Market Data

June 27, 2022

SMU Survey: Most Think HRC Prices Heading Below $1,000/ton

Written by Michael Cowden

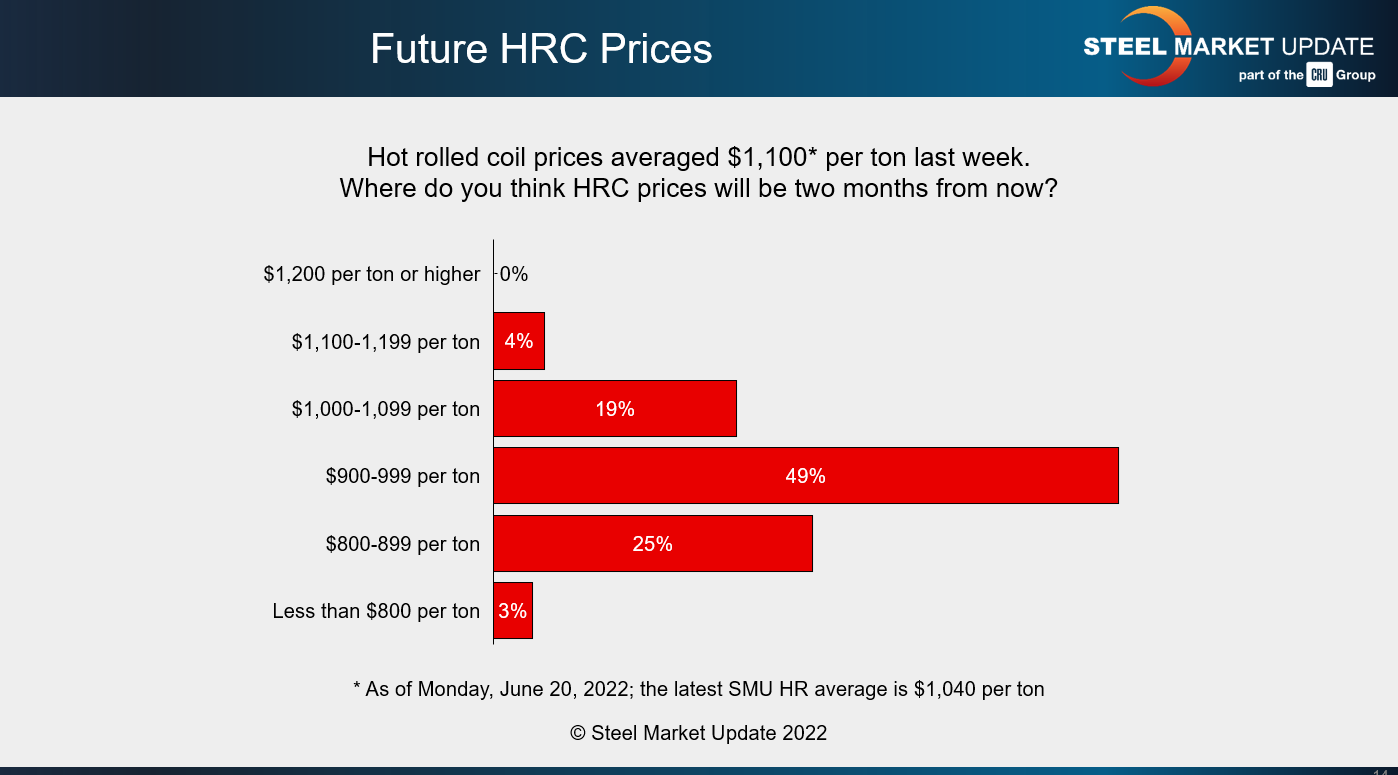

Most respondents to SMU’s latest survey think that hot-rolled coil prices will be below $1,000 per ton ($50 per cwt) two months from now.

That’s a big change from earlier this month, when we did our last full survey and when those who thoughts tags would dip below the $1,000-per-ton threshold this summer were in the minority.

Here is where things stand now:

Nearly half of survey respondents (49%) think HRC prices will be $900-999 per ton in late August. A sizeable minority (28%) think that prices could fall into the $800s per ton or lower. Only 23% think that prices will be above $1,000 per ton two months from now.

Note that just two weeks prior approximately two-thirds of respondents said prices in August would be $1,000 per ton or higher. Only about a third thought tags would drop below that level.

