Market Data

September 16, 2020

Service Center Shipments and Inventories Report for August

Written by Estelle Tran

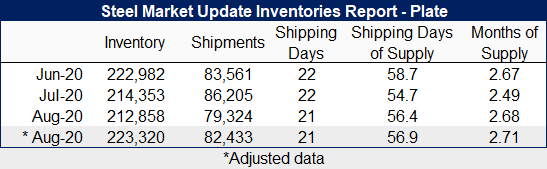

Flat Rolled = 48.6 Shipping Days of Supply

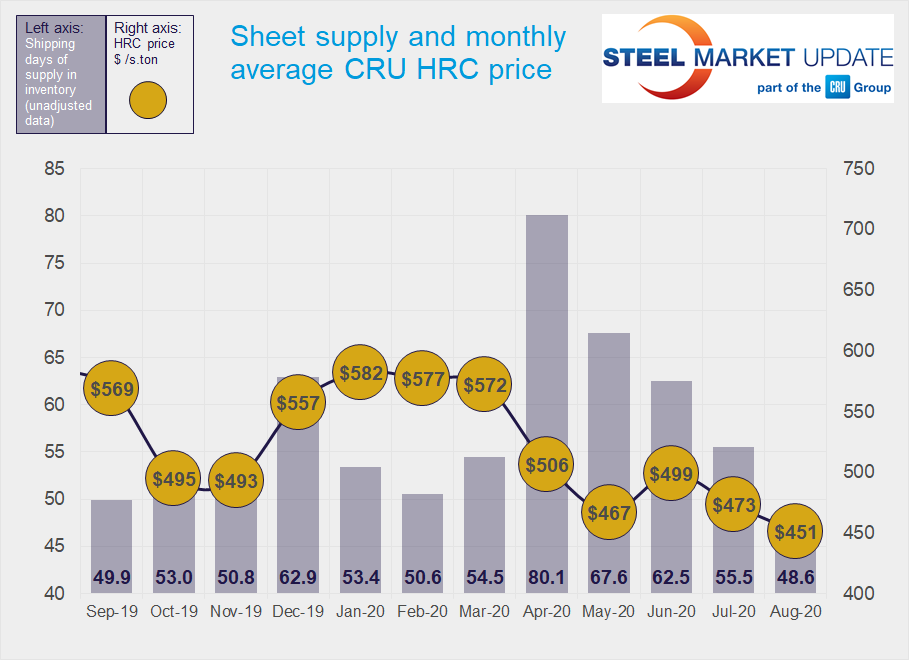

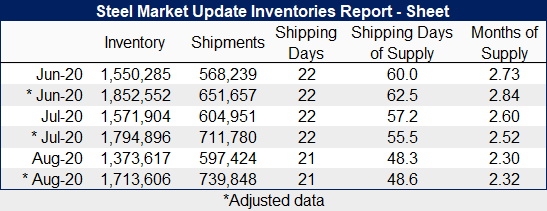

Plate = 56.9 Shipping Days of Supply

Flat Rolled

Service centers’ flat rolled steel supply reached its lowest point of the year in August, as shipments increased and intake remained nearly flat month on month. In August, service centers carried 48.6 shipping days of supply of flat roll inventory, according to adjusted data; this is down from 55.5 shipping days in July. End-of-month inventories in August represented 2.32 months of supply, down from 2.52 in July.

Even with 21 shipping days in August compared with July’s 22, shipments increased about 4 percent month on month. The daily shipping rate reached the highest level seen since February.

The CRU Midwest HRC index reached the bottom on Aug. 12, and prices have been rising steadily since. With multiple rounds of price increases from the mills, we expect lead times to continue to extend and service center inventories to build from here.

The combination of low inventories and increase in on-order volumes made the percentage of inventory on order jump in August to the highest level recorded since we began this survey in January 2019. In terms of shipping days, on-order volumes appear to be keeping up with shipments. We expect on-order volumes to rise further in September, as service centers increase their contract orders and industrial activity remains strong in the near term.

The percentage of inventory dedicated to contracts edged down to 41.9 percent in August from 52.9 percent in July.

Plate

Service centers’ plate supply edged up in August, as shipments slumped 4 percent month on month. At the end of August, service centers carried 56.9 shipping days of plate supply, according to adjusted data, up from 54.7 in July. Plate supply was also up year over year from 52.1 days in August 2019.

Plate supply in August represented 2.71 months of supply, up from 2.49 in July. The daily shipping rate in August was flat month on month, as plate has not gotten the same boost in demand seen in sheet.

Plate mills announced price increases at the end of August, and Nucor established minimum pricing last week, supported by higher scrap and sheet prices.

On-order volumes increased at the end of August and could be poised to rise further. Plate on order was up modestly month on month.

The percentage of inventory tied to contracts was 34.3, unchanged month on month.