Overseas

March 8, 2022

CRU: Iron Ore Price Soars as Europe Struggles to Replace Supply Lost from Ukraine War

Written by Aaron Kearney-Keaveny

By CRU Research Analyst Aaron Kearney-Keaveny, from CRU’s Steelmaking Raw Materials Monitor, March 8

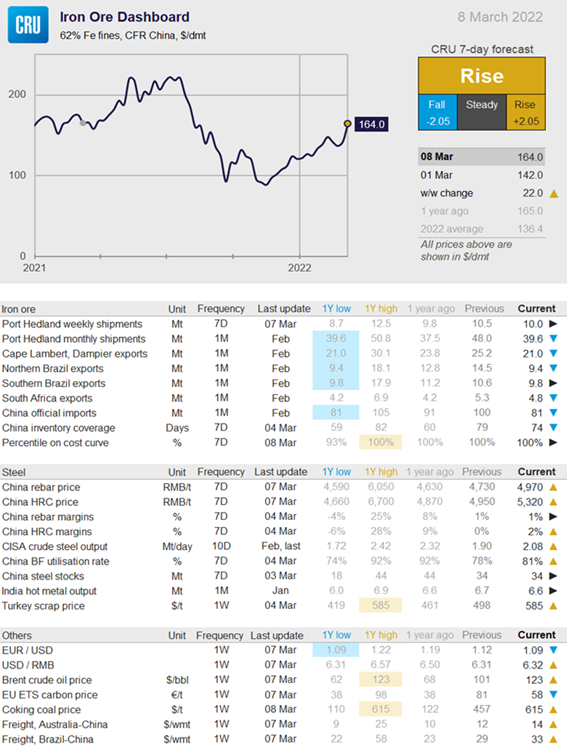

The war in Ukraine has caused a dramatic rise in the iron ore price, which now stands at $164 /dmt. European steelmakers are now scrambling to find iron ore to replace lost imports from Ukraine and Russia. The market will take more than the upcoming week to settle into a new equilibrium.

![]()

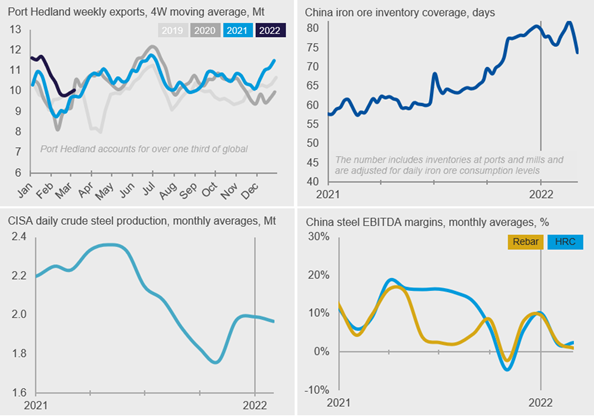

Chinese HRC and rebar prices have been elevated over the past month on continued demand improvement and higher input costs. As of Monday, our daily assessment of HRC and rebar for domestic sales has risen by RMB370 /t and RMB240 /t w/w respectively. In the domestic market, despite the continuation of production increases, steel flat product inventories fell faster, while inventory build-up of long products started to decelerate. Meanwhile, we heard increasing enquires for Chinese steel products in the trade market, evidenced by faster increases in the HRC export price.

In between the end of the Winter Olympics, the start of the Paralympics and the government’s “Two Session” meeting, hot metal production lifted again w/w on eased operating restrictions for a short period of time. The surveyed daily hot metal output registered the highest value since September. This pushed up iron ore consumption activity for port side inventories. Having said that, the improvement was modest w/w given that tighter operating restrictions were reintroduced this week while the two events are ongoing. Meanwhile, sintering restrictions were eased, leading to higher sinter rates in the Fe burden at the expense of pellet and particularly lump.

Russian forces have captured Ukrainian lands north of Crimea and fighting has occurred close to the Zaporizhzhia mine, but they remain far from the main cluster of mines in central Ukraine. The closures of ports, railways and barge routes have resulted in iron ore piling up at the operational mines. European steelmakers face a major shortage as a result, with Ukraine unable to export their production and sanctions, or the fear of them, making Russian materials unavailable. In 2021, the two nations supplied 27% of Europe’s iron ore and 55% of pellets. Europeans are therefore attempting to source iron ore from other regions, particularly pellets and lump to avoid higher sintering rates.

In Australia, Port Hedland’s shipments fell by 0.5 Mt to 10.0 Mt. BHP increased their production by 1 Mt, but the port total was dragged down by the other producers. Rio Tinto saw levels fall much more drastically, with the lowest weekly production seen in months. Cyclone Anika, which was projected to affect operations at Port Hedland, was ultimately harmless against iron ore activity and has dissipated. There are currently no cyclones or tropical lows active in the region. There have been discussions in the market about Australian producers shipping lump to Europe to help resolve the shortage in the region.

Brazilian trade data reveals a very poor performance in both northern and southern Brazil during February. Northern Brazil shipped 9.4 Mt, a 5.1 Mt drop from January or 3.4 Mt drop from February last year. The south fell by a much more moderate 0.8 Mt to 9.8 Mt. Some Europeans have hoped that they could source iron ore from Brazil, particularly lump, although there would be limited supply. More iron ore is available from other regions for this, such as lump from South Africa and pellets from India or the USA.

Freight rates have risen in the past week with the war in Ukraine affecting traffic into the Black Sea. There are fears around global trade flows being affected and dry bulk material potentially being sourced from more distant markets, for example European steelmakers buying iron ore and coal from other regions than CIS.

Iron ore has seen a dramatic rise, which will continue. European steelmakers will burn through stocks and become increasingly desperate for iron ore, and we see a high chance of steel production in Europe eventually being cut if the ability to source raw material worsens. Supply from other regions will take time and create a knock-on effect of reduced availability for other regions.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com