Market Data

April 27, 2022

Manufacturing Indicators Strong Through First Quarter

Written by Brett Linton

Data on US industrial production, capacity utilization, new orders and inventories continue to improve. February and March 2022 reports indicate a strengthening manufacturing sector. The health of the manufacturing economy has a direct bearing on the health of the steel industry.

![]() The Industrial Production Index

The Industrial Production Index

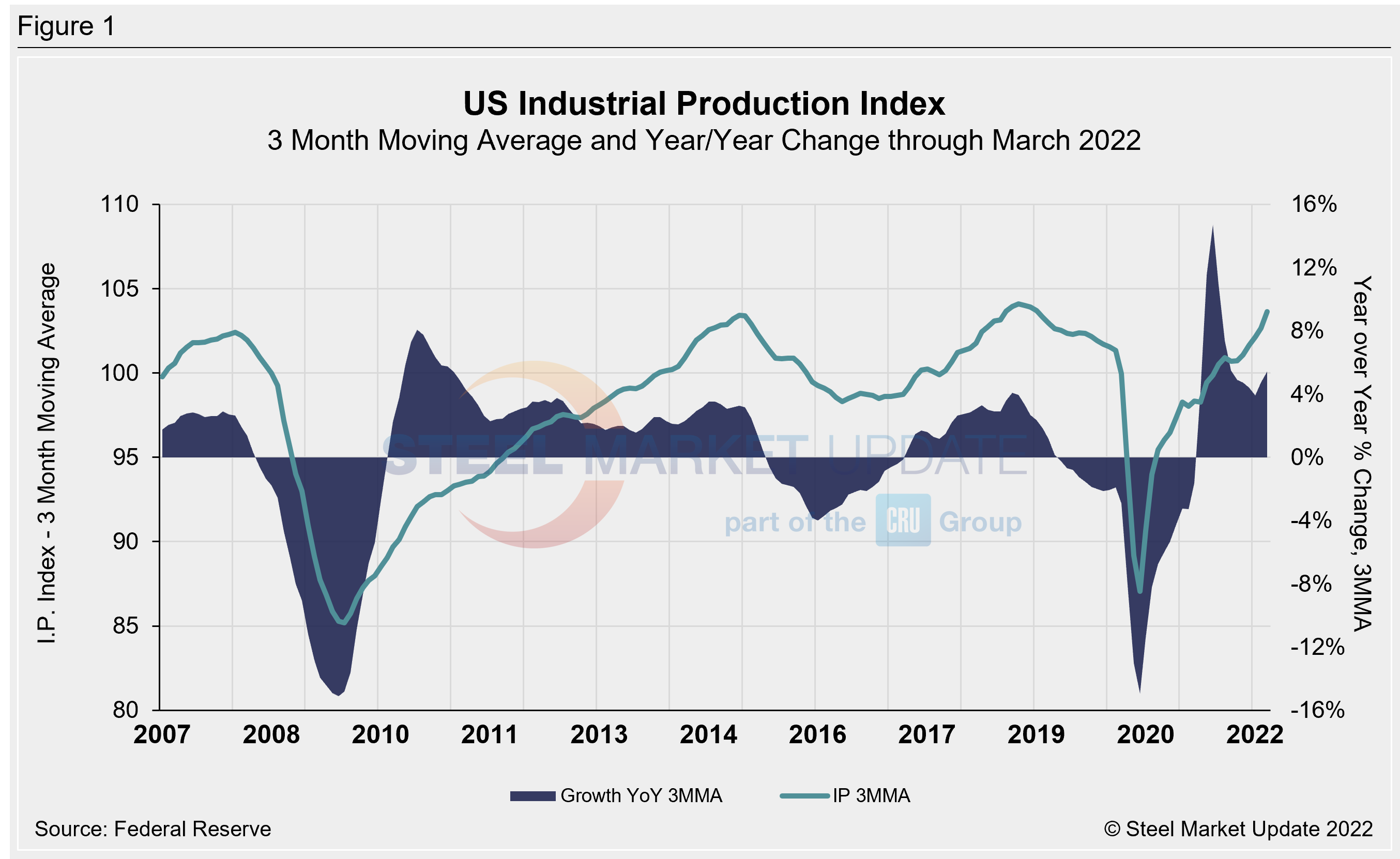

The IP index is a gauge of output from factories, mines and utilities. Industrial production took a hit from the shutdowns of nonessential businesses and other measures following the outbreak of the pandemic in mid-2020. Figure 1 shows the three-month moving average (3MMA) of the IP index since February 2007 as the black line and the year-over-year change in orange. We use the 3MMA calculations here to smooth out some of the monthly variability. From March through June 2020, the 3MMA of the IP index declined 13%, reaching a 10-year low of 87.1. The 3MMA has recovered nearly each month since, climbing to 103.6 in March, up 5.4% over the same period last year and the highest measure since January 2019.

