Prices

June 16, 2022

Hot Rolled Futures: Inflation Concerns and the Effect on Demand

Written by Jack Marshall

The following article on the hot-rolled coil (HRC), scrap and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Hot Rolled

HR futures are coming back to life after a quiet spell in May. Month to date in June more than 225,000 short tons (ST) of HR has traded. Q3’22 HR has been especially busy this past week.

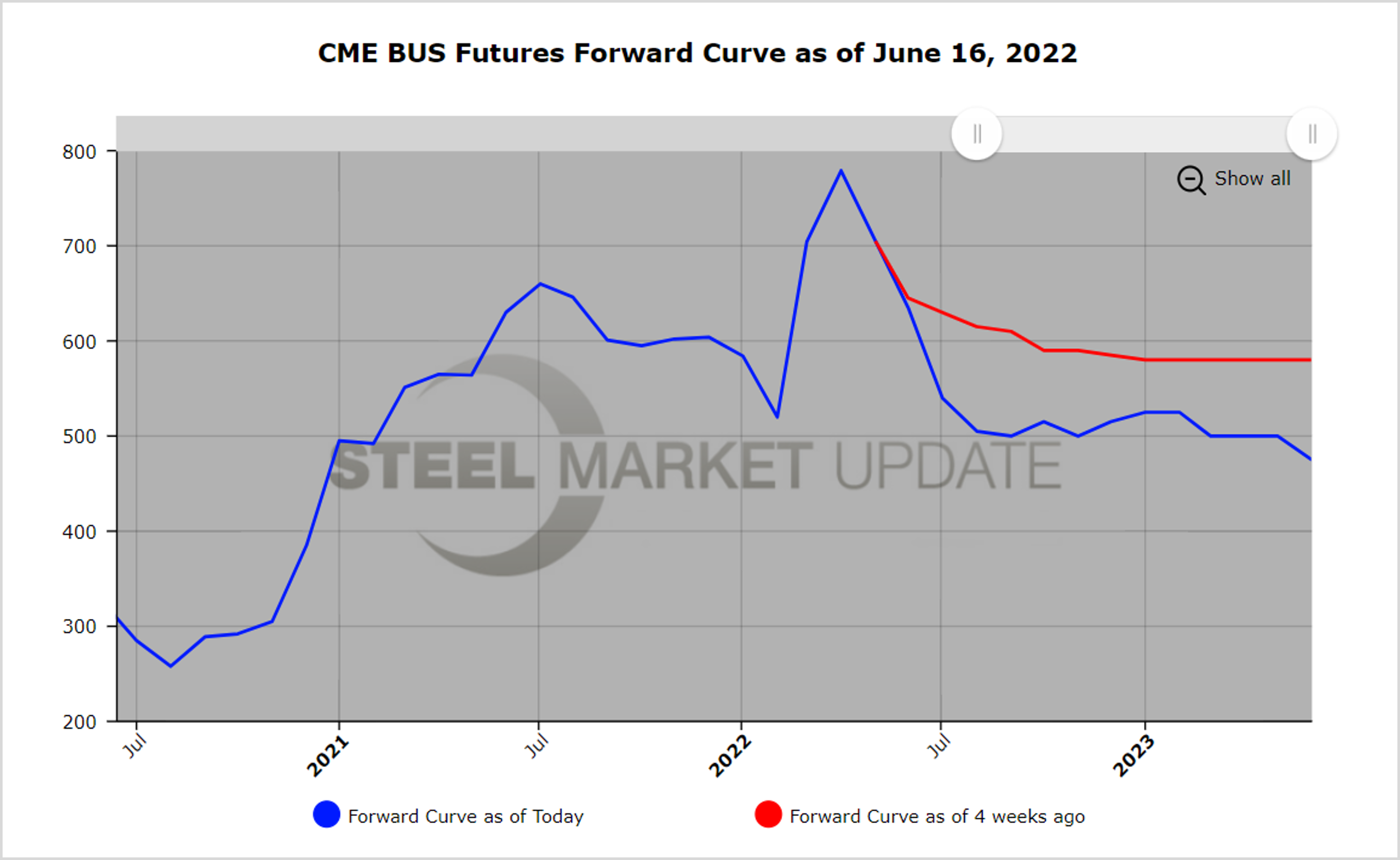

Open interest has risen about 3,400 contracts so far this month on a pickup in hedging of physical deals as the spot price has continued its decline. Spot has retraced a little over $200/ST since the end of May, and the average forward curve prices in Q3’22 and Q4’22 have declined $30/ST and $15/ST, respectively.

