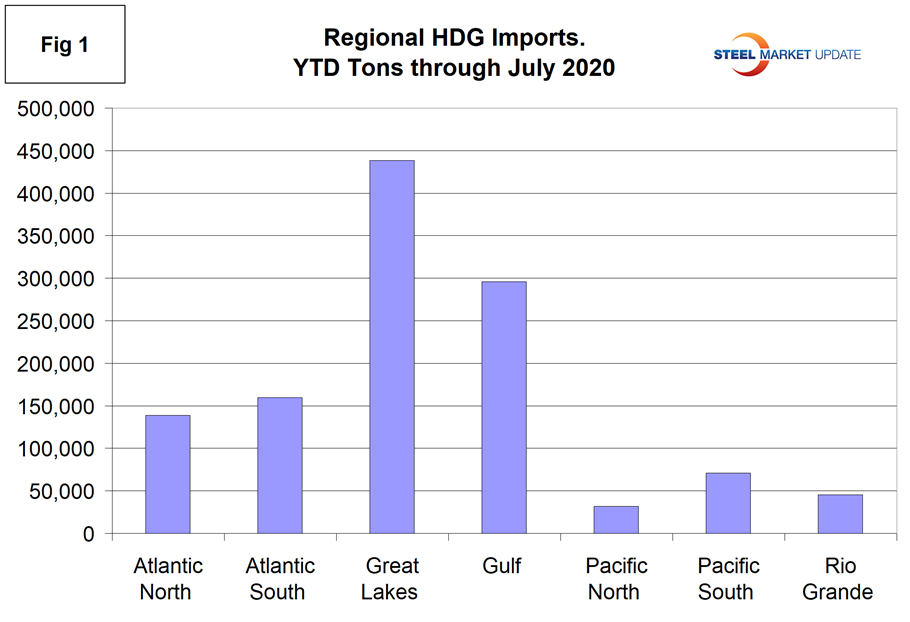

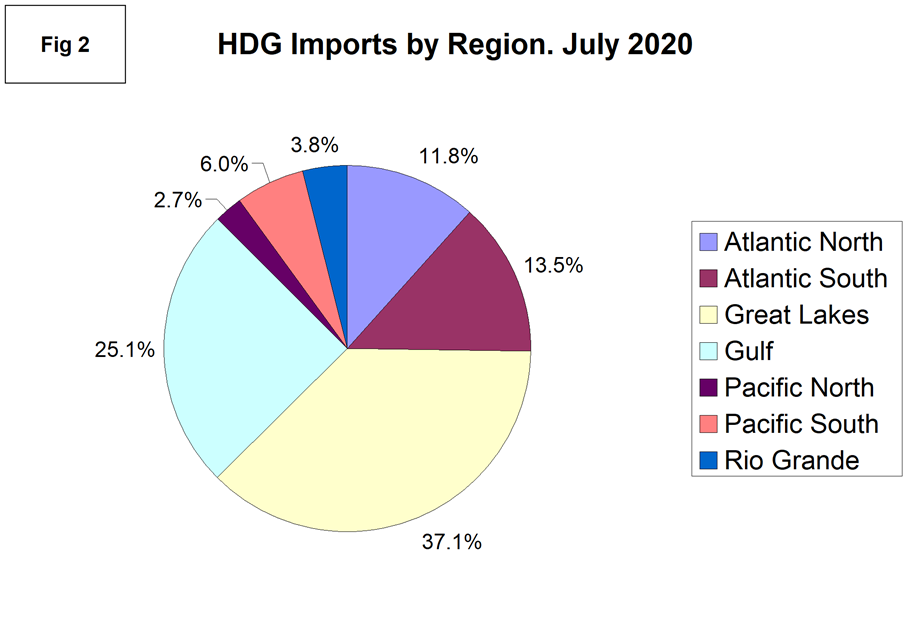

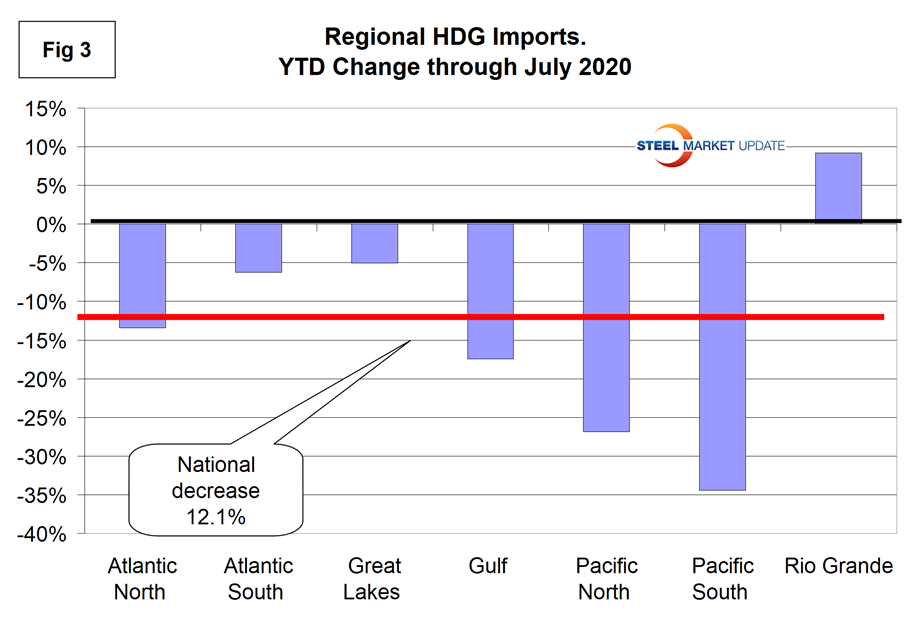

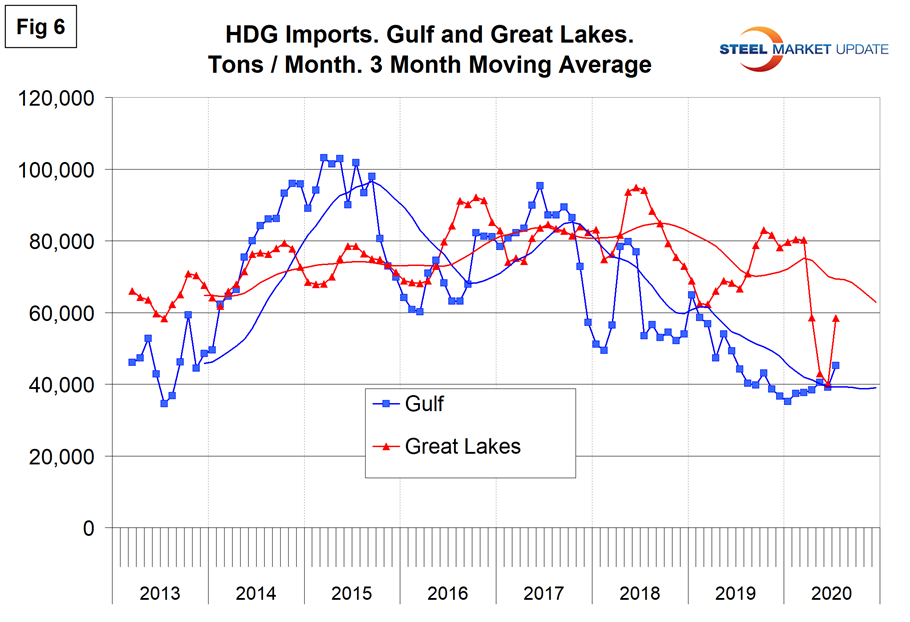

In July, HDG imports were down by 12.1 percent at the national level, but on a regional basis ranged from a 34 percent decline at the South Pacific ports to an increase of 9 percent across the Rio Grande. The Great Lakes received the most tonnage followed by the Gulf. Tonnage into the Pacific Coast and across the Rio Grande is minimal.