Manufacturing Capacity Utilization

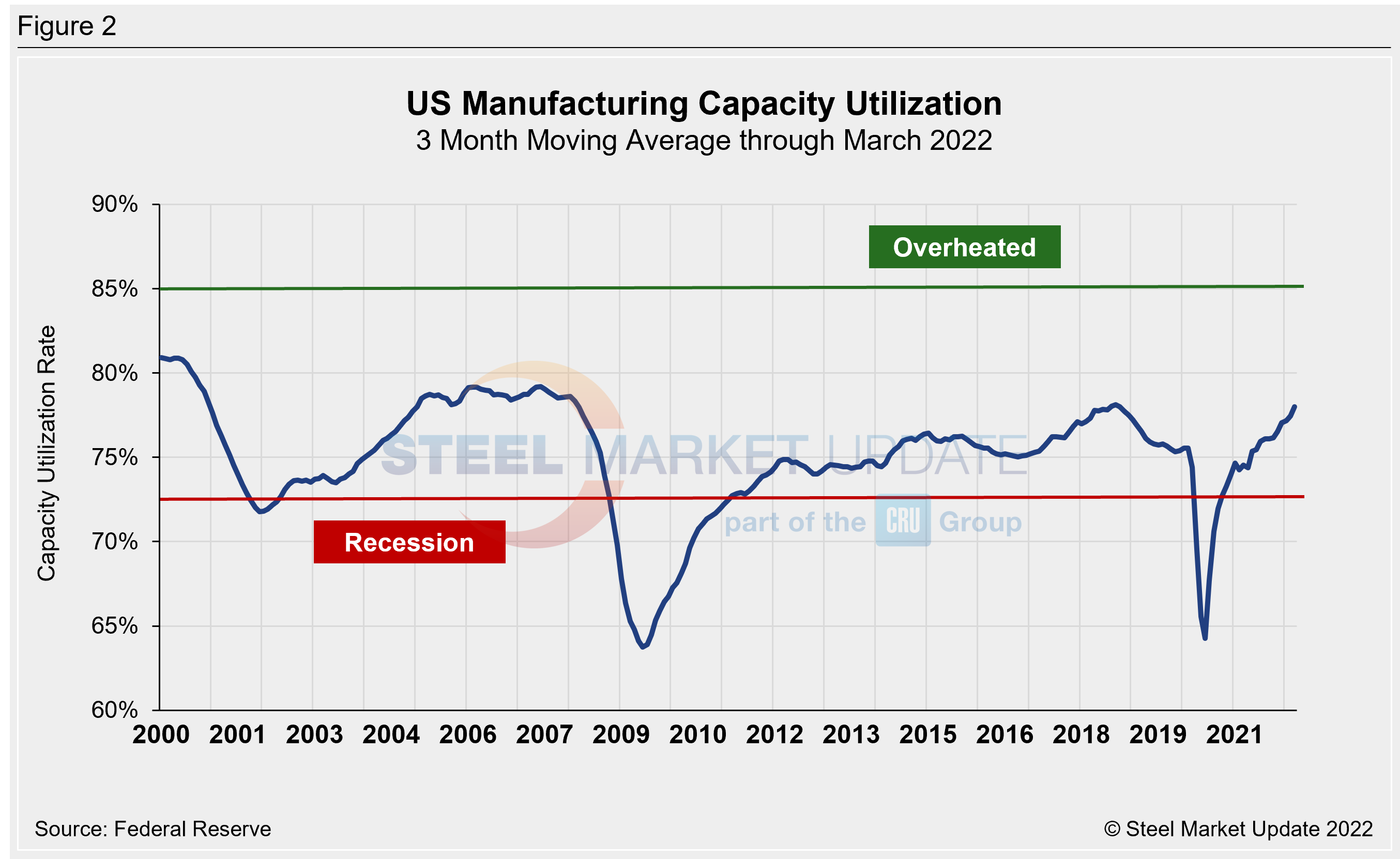

Manufacturing capacity utilization through March was measured at 78.0% as a 3MMA, the 18th consecutive month above recessionary territory, and the highest 3MMA rate recorded since October 2018. The rate had hovered around 75% for most of the 2010s but began to dip in April 2020 and reached a low of 64% in June 2020 (Figure 2).

