Market Data

October 20, 2020

CRU: Potential Implications of a Biden Administration

Written by David Schollaert

With early voting underway, record breaking mail-in ballots, and a final voting date a mere 14 days away, it is safe to say that much is riding on the upcoming U.S. presidential election. With two candidates who share little common ground in a bitter election battle, it’s clear that a shift in presidential administration will bring about much change. What does that mean for the steel, commodity and manufacturing industries? More importantly, what would a Biden presidency signify for trade, climate and fiscal policy?

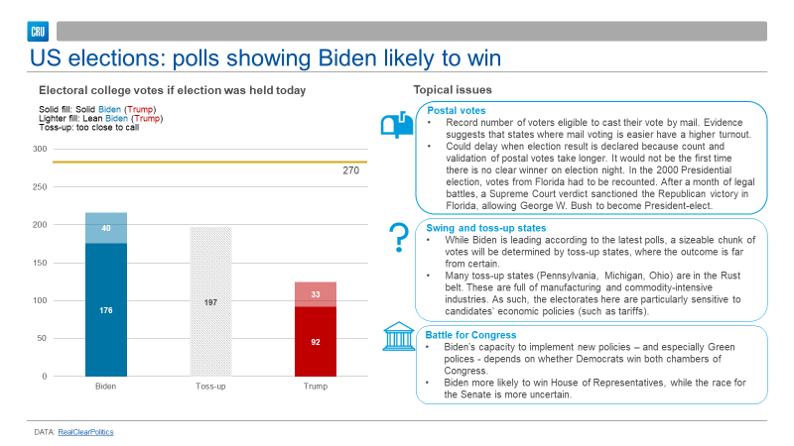

Current polls point to a possible Biden win. As a result, CRU economists have tackled these questions and provided a high-level analysis of the United States’ current economic landscape and the potential changes a Biden administration would bring.

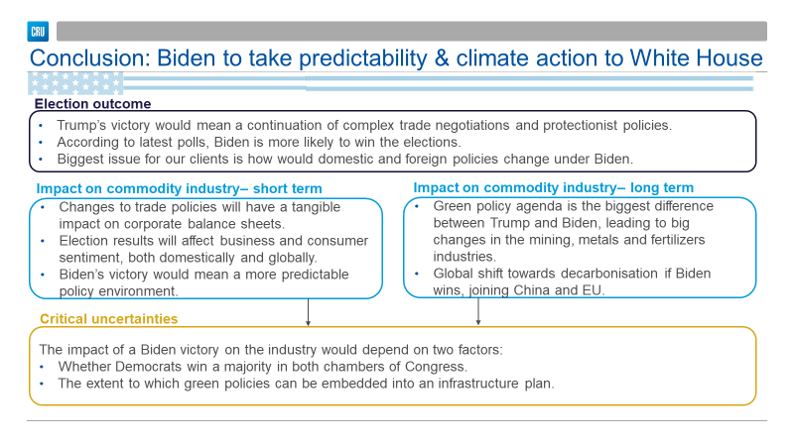

From the onset, this analysis underscores the fact that if the Trump administration secures a second term, it would largely suggest “no change” across the steel, commodity and manufacturing industries. Policies would be similar or the same as the first term, highlighted by low taxation, complex trade negotiations and protectionist trade policies. Thus, the principal issues noted below are how U.S. domestic and foreign policies might change under a Biden administration. Consequently, the spotlight focuses on its impact on (1) trade, (2) climate policy, and (3) fiscal policy.

First, from a trade perspective, protections are projected, but to what extent? A Biden administration is expected to maintain an equally tough stance on China and Section 301, and tariffs are unlikely to be revoked. The emphasis would shift, however, to “illegal and/or unfair” trade practices from China, while also refocusing on Russia. Biden has said that he would leverage a collective approach focusing on rules and violations by imposing antidumping/countervailing duties or multilateral tariffs instead of unilateral tariffs.

Regarding Section 232, the Biden administration would not support the use of national security claims. Therefore, the impact on the aluminum and steel sectors is not clear, as it’s still unclear if he’ll revoke existing tariffs. Biden’s “Buy American” agenda, however, could limit imports of foreign aluminum and steel, while auto tariffs will potentially cease, likely improving relationships with the EU and Japan. The Biden administration is expected to support existing free trade agreements, but new deals would not be a priority. Biden’s policies would shift from “free trade to fair trade,” focusing on investment in U.S. workforce, environmental and labor rules. He would also focus on Mexican and U.S. supply chain integration.

Second, Biden has been clear that under his administration, the U.S. would recommit to the Paris Agreement and focus on climate policy. He is committed to net zero carbon emissions no later than 2050 and emissions free electric power by 2035. Although not confirmed, there is also speculation that Biden may introduce national carbon pricing. He has pledged $2 trillion on low carbon infrastructure over the next four years, auto rebates and initiatives for consumers to switch to electric vehicles, building 500,000 electric vehicle charging stations to support that initiative. He would also build 1.5 million new energy efficient homes and public housing, while improving 6 million buildings. Spending on R&D to support sustainable energy technologies and 5G are also anticipated.

Third, regarding federal spending, Biden has committed to raise spending by $7 trillion over 10 years, leveraged by his “Buy American” agenda and spending $2 trillion on infrastructure and “Build Back Better” climate policy. A Covid-19 relief package expected at around $1.5 trillion would be seen shortly after the potential transfer of power. All of this would be supported in part by tax increases, implementing tax hikes of $4 trillion over a decade, mainly on corporations.

In conclusion, a Trump victory would indicate an extension of complex trade negotiations and protectionist policies–much of the same. Under Biden, however, domestic and foreign policy changes would have immediate effects on trade, and therefore corporate balance sheets, as well as domestic and global consumer sentiment. A significant and extended impact would be leveraged on green policy–a global move towards decarbonization–that would produce noteworthy shifts in the mining, metals, and fertilizers industries.

The greatest impact of a Biden victory on the steel industry, however, would still depend on whether the Democrats win a majority in both chambers of Congress, and the extent to which green policies can be embedded into an infrastructure plan, concluded the CRU economics team.