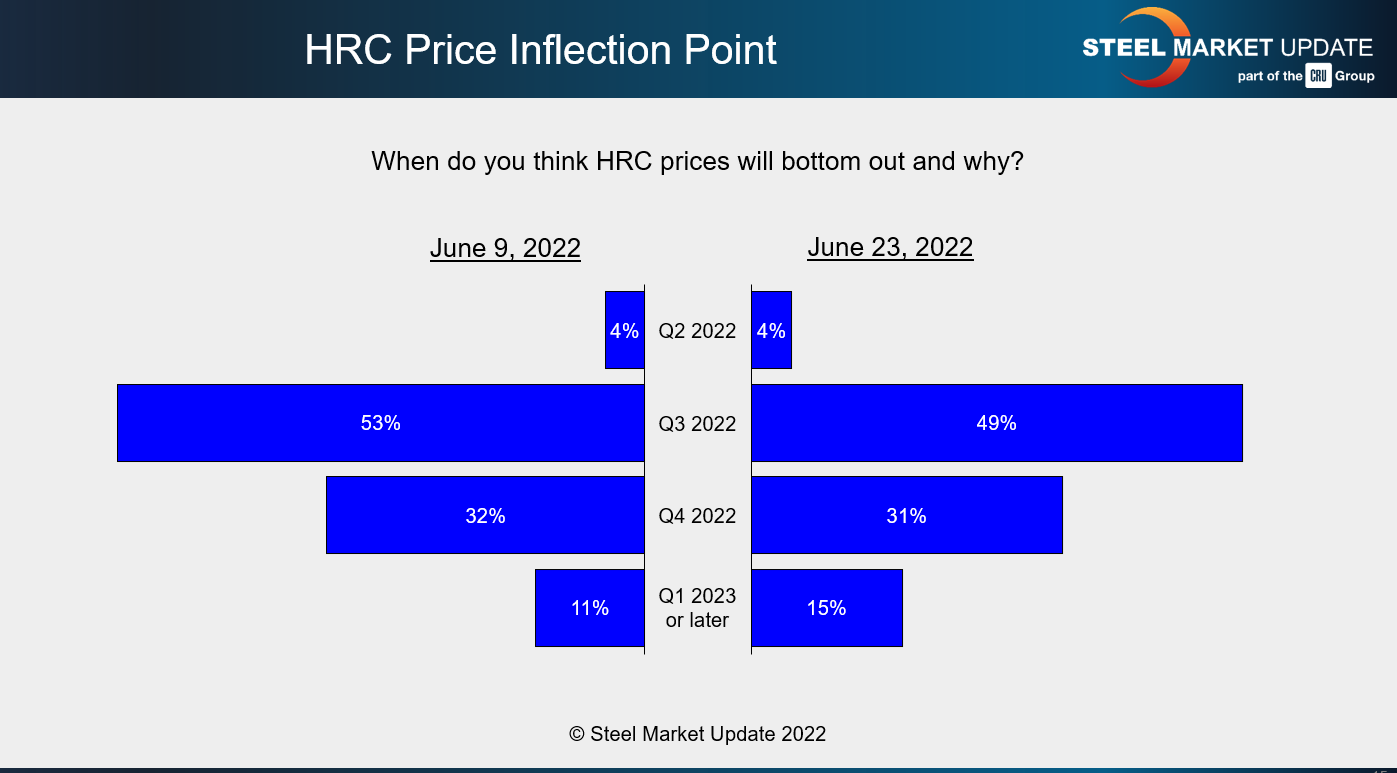

As for when steel prices might bottom, here is where things stand:

Nearly half of survey respondents (49%) continue to expect that a floor will be found in Q3. Approximately the same number (46%) think a bottom won’t be found until Q4 or until 2023.

Here is what survey respondents had to say about their new, lower predictions for steel prices and about when and why a bottom might be reached:

“I believe it gets below $1000 … but then union labor negotiations create a floor.”

“$800 give or take unless some capacity is taken down or a strike.”

“We will overcorrect near $800/ton, then bottom out. Demand still good but not great; most worried about recession.”

“Don’t catch a falling knife!”

“I am still hoping for a bottom in late July/early August in the early $900s. Fingers crossed it doesn’t go too far below that.”

“Service center inventory levels are low, and they will have to replenish stock.”

“Prices will bottom out in the next 45 days +/-.”

“Prices will drop through July, pick up a bit in Q3 and bottom in Q4.”

“4th QTR is typically slow and new capacity should be in full swing.”

“Nobody knows for sure. Eventually, excess capacity will be idled if prices drop too drastically.”

Talk of contract negotiations refers to those underway between the USW and steelmakers in both the US and in Canada.

SMU has picked up HRC transactions below $1,000 per ton. Our average HRC price was at $1,040 per ton when this article was filed. We will next update our prices Tuesday evening.

By Michael Cowden, Michael@SteelMarketUpdate.com