Market Data

January 6, 2022

Steel Mill Lead Times: Declines Continue

Written by Tim Triplett

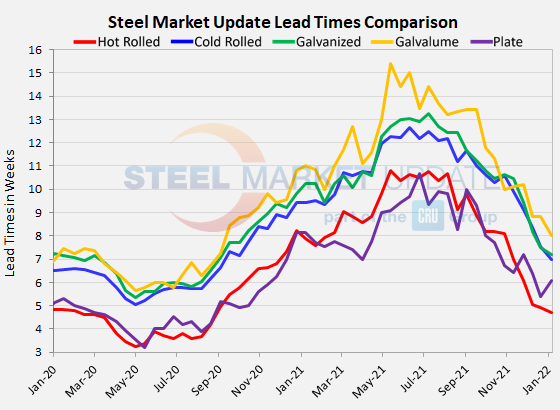

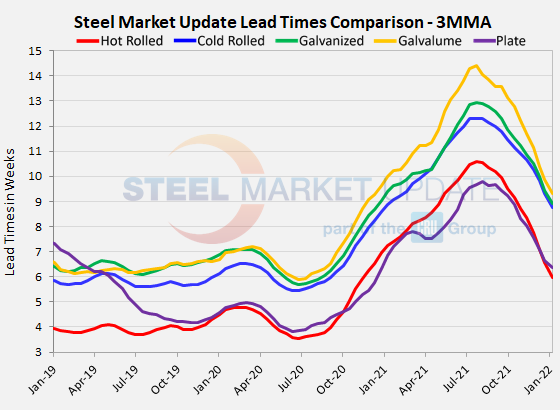

Lead times on spot orders from domestic steel mills continue to decline, with no sign yet of how soon they might level out. Declining lead times are a leading indicator of declining steel prices.

The average lead time for hot rolled is now approaching four and a half weeks, while cold rolled and galvanized are down around seven weeks, based on Steel Market Update’s check of the market in the first week of the New Year. (SMU measures lead times as the time it takes from when an order is placed with the mill to when the order is processed and ready for shipping, not including delivery time to the buyer.)

Buyers polled by SMU this week reported mill lead times ranging from 3-8 weeks for hot rolled, 4-10 weeks for cold rolled, 4-11 weeks for galvanized, 5-10 weeks for Galvalume, and 4-8 weeks for plate.

The average lead time for hot rolled has declined to 4.69 weeks from 4.92 two weeks ago. Cold rolled lead times now average 6.99 weeks, a decline from 7.53 prior to the Christmas holiday. Galvanized lead times dipped to 7.21 weeks from 7.50 in the same timeframe. The average Galvalume lead time is down by nearly a week to about 8.0 weeks.

Mill lead times for plate are now at 6.07 weeks, up slightly from the third week in December. But that increase might reflect a limited number of transactions during the holiday period.

Lead times are the shortest they have been in nearly a year and a half after hitting historic highs in 2021. But like prices, it appears they have more room to slide before reaching a new normal.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

By Tim Triplett, Tim@SteelMarketUpdate.com