Prices

November 22, 2022

SMU Survey: Buyers See Hope of a Pricing Bottom

Written by Laura Miller

As hot-rolled coil (HRC) prices continue to trend lower and we approach the end of 2022, steel buyers are starting to see hopes of a pricing bottom, according to Steel Market Update’s latest survey results.

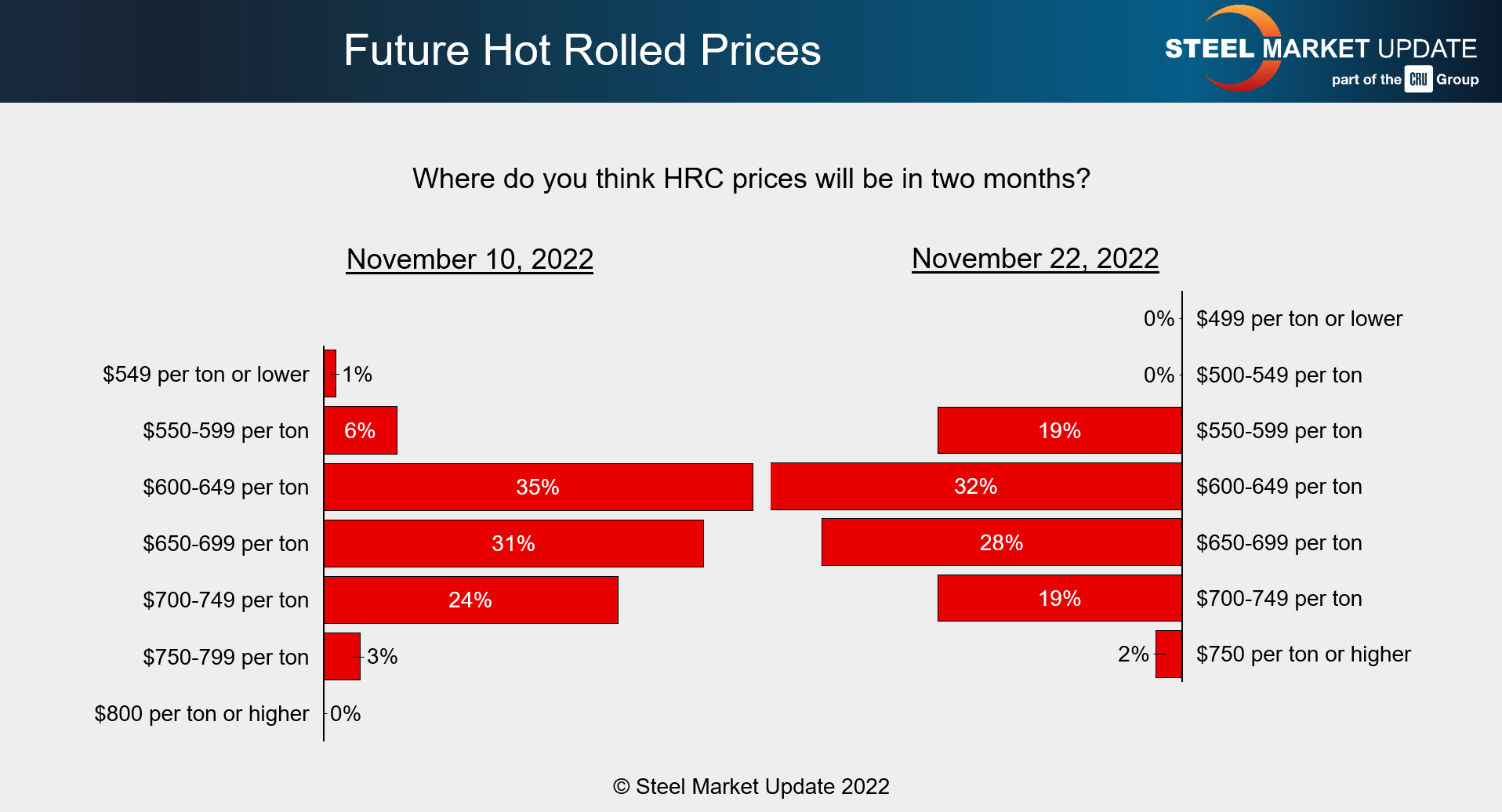

HRC prices this week declined for another consecutive week, with the average price of $615 per net ton, down $15 per ton week-on-week.

Rumors continue to be heard of a mill price hike coming any day now in hopes of stopping the price erosion. But the power of any price increase remains unclear with weak year-end demand. And HRC lead times, at an average of fewer than four weeks, have yet to push into January.

