Market Data

March 7, 2021

SMU Steel Buyers Sentiment: Cautiously Positive

Written by Tim Triplett

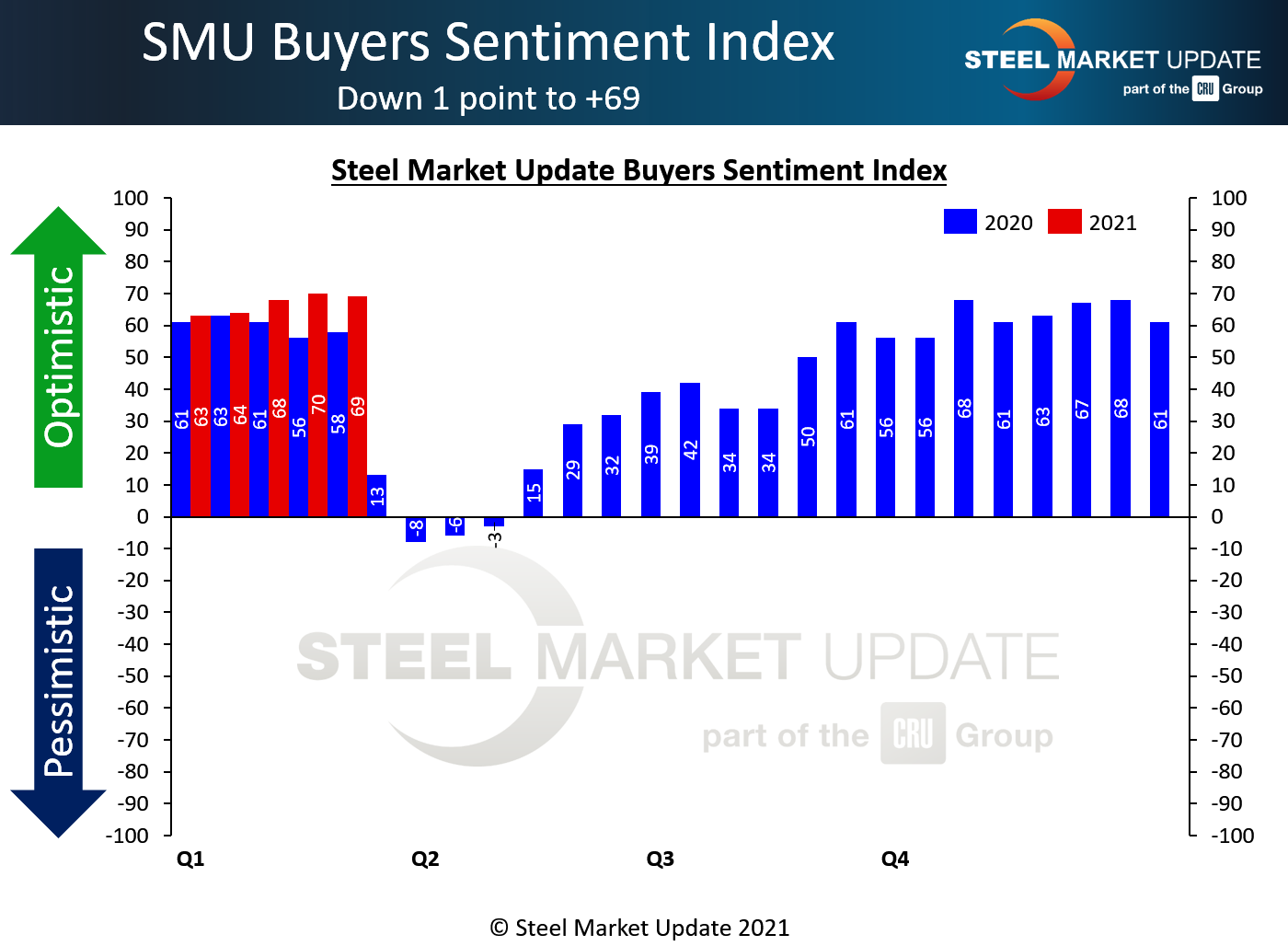

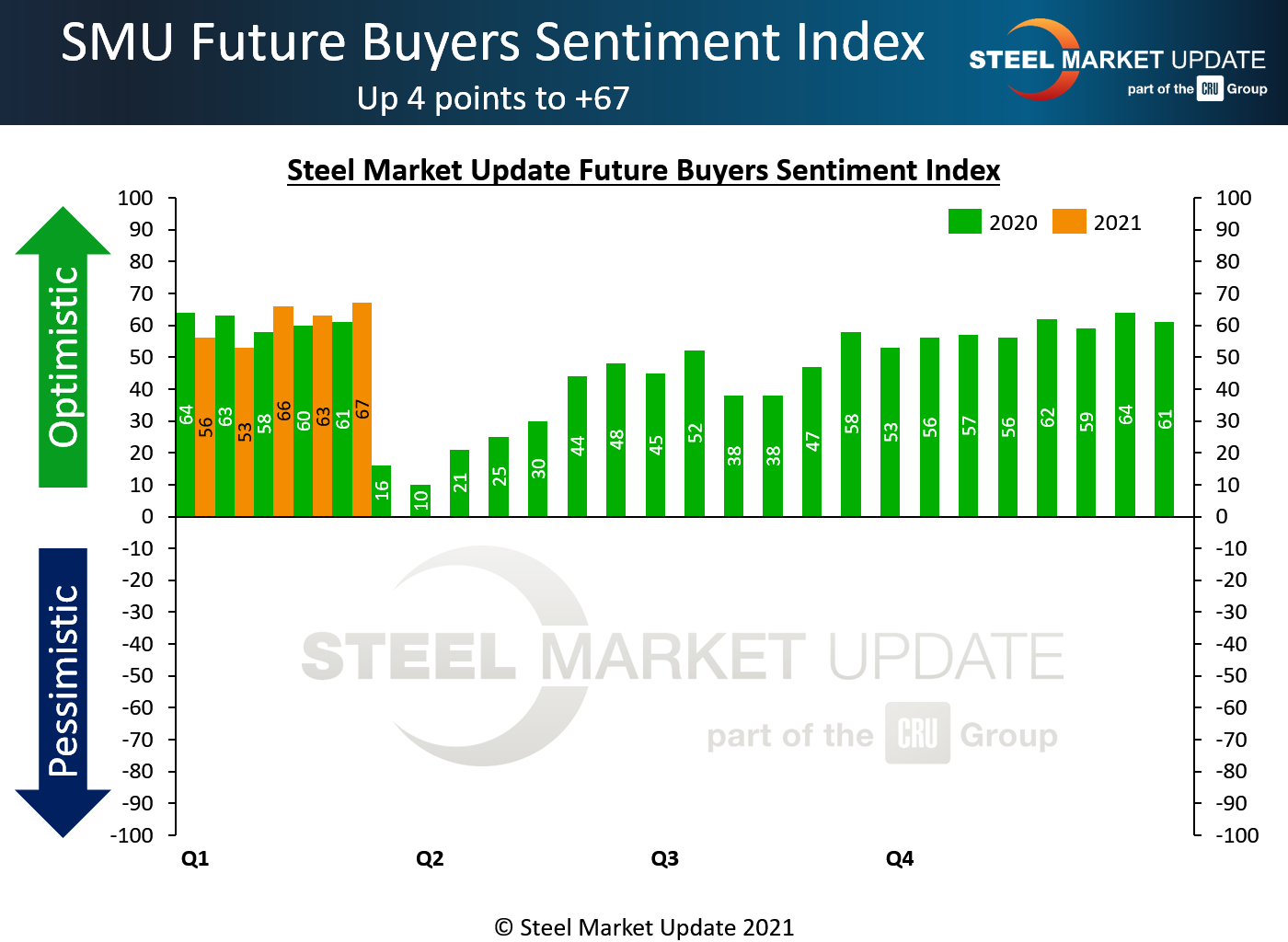

Steel Buyers Sentiment, as measured by Steel Market Update, has seen little change since the beginning of February, recording a very optimistic reading of +69 this week. Future Sentiment moved up four points to a nearly as bullish +67. Both Current and Future Sentiment now exceed pre-pandemic levels and suggest that the market is hopeful about the year ahead.

Measured as a three-month moving average (3MMA), Current Sentiment hit +65.83, while the Future Sentiment 3MMA moved up to +61.00—both well above average. For comparison, the record high 3MMAs were around +74 in the spring of 2017; the record lows were about +40 in the fall of 2019.

What Respondents are Saying

Every two weeks, SMU asks steel buyers how they view their company’s chances for success in the current environment, as well as three to six months in the future. Comments from respondents are cautiously positive, but reveal concerns about the tight steel supplies and the potential for record-high prices to suddenly correct:

“January was our best month ever, only to be surpassed by February. And with 23 business days in March (and, fingers crossed, no weather/power issues), this month could be even better still.”

“We have set company sales records every month for the past three months. We just need the supply and we could be selling much more.”

“I don’t see any changes in demand in the next six months that will affect our ability to be successful. Demand will remain steady and strong.”

“Lack of steel availability is hindering our ability to meet customer demand.”

“We’re concerned the combination of limited supply, high prices and weakening demand will all come to a logjam in early second quarter.”

“Steel is just too expensive. I don’t know how much longer we can operate with these numbers from the mills.”

“Concerned that things are too far out of whack right now for supply, demand and price levels.”

“Demand outlook is good; supply outlook is the key variable.”

“We will be importing buffer material to ensure we don’t have any issues in the second half of the year. At some point, I will have more steel than I need.”

“If steel prices drop sharply, we will get caught with overpriced inventory.”

“The closer 2022 comes, the louder the wave of imports and new capacity here domestically becomes. We all just need to show some discipline.”

“Concern about trade is key. How will Section 232 continue? Steel oversupply worldwide is a factor that will not go away.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.

By Tim Triplett, Tim@SteelMarketUpdate.com