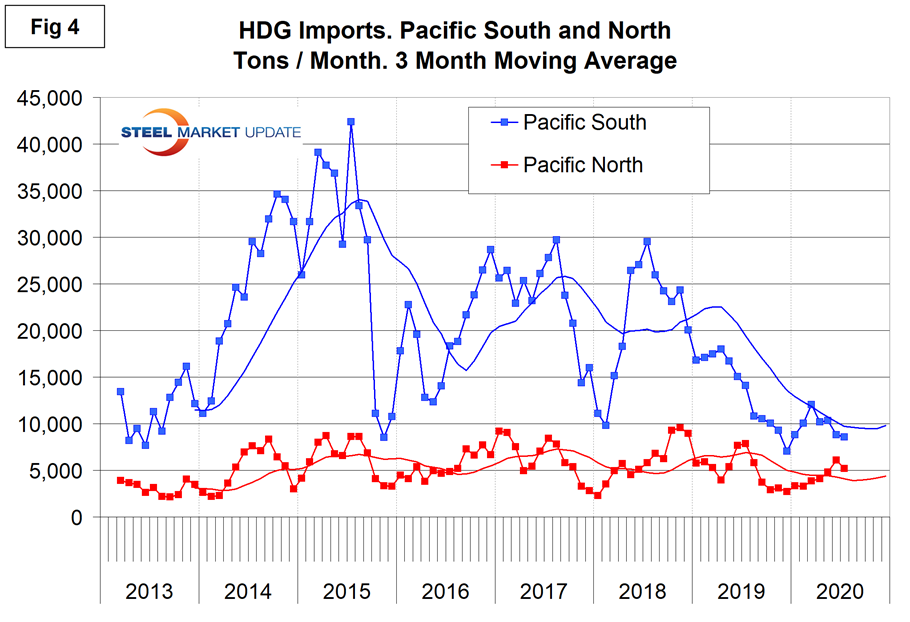

Pacific Coast: The tonnage of HDG into the South Pacific ports has been declining for two years, but still receives over twice as much tonnage as the northern ports.

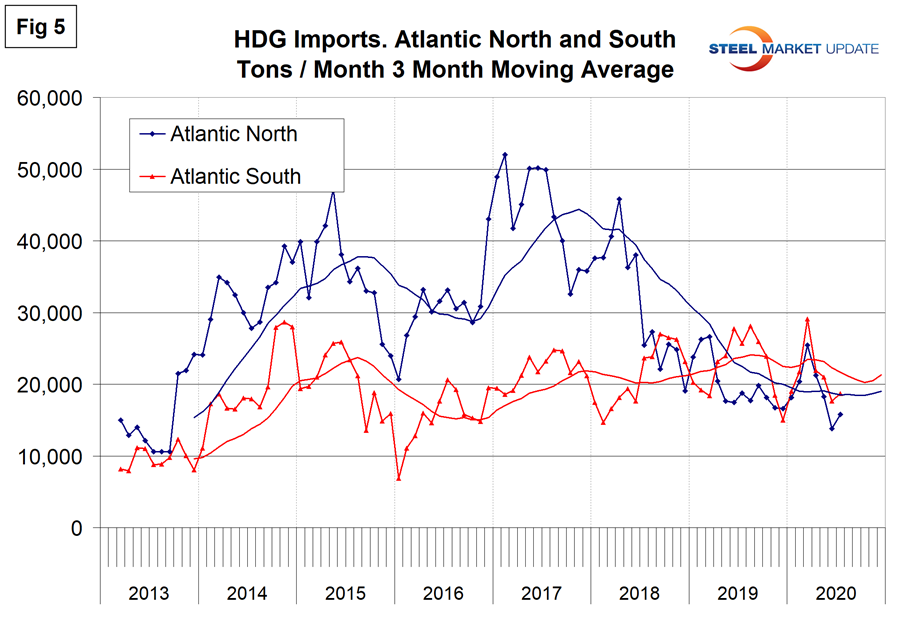

Atlantic Coast: The HDG tonnage into the North and South Atlantic ports is similar and accounts for 12 and 14 percent of the total, respectively. Both have been gradually declining since September 2018.