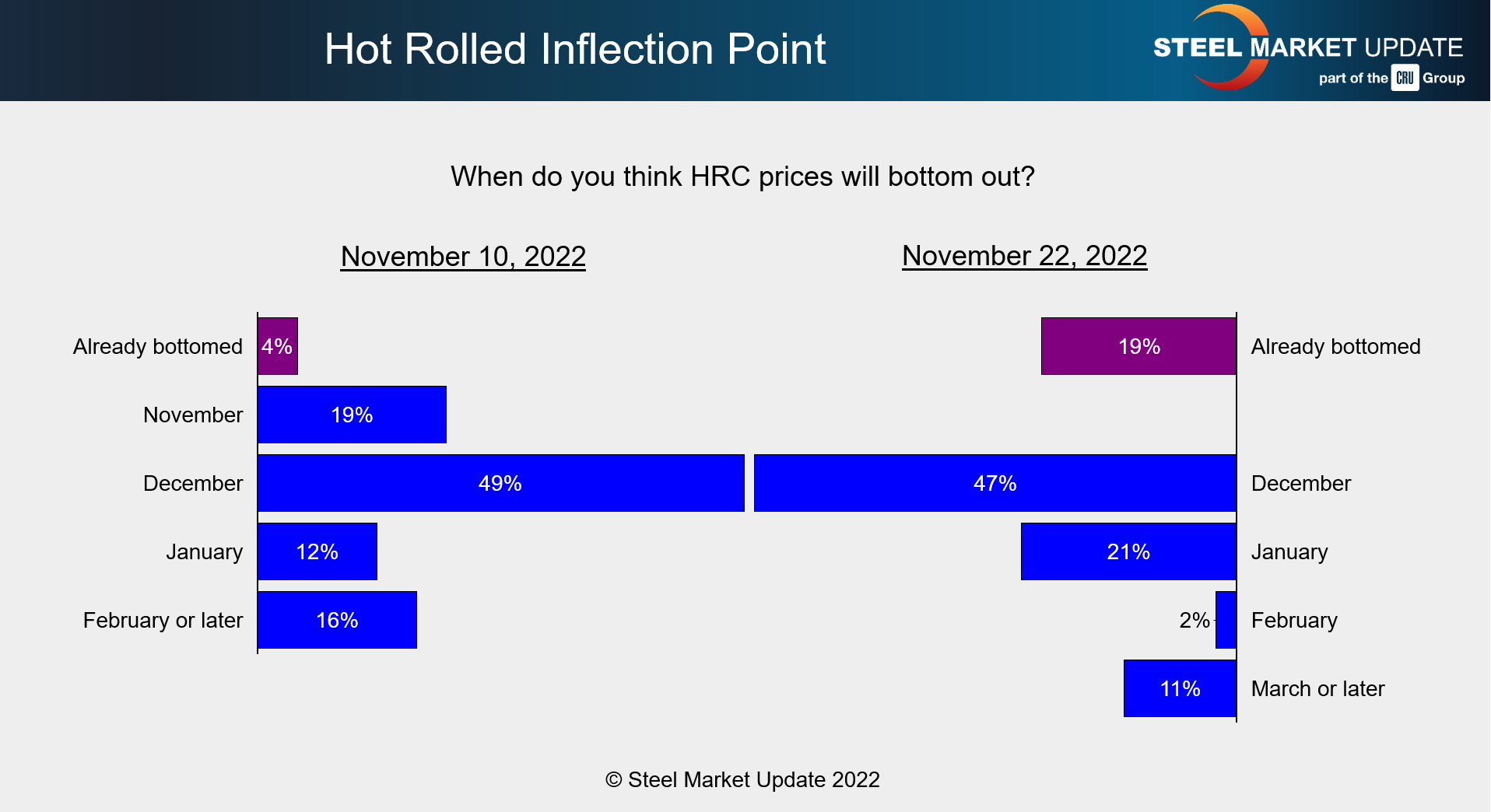

Nearly half of buyers surveyed by SMU this week believe prices will bottom in December and 19% believe prices have already found the low end of an inflection point.

Still, one buyer said, “For better or for worse, I think we still have some room left to move down. With lead times this short, the strength just isn’t there — regardless of whether we see a mill hike or two coming up.”

Prices are “bouncing around a bottom now,” said another. “If prices go too much lower mills will not make money as input costs are still high,” they pointed out.

