Prices

February 26, 2021

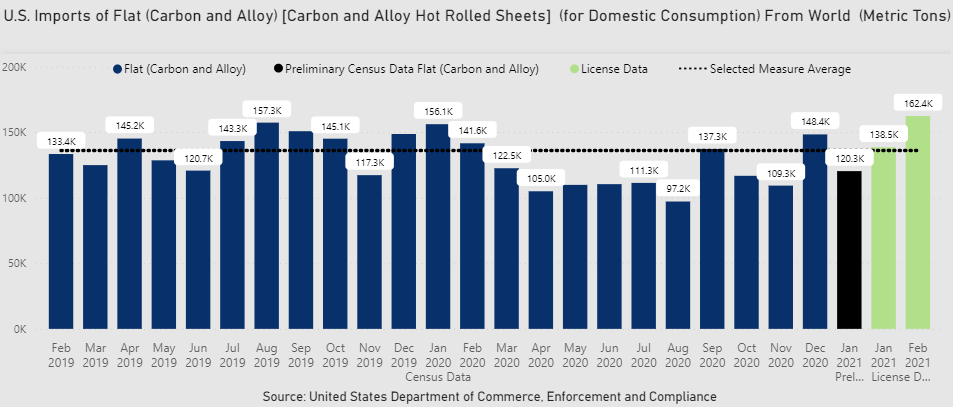

HRC Imports Highest in at Least Two Years

Written by Michael Cowden

U.S hot-rolled coil import volumes are at their highest level in at least two years–and import data for February is not yet complete.

The U.S. is poised to import at least 162,357.3 metric tonnes of hot-rolled coil in February, according to import license data last updated by the Commerce Department on Wednesday, Feb. 24.

That volume is already nearly 35% higher than the 120,336 tonnes that arrived in January, per preliminary government import data.

Import licenses, typically updated by Commerce weekly, provide an initial snapshot of import volumes. Preliminary figures, updated monthly, are more authoritative but lag the license data.

February’s volumes, through the 24th, are also 4% higher than a 2020 high, posted in January of last year, of 156,136.2 tonnes and 22% above the 133,382.7 tonnes that arrived in February 2019.

South Korea accounted for the bulk of foreign hot-rolled coil arrivals in the data collected through Feb. 24. The East Asian nation accounted for 57,487.7 tonnes, or 35%, slightly outpacing Canada, which accounted for 55,942.3 tonnes, or 34%.

Canada is typically the largest supplier of foreign hot-rolled coil to the U.S. market. South Korea has not outpaced the United States’ northern neighbor in hot-rolled coil imports in at least two years.

Japan had through Feb. 24 weighed in as the No. 3 supplier of hot-rolled coil to the U.S. market with 29,519.3 tonnes, or 18% of the total through Feb. 24. Japan’s volumes are up sharply from 2,328.6 tonnes in January and mark its highest single month of HRC shipments to the U.S. since 34,593.7 tonnes in April 2019, per Commerce figures.

Other notable trends include the reappearance of Turkey on the domestic scene. Turkey was licensed to ship 7,773.8 tonnes of HRC to U.S. ports through Feb. 24.

That figures marks the highest total for Turkish hot-rolled coil imports since at least February 2019, when U.S. imports from Turkey totaled 3,007.5 tonnes. Turkey has not shipped more than 1,000 tonnes of hot-rolled coil to the U.S. in a single month since April 2019.

The uptick in hot-rolled coil volumes comes as Steel Market Update’s average hot-rolled coil price has skyrocketed to $1,210 per ton – an all-time high.

Import offers for late spring or summer arrival, meanwhile, are approximately $950-1,000 per ton, market participants have told SMU. Those offers include not only South Korea and Turkey but also countries such as Egypt that have not been in the domestic hot-rolled equations since the first half of 2019.

And those offers are roughly $200-250 per ton below SMU’s price and $300 per ton below some U.S. mills offering HRC at $1,250 per ton.

By Michael Cowden, Michael@SteelMarketUpdate.com