Prices

November 1, 2020

SMU Market Trends: Where Will HR Price Peak?

Written by Tim Triplett

Hot rolled steel prices just keep rising. Steel Market Update puts the current benchmark price for HR at $685 per ton. How much higher can it go before correcting? Opinions vary widely.

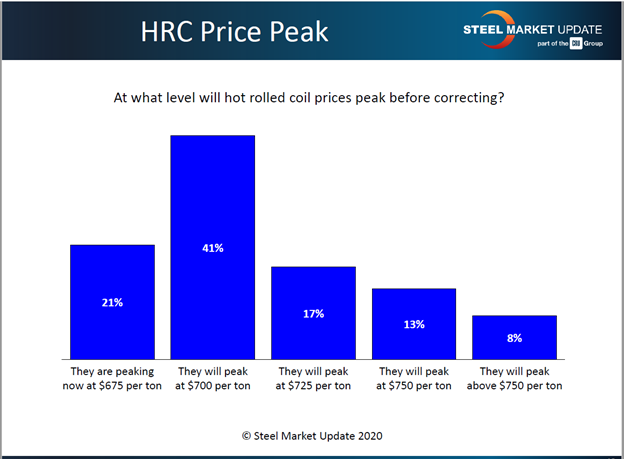

Responses to Steel Market Update’s market trends questionnaire this week indicate that a solid majority (62 percent) of industry executives believe the HR price will peak at no more than $700 per ton. But 38 percent can envision hot rolled prices above $725, and a small percentage even beyond $750.

Several market factors continue to push steel prices higher. Demand is improving as companies come to grips with doing business in a pandemic. Steel supplies remain tight as the mills take their time bringing back idled capacity. SMU data shows lead times for spot orders of hot rolled steel extending to more than six and a half weeks, suggesting the mills remain busy. At the same time, service center inventories are at very low levels, promising more buying ahead. And there is some recent precedent for even higher prices; the last time hot rolled hit $700 was in March 2019, and it topped $900 per ton in July 2018. But some experts see an end to the uptrend in the next few months as mills add capacity to the market while seasonality tempers demand and competition from imports becomes a factor once again.

Here’s what some respondents had to say this week:

“Prices will rise $30-40/ton more, but then will flatten out and start to retreat when new capacity comes on stream and imports become more attractive.”

“We have an offer from South Korea at $34.75/cwt base EDDP LA for December/January ship. Ocean transit time from South Korea to West Coast ports is about 2-3 weeks. It is about $5.00/cwt rail rate from steel mills east of the Rockies to the West Coast. Quality is not a concern from this steel mill. There isn’t any reason why we should not place our order with this South Korean mill.”

“Based on outbreaks of Covid, I can see several states going back to closing non-essential business after the election. If/when that happens, expect pricing to plunge. Supply chains will be disrupted globally.”