Prices

January 13, 2022

CRU: U.S. Prices Fall Further as Excess Supply Overwhelms Demand

Written by Josh Spoores

By Principal Analyst Josh Spoores from CRU’s Steel Sheet Products Monitor, Jan. 22

Trends in the North American sheet market have picked up where 2021 left off, particularly a continued decline in sheet prices. Various supply pressures have overwhelmed demand and led to lower sheet prices in all North American markets.

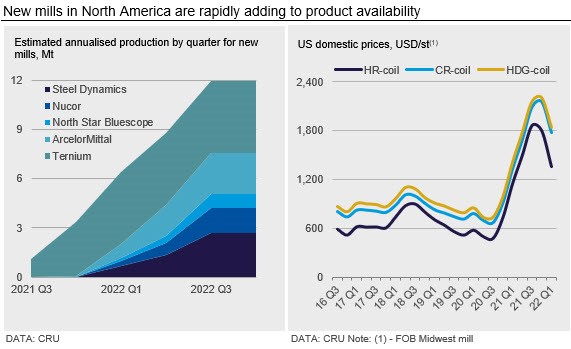

In the U.S. Midwest market, sheet prices have fallen by as much as $160 /s.ton since our Dec. 8 assessment. This price weakness has come about as import arrivals remain high and mill production has ramped up from the 2021 H2 maintenance outages. In addition, the new hot strip mills in Mexico are adding to available supply while three new EAFs in the USA are in their start-up process and some are offering volume for later this quarter (see chart).

Lastly, inventories at service centers have continued to rise and remain at a substantial surplus to expected demand. Alongside these high inventory levels, we continue to find that the amount of material on order at mills remains at higher-than-average levels.

On the West Coast, sheet prices remained steady, yet buyers are expecting a significant decrease when mills begin accepting March orders as competition among North American producers is increasing. Pricing from imports and domestic mills in other regions is significantly lower than current West Coast prices despite recent prices dropping $166 /s.ton from January numbers. More buyers are reporting opportunities to purchase material from Midwest and Southern mills for the first time in over a year.

In Mexico, prices have continued to fall, losing around 4% m/m for HR and CR coil. In the automotive sector, production of light vehicles in December fell by 15% m/m and 17% y/y. On the supply side, ArcelorMittal produced the first hot-rolled coil at its new hot strip mill at Lazaro Cardenas in December. This plant is part of the investments announced back in 2018 by the company and will start continuous production in January. In this first stage, it is planned to produce 2.5 Mt/y of steel.

Outlook: Rapid Price Decline Likely, Particularly for CR and HDG Coil Products

Our near-term outlook remains bearish on prices. Based on market feedback, quiet low-priced deals are starting to get discussed among more market participants. Some of these offers are to compete with imports, others are to compete with sheet products from the new mills.

While we continue to expect lower HR coil prices, we are now focusing on a potential rapid decline in CR and HDG coil prices. Unlike the price of HR coil, these prices have been slower to fall and due to this, frustrated buyers continue to look to imports as a source of competitive supply. The high level of import arrivals coupled with a rapid increase of new regional supply and high inventories throughout the supply chain will soon force mills to battle for market share while margins still remain at historically high levels.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com