New Orders for Durable Goods

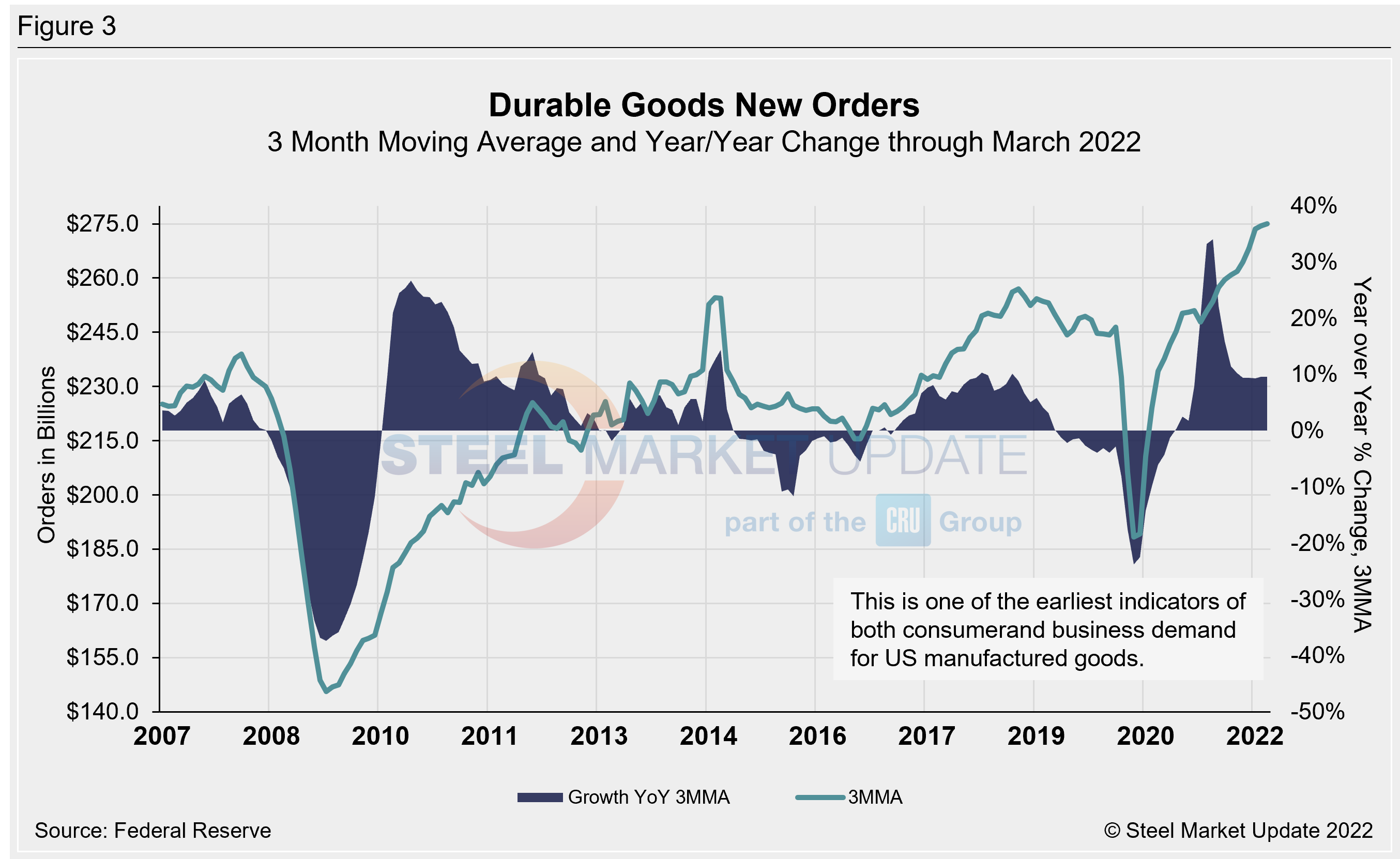

New orders for durable goods, an early indicator of consumer and business demand for US manufactured goods, continues to recover from the 2020 shock and reached a new record level in January of $277.5 billion (Figure 3). New orders increased to $275.1 billion as a 3MMA through March 2022, the highest level in our history dating back to 1992. The 3MMA had dropped by 23% from February through May 2020, reaching a 10-year low of $188.4 billion.

