Product

August 30, 2022

SMU Steel Summit: Steel Prices, What a Ride

Written by David Schollaert

The steel and commodity price forecast panel – always a popular program at SMU’s Steel Summit – once again didn’t disappoint.

Speakers included three of the steel industry’s most respected analysts: Josh Spoores, CRU’s principal steel analyst, Timna Tanners, Wolfe Research’s managing director, and John Anton, S&P Global Market Intelligence’s director.

The sheet market today is clearly very different from a year ago, said Spoores. “Demand growth is slowing from year-ago levels, new supply is finally ramping up, and inventories remain in a surplus.”

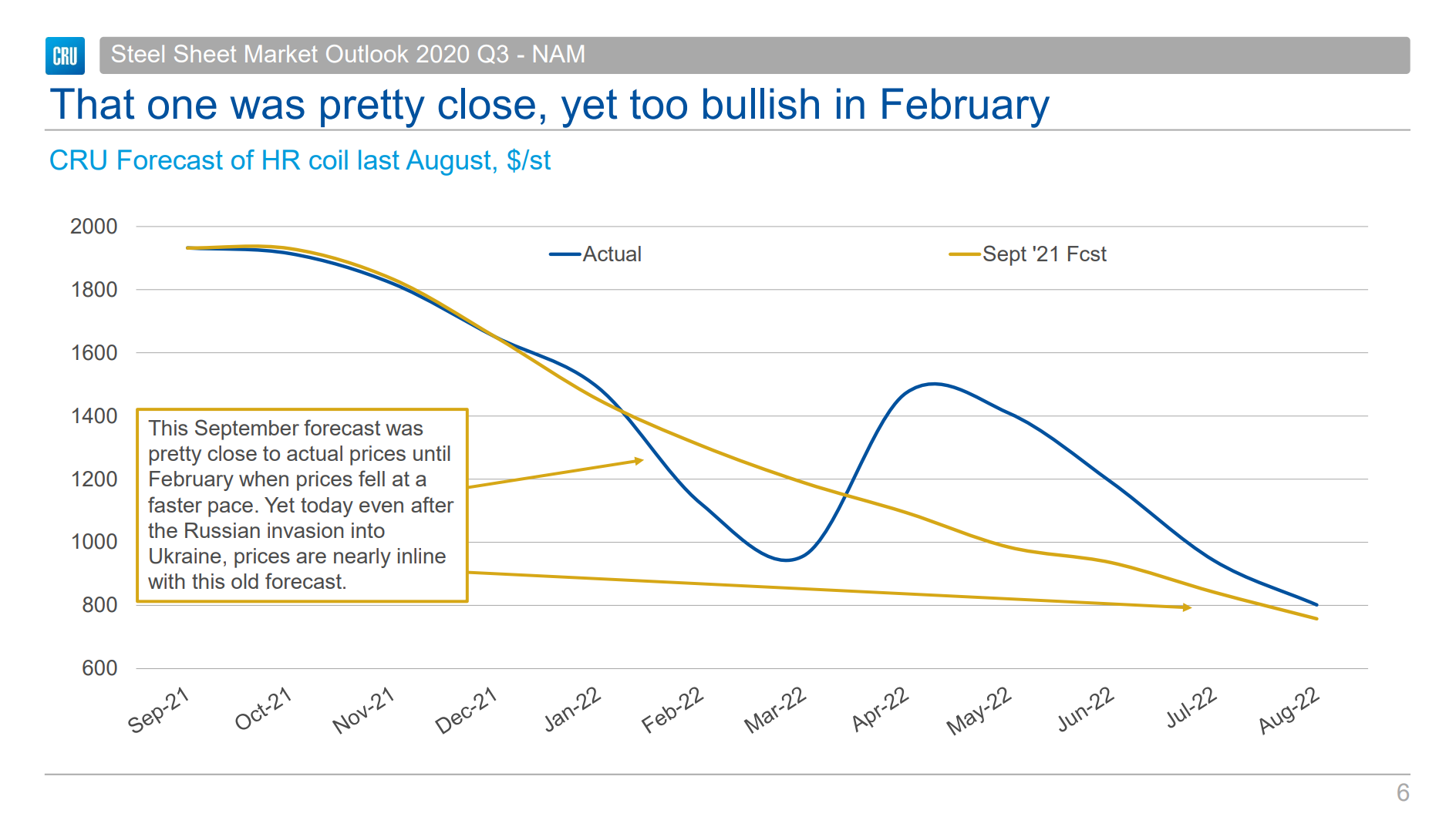

No one got the post-covid bonce right, said Spoores, but CRU’s revised forecast from September 2021 was pretty close to actual prices until February when tags fell at a faster pace due to the war in Ukraine. Following those sharp swinging, prices are nearly in line with the original forecast (chart below).

For Tanners, storm clouds have arrived and the new capacity scenario that’s been spoken of over the past few years is here. She said that new capacity is indeed the culprit for lower sheet prices in the US, and she anticipates that rebar may be next.

Spoores agreed, noting that mill shipments are now flat year-to-date (YTD) and new capacity is quickly ramping up. Service centers and shipments are down 4% YTD, and deeper data suggest that inventories are correcting, though they are still in surplus, he added.

Anton said that steel prices have given back almost all of the 2021 spike, adding that every downside risk came true. He said that prices are not back to their 2010-2019 averages but are getting close, with just some downside remaining.

All agreed that these dynamics will likely bring sheet prices back to a more historical spread over costs. Risks remain, though, on the upside and downside.

The first quarter is always risky, and this year could be worse, Anton said, adding that outside of a recession all risks are on the upside.

On the upside, some of the key drivers could be a faster-than-expected rebound in the automotive sector, while China’s post-lockdown stimulus could drive steelmaking costs higher.

Supply disruption whether it is operational, labor-related, or a lack of affordable inputs like energy could push prices higher, while stronger than expected demand from government-led infrastructure and green energy spending could surprise to the upside as well.

On the downside, slower than expected global economic activity, especially in China. Its zero-covid policies could stunt global growth and potentially disrupt supply chains.

Continued weakness in China’s construction sector further pressures steelmaking costs lower and global oversupply higher.

If metallics challenges aren’t resolved and Russia stays out of the picture in the long term, it could heavily impact steel. Tanners said that new pig iron and hot briquetted iron (HBI) options will only rive in 2024.

And if pockets of the US economy continue to struggle, it could be ripe for a slowdown. If the energy, automotive, and infrastructure sectors stack up against slower private construction, prices will be impacted.

By David Schollaert, David@SteelMarketUpdate.com