Market Data

October 14, 2021

Steel Mill Lead Times: Falling Along With Prices

Written by Tim Triplett

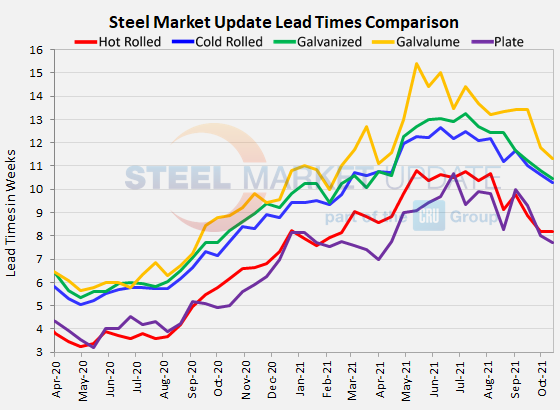

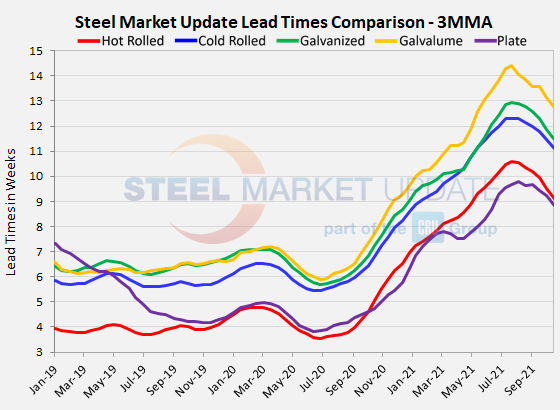

Mill lead times for orders of flat rolled and plate products have shortened significantly over the past month. Steel Market Update’s latest check of the market shows the average lead times for hot rolled, cold rolled and galvanized steel have come in by roughly three-fourths of a week. The typical hot rolled lead time is down to nearly eight weeks, while cold rolled and galvanized are now closer to 10 than 11 weeks. Plate lead times have shrunk to less than eight weeks.

Buyers polled by SMU this week reported mill lead times ranging from 5-11 weeks for hot rolled, 8-12 weeks for cold rolled, 6-14 weeks for galvanized, 9-13 weeks for Galvalume, and 6-10 weeks for plate.

The average lead time for spot orders of hot rolled has declined to 8.19 weeks, down from 8.89 weeks one month ago. Cold rolled lead times moved down to 10.30 weeks from 11.00. Galvanized lead times dipped to 10.48 weeks from 11.22 weeks in mid-September. The average Galvalume lead time dropped by a full two weeks to 11.33 from 13.43 weeks in the same period.

Like sheet products, mill lead times for plate have also shortened. The average plate lead time moved down to 7.71 weeks from the 9.30 weeks seen in SMU’s check of the market a month ago.

Lead times are considered a leading indicator of steel prices. The shorter the lead times, the less busy the mills and the more likely they are to negotiate on price to secure orders. Shorter lead times are consistent with the declining steel prices seen over the past few weeks.

By Tim Triplett, Tim@SteelMarketUpdate.com