New Orders for Manufactured Products

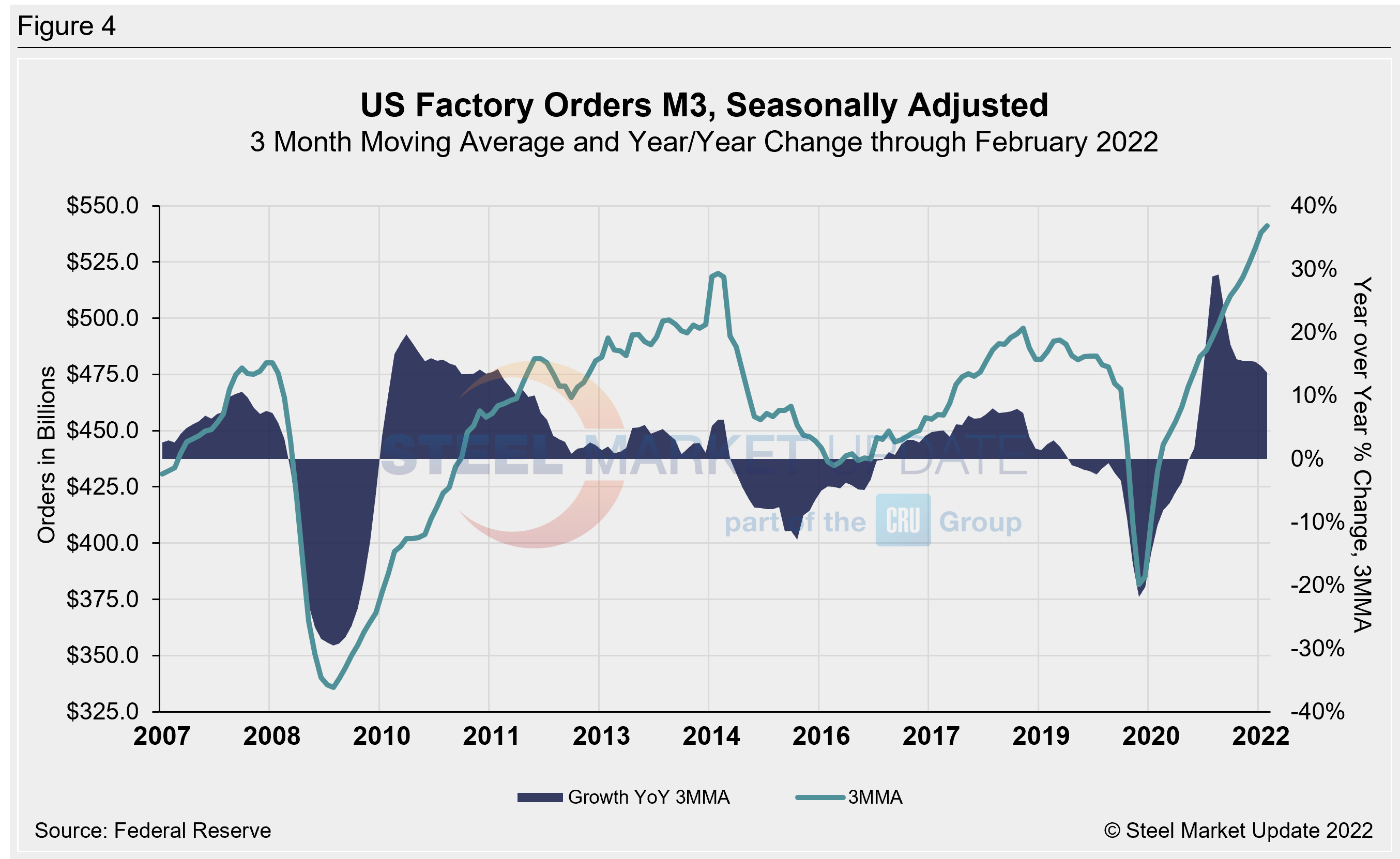

The growth rate of new orders for manufactured products as reported by the Census Bureau was slightly negative for most of 2019, then declined sharply from March to July 2020 (Figure 4). On a 3MMA basis, factory orders have increased each month since then, reaching $541 billion in February 2022. This is up 13.6% compared to one year prior, and also the highest level in our 30-year data history.