Gulf and Great Lakes: The tonnage of HDG into the Great Lakes dropped by half in May and June compared to January through April, then partially recovered in July. The tonnage into the Gulf has been quite stable at 40,000 tons per month for the last year.

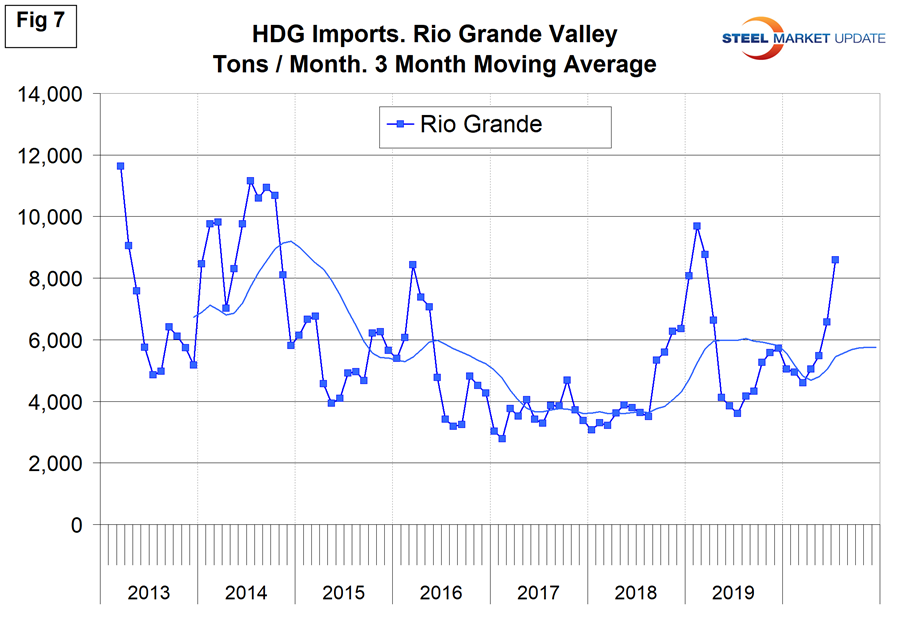

Rio Grande: This was the only region to experience a tonnage increase year to date, but has the second lowest tonnage of all seven regions.

Notes: SMU presents a comprehensive series of import reports ranging from the first look at licensed data to a detailed look at volume by district of entry and source nation. The report you are reading now is designed to plug the gap between these two. This report breaks total year to date import tonnage of six flat rolled products into seven regions and the growth/contraction for each product and region. There is a summary table for each product group and a bar chart showing volume by region for the first seven months of 2020. These are reference documents with no specific comments. These charts have been developed as a guide for buyers and sellers to have a broader understanding of what’s going on in their own backyard.

Regions are compiled from the following districts:

Atlantic North: Baltimore, Boston, New York, Ogdensburg, Philadelphia, Portland ME, St. Albans and Washington. DC.

Atlantic South: Charleston, Charlotte, Miami, Norfolk and Savannah.

Great Lakes: Buffalo, Chicago, Cleveland, Detroit, Duluth, Great Falls, Milwaukee, Minneapolis and Pembina.

Gulf: Houston, New Orleans, Mobile, San Juan, St. Louis and Tampa.

Pacific North: Anchorage, Columbia Snake, San Francisco and Seattle.

Pacific South: Los Angeles and San Diego.

Rio Grande Valley: Laredo and El Paso.