Plate

June 22, 2021

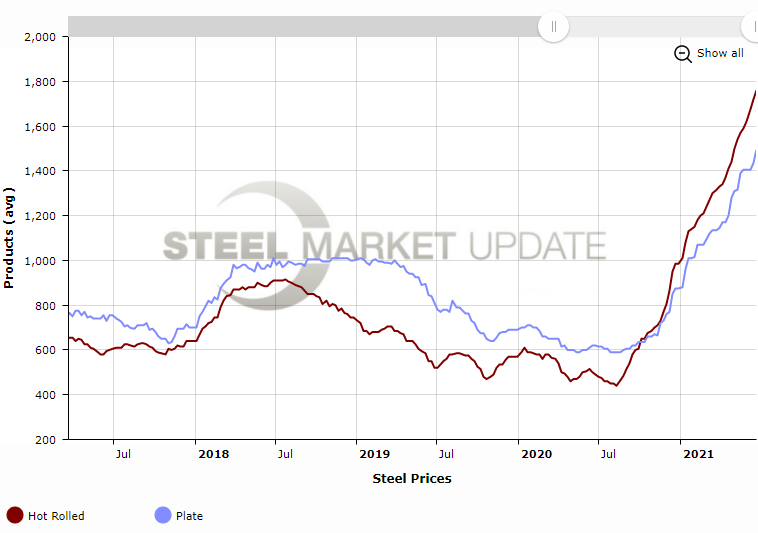

SMU Deep Dive: Sheet Premium to Plate Balloons Despite Big Price Hikes

Written by Michael Cowden

Plate prices have seen an astronomical rise, but the big gains have not been enough to keep the spread between sheet and plate from ballooning.

And that spread is already the inverse of what is the norm. Normally plate prices carry a premium to sheet prices – now the reverse is true. Sheet carries around a $300-per-ton premium to plate.

Domestic plate mills have been increasing prices at a rapid clip: At least $100 per ton ($5/cwt) last month, another $100 per ton this month – and some sources expect another ~$100-per-ton increase next month as well. They say plate mills are under pressure to bring plate prices at least closer to parity with hot-rolled coil prices.

But can the normal spreads – plate carrying a premium to sheet – be restored, or is even a potential $300 per ton in combined price hikes over three months not up to the task?

It’s hard to make dollar-for-dollar comparisons between plate and sheet when it comes to announced price hikes – because sheet mills have not been announcing price hikes since the post-pandemic recovery got underway in earnest. Instead, they’ve been quietly raising prices from one week to the next.

That said, we can use SMU data to illustrate the trend.

Upside Down: HRC-Plate Spreads

SMU’s benchmark plate price stands at $1,495 per ton ($71 per cwt) as of Tuesday, June 22, up nearly 71% from $875 per ton at the beginning of the year and more than double $590 per ton in August 2020, when both sheet and coil prices bottomed out.

Those are impressive gains. But hot-rolled coil’s gains have been even more remarkable.

SMU’s average hot-rolled coil price was at $1,760 per ton ($86 per cwt) as of Tuesday, up about 79% from $985 per ton at the beginning of the year and quadruple an August 2020 low of $440 per ton.

No one forecast that coil prices would quadruple 10 months ago. But it’s not unheard of for plate prices to dip below coil prices. What is without recent precedent is coil prices remaining above plate prices by such a wide margin and for so long.

Last August, plate prices were still higher than coil prices. That is typically how things are. Cut-to-length plate, which is what SMU’s specification is for, involves another step of processing and so requires more time on the mill.

Time is money, and steelmakers are typically able to charge a premium for that extra time. You can see in the chart above, which goes back to early 2017 – so before Section 232 came into play – that that’s generally been the case. The spread might widen or narrow, but it rarely flips for very long.

Not this time around. The sheet-plate spread has inverted since early in the fourth quarter of 2020. Coil prices had jumped to $650 per ton by early October of last year. Plate prices at the time were at $635 per ton. Normally you’d chalk that one up to noise in the numbers – nothing all that significant. And yet since then that spread has continued to balloon. It’s not $15 per ton anymore, it’s $265 per ton. So what gives?

One could make a case that plate’s prospects will improve as energy activity rebounds – and should an infrastructure bill pass, especially if it includes heavy spending on plate-intensive projects such as offshore windfarms.

Plate is more exposed to energy and heavy construction markets than sheet, which has been bolstered by consumer spending on items like cars and new appliances in the wake of the pandemic. And presumably spending on durable goods – things that are intended to last – can’t remain on an upward trend indefinitely.

Market Reaction

Does plate catch up to and then overtake sheet? Or will sheet slip back to where it has historically been – namely, below plate prices? That remains to be seen.

Market outlooks, after a year of almost uniformly bullish sentiment, are starting to diverge.

Spot prices remain very, very high. But more tons are available, especially for contract customers, one Midwest service center source said, echoing the sentiment of others.

Case in point: Mills had been holding customers to the “min” or minimum tonnage of min-max contracts. The maximum tonnage might not be available yet, but allocations above the minimum are increasing significantly, he said.

Also, inventories – which have been tight for much of the last year – are beginning to become more balanced. And that means service centers might not need the additional tons available to them now, the Midwest source said.

“Nobody has forecasted what we’re going through, so it’s anybody’s guess where we’re going,” he said. Mills have told his company that supplies will tighten again as automotive demand ramps up on better chip availability and on second half maintenance outages.

“But I am not in that camp. … The only thing I know is that supply is starting to come in at a much heavier flow, and it is starting to balance out against demand. That should flatten out the pricing, and if that trend continues, then pricing will come down,” the Midwest source said.

He pointed to lumber prices, which have come down more than 45% from post-pandemic peaks. And he questioned whether steel might be following a similar trajectory, albeit on a lag.

That sentiment is not unanimous. Other buyers remain more concerned about availability than about prices – as they have been for most of this year.

“The message we are getting from them (mills) right now is that, “If you don’t want the tons, someone else will take them,’” one end user source said. “It’s not ‘What will it take for you to place an order with us?’ We’re not hearing that yet.”

SMU isn’t seeing it in the data that we collect either. Galvanized base prices were flat this week. But prices were up for the other sheet and plate products we track.

“Eventually the pendulum will swing the other way. But I don’t see it right now,” the end user said.

By Michael Cowden, Michael@SteelMarketUpdate.com

If you like the chart above, check out SMU’s interactive pricing graphs and tables on our website. You can reproduce this chart. Or you could, for example, chart out sheet prices, scrap prices and lead times. And you can do all of that in just a few clicks.

For a demonstration, contact Paige Mayhair at Paige@SteelMarketUpdate.com.