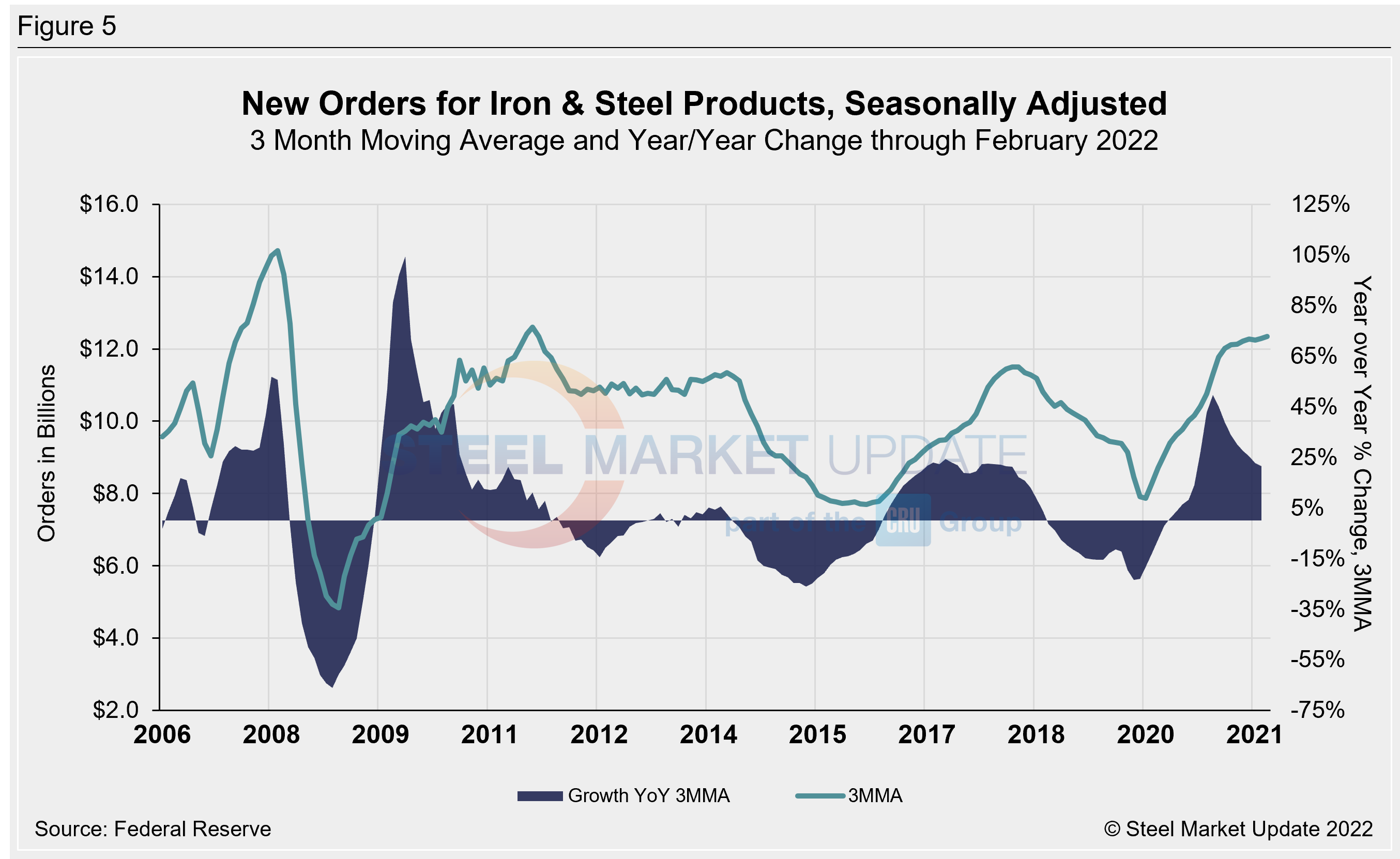

New Orders for Products Manufactured from Iron and Steel

Within the Census Bureau M3 manufacturing survey is a subsection for iron and steel products. Figure 5 shows the history of new orders for iron and steel products since 2007 as a 3MMA. The 3MMA year-over-year growth rate, which reached negative 23.4% last May, has climbed to a positive 21.5% as of February at $12.3 billion (3MMA). This is now the highest new order level seen since February 2012. Back in June 2021, the 3MMA year-over-year growth rate reached a multi-year high of 49.6%, the highest rate since July 2010.

