Market Data

October 14, 2021

Steel Mill Negotiations: More Buyers Pushing Back

Written by Tim Triplett

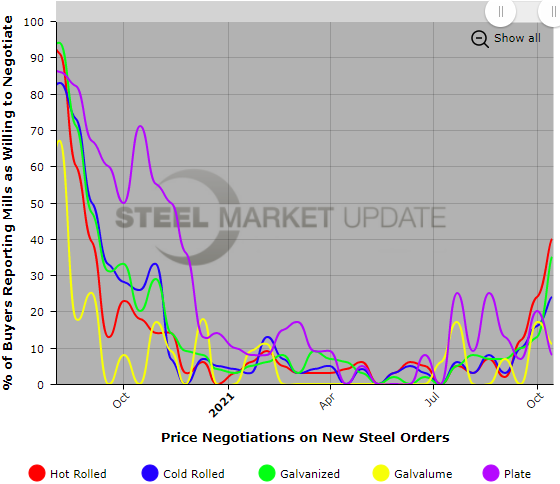

Since this time last year, mills have been in the driver’s seat when it comes to steel price negotiations. With demand exceeding supplies – and with buyers more concerned about finding steel than what they had to pay for it – mills have basically been able to steer prices wherever they wanted. That appears to be changing, though, as the latest Steel Market Update negotiations data suggests buyers are no longer just along for the ride.

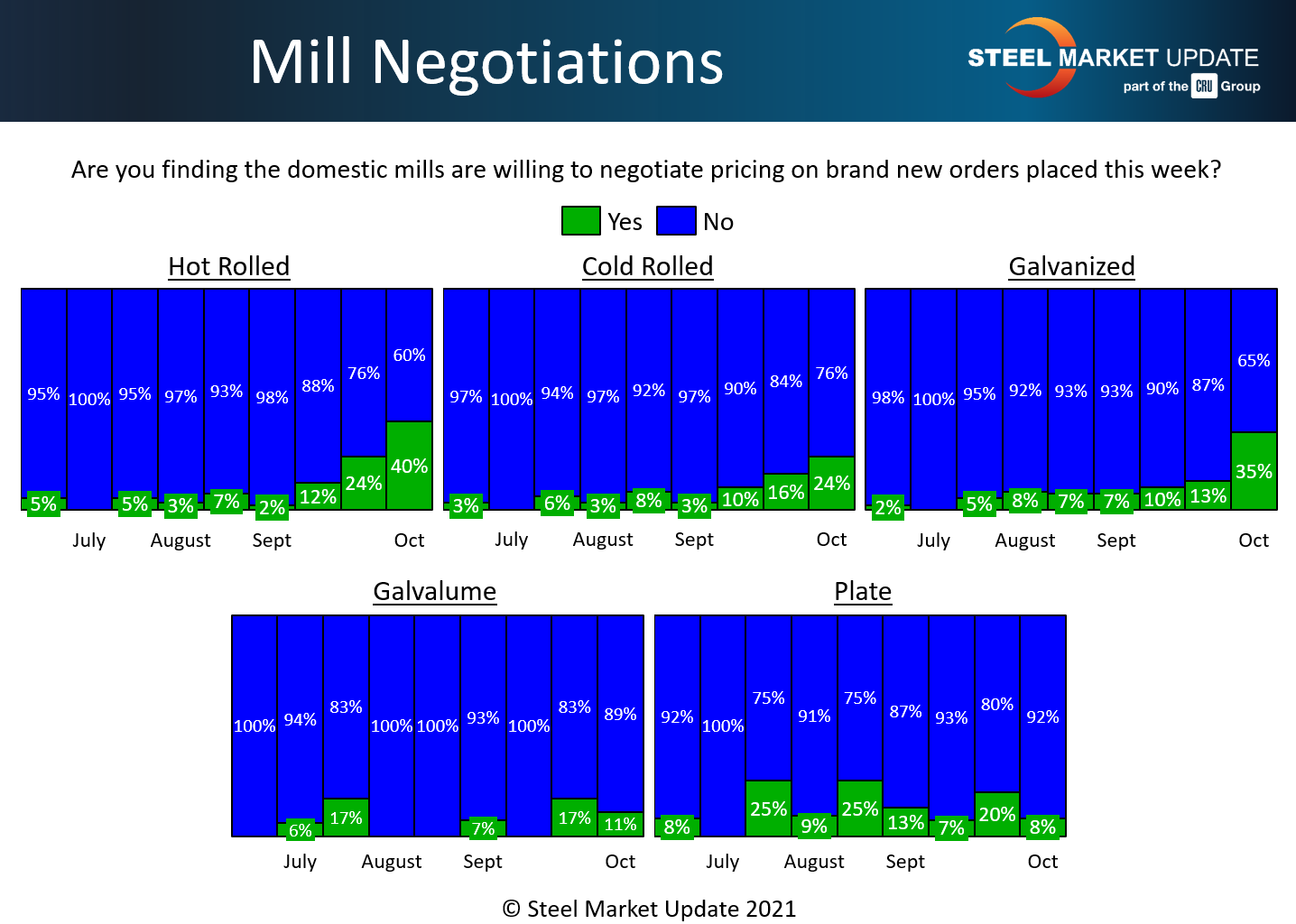

SMU asks buyers every two weeks if mills are willing to talk price on spot orders. Around 40% of hot rolled buyers responding to this week’s survey said mills are now open to negotiating – which is a big shift. As recently as the first week of September, just 2% had reported mills willing to negotiate.

The change in the tone of price talks is similar in other product categories: About 35% of galvanized buyers and 24% of cold rolled buyers now report some wiggle room in price negotiations. Talks are still very tight in Galvalume and plate, however, report survey respondents.

Mills clearly still have the dominant bargaining position, but it appears to be weakening a bit as competition from imports increases, lead times shorten and prices begin to moderate.

By Tim Triplett, Tim@SteelMarketUpdate.com