The curve between Jul’22 and Mar’23 continues to narrow on a settlement basis, shrinking from -$79/ST to -$62/ST. Bearish market sentiment continues to build as continued labor issues and Covid-related supply disruptions along with major inflationary headwinds curtail upcoming quarterly forecasts. In addition, some announced layoffs in the automotive space and difficulties in the housing/construction arena further invite concern. Numerous participants have expressed the expectation that prices will continue to decline at a similar pace for the remainder of June, which given shortening lead times is likely supported. Also, soft metallics prices are adding to the price discomfort.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features. You can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

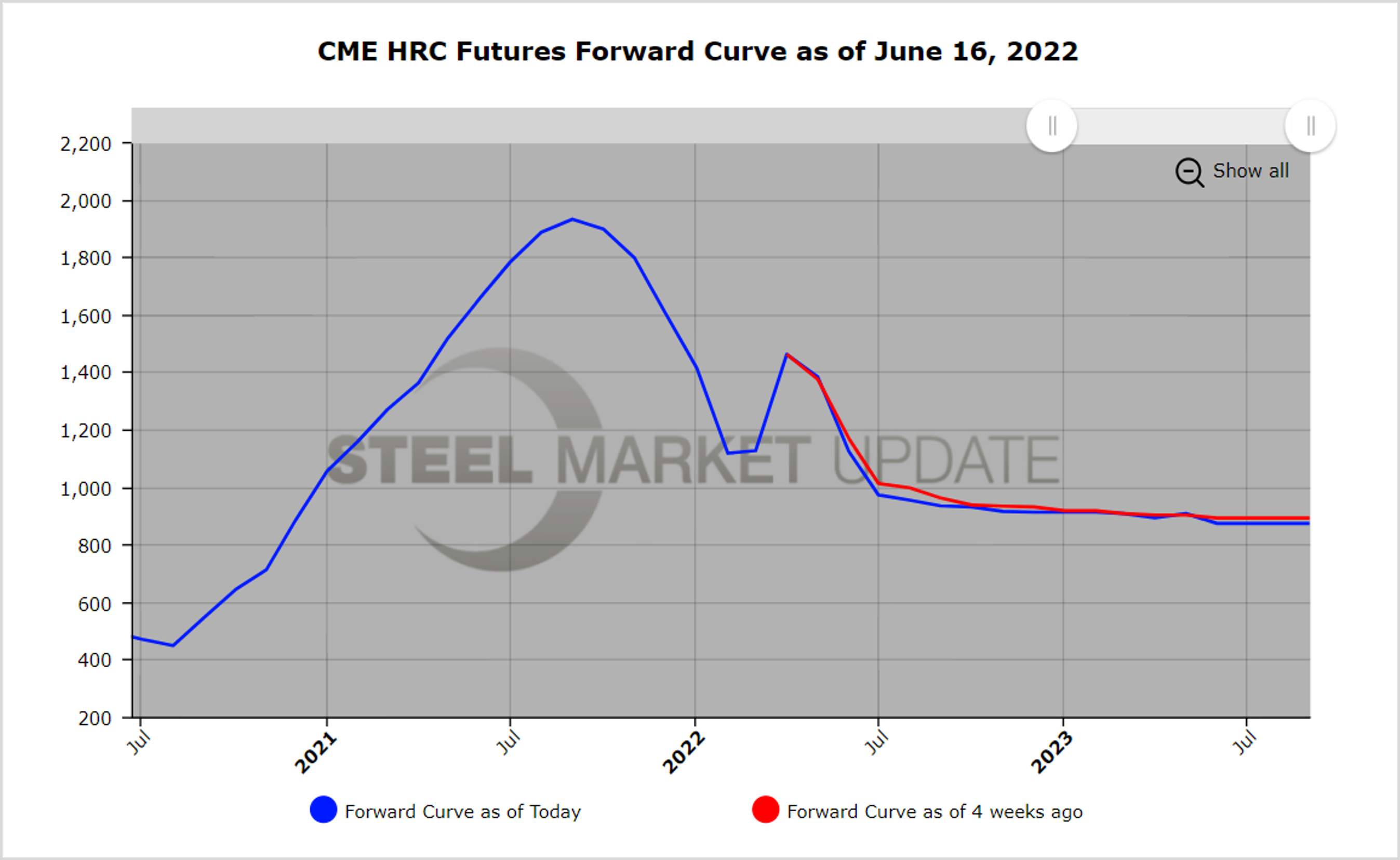

Scrap

BUS reflects a larger price move lower in the last month. Not only did the spot decline over $70 per gross ton (GT) from May to June settlement ($705.08 to $634.78) but the forward curve also shifted much lower. Q3’22 BUS declined an average of almost $87/GT to $515/GT, and Q4’22 BUS declined an average of $83/GT to $510/GT. The net effect of the faster falling BUS curve prices has helped to push the metal margin (HR minus BUS) higher.

The 2H’22 average metal margin price differential has increased on a settlement basis from roughly $365/ton to $427/ton.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features. You can do so by clicking here.