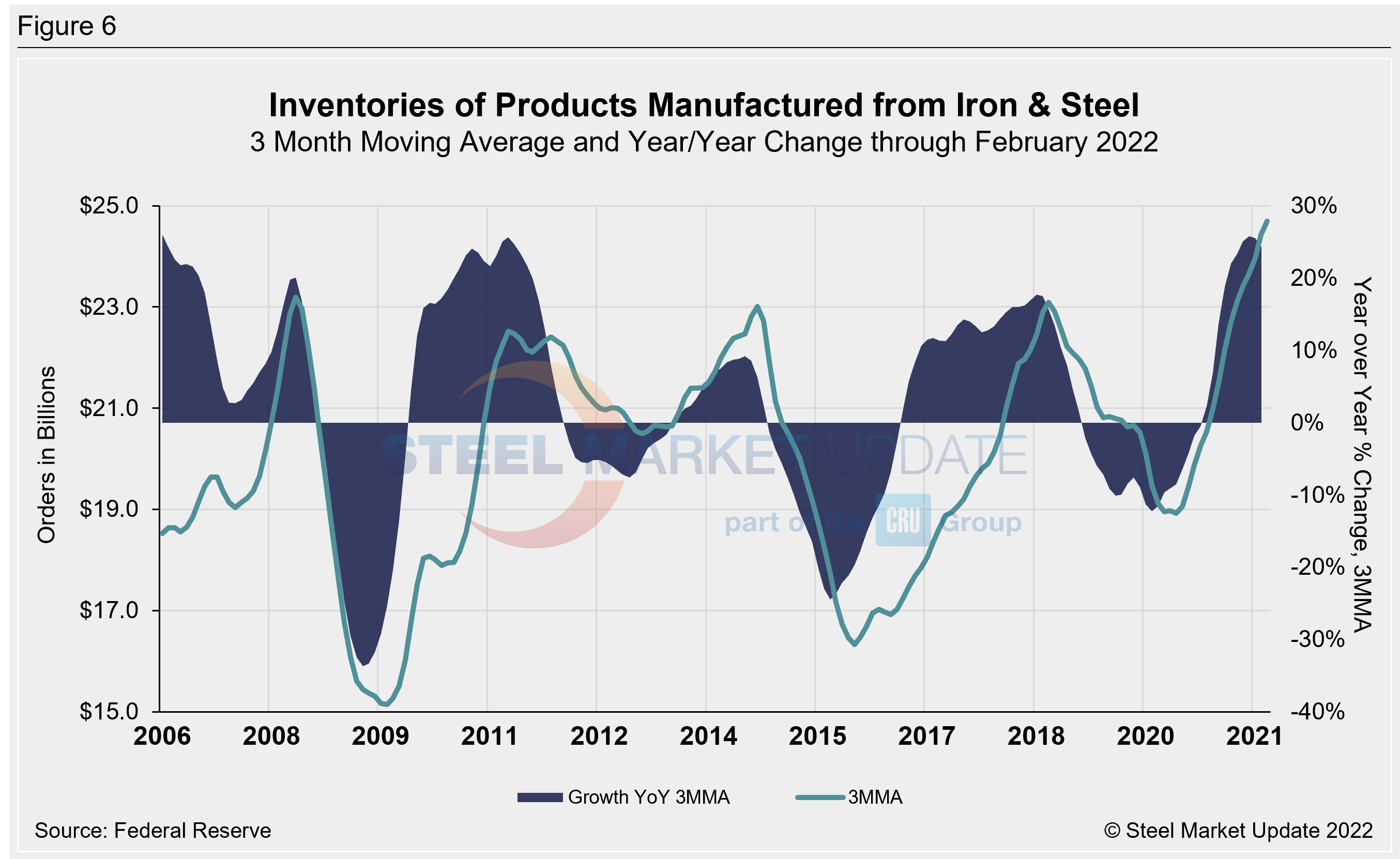

Inventories of Products Manufactured from Iron and Steel

Inventories of iron and steel products broke their multi-month decline streak in November 2020, and have risen each month since. The latest iron and steel inventory levels totaled $24.7 billion on a 3MMA basis in February, up 24.2% compared to the same period the year prior (Figure 6). This is now the highest 3MMA measure seen in our 29-year history, and the fourth highest year-over-year change seen in the last decade.

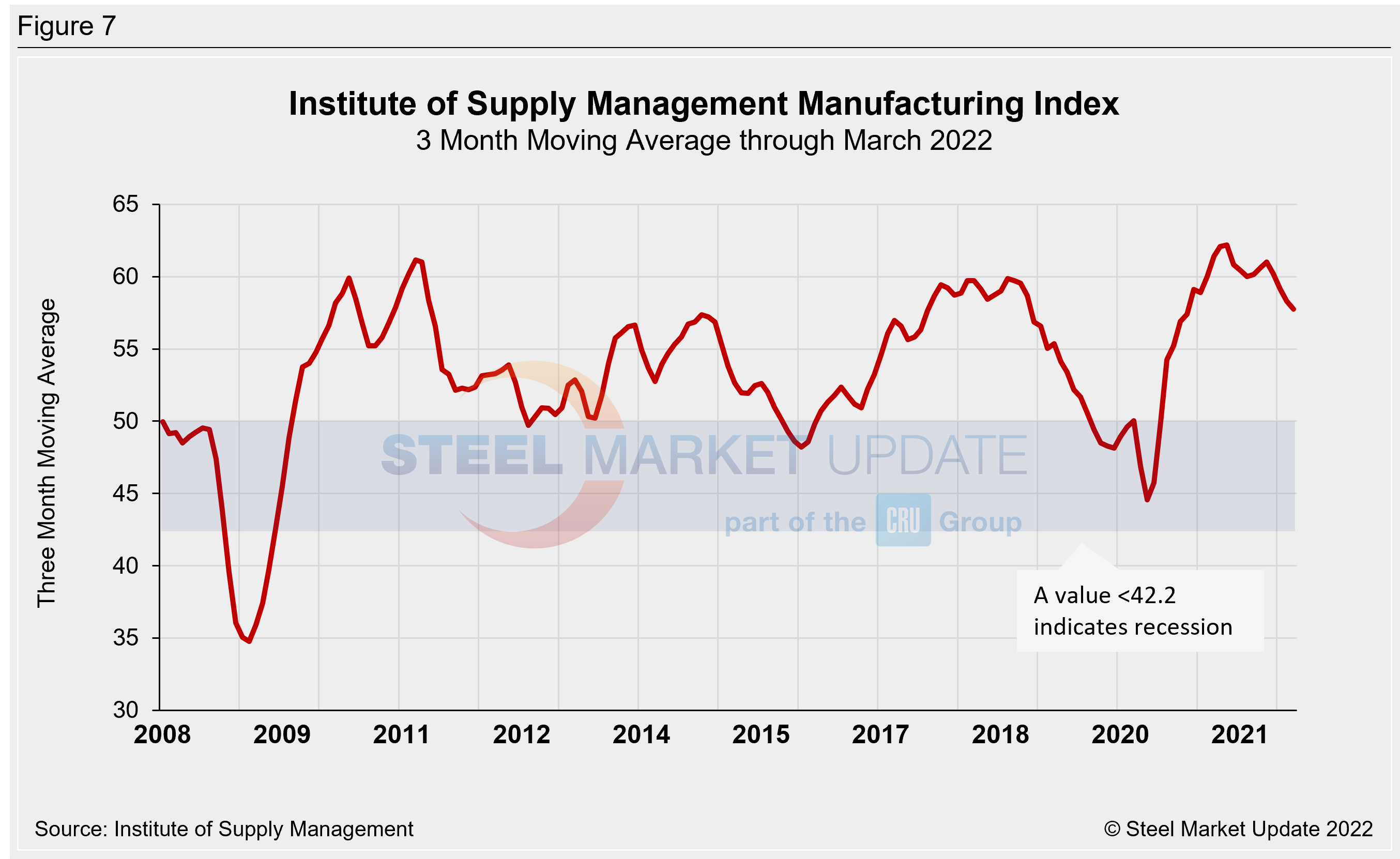

The ISM Manufacturing Index

The Institute for Supply Management® Manufacturing Index is a diffusion index. An index value above 50 indicates that the manufacturing economy is expanding. As Figure 7 shows, the index on a 3MMA basis was in contraction territory from September 2019 through July 2020, peaking last May at 62.2. Now standing at 57.8 through March, the 3MMA index is down 0.5 percentage points from the month prior, but remains strong historically.

“The U.S. manufacturing sector remains in a demand-driven, supply chain-constrained environment. In March, progress was made to solve the labor shortage problems at all tiers of the supply chain, which will result in improved factory throughput and supplier deliveries,” said ISM Business Survey Committee Chairman Timothy Fiore.

By Brett Linton, Brett@SteelMarketUpdate.com