More than half of surveyed buyers believe HRC prices will be somewhere in the range of $600-699 per ton two months from now. Only 19% believe they’ll be under $600 per ton and 21% believe they’ll be $700 per ton or higher.

One buyer commented that scrap prices are nearing a bottom and that the spread to HRC is so narrow now that mills will likely begin to attempt price increases. “Demand will return (albeit slowly) after the holidays, supporting a bottom and small bounce,” they predicted.

“At the first sign of [a price] increase,” said another buyer, “buyers will jump back into the market.”

Another respondent said demand is still too weak to raise prices and that mills will start to take capacity offline before they take orders at significant losses.

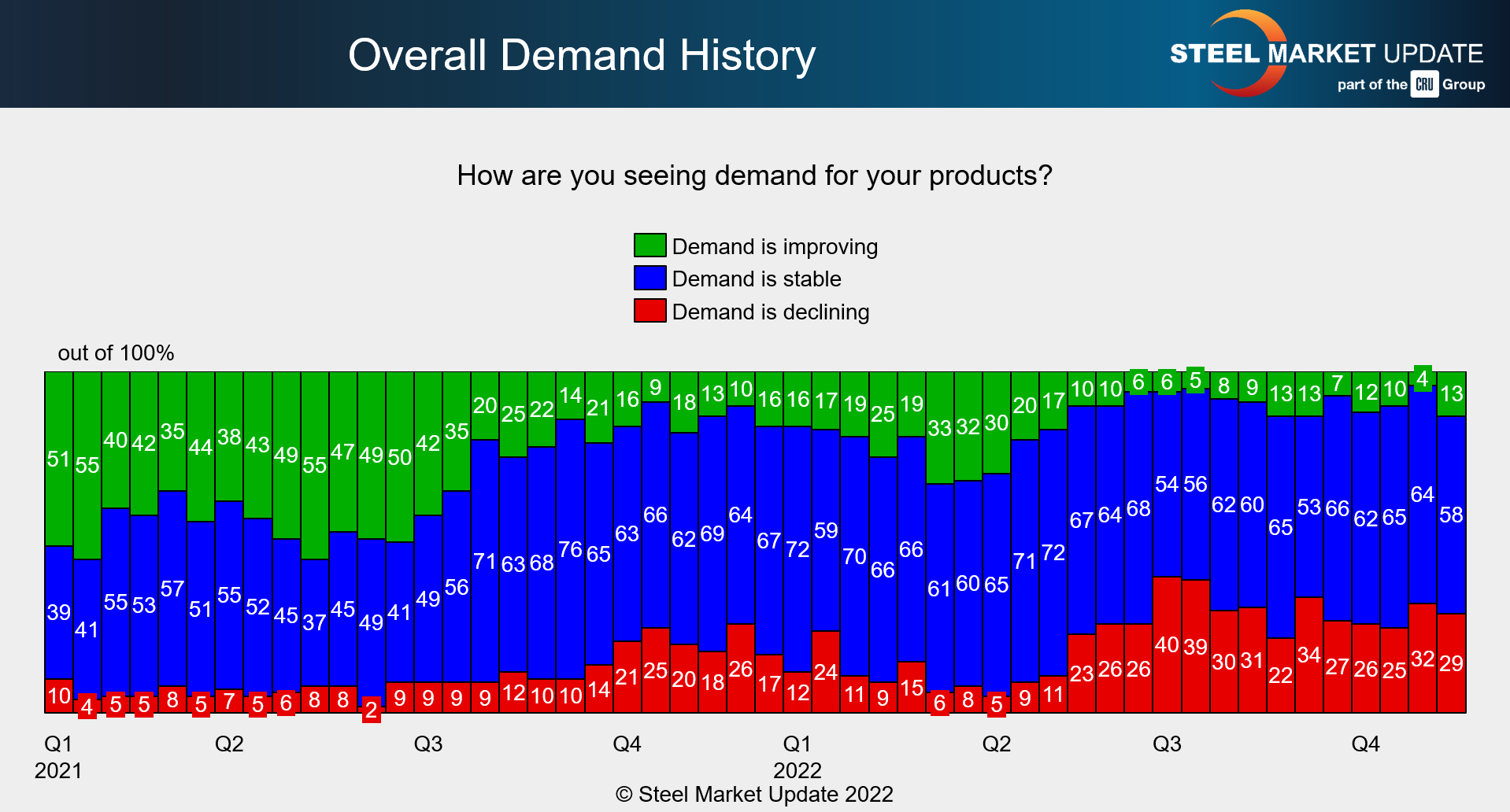

More than half of survey respondents said that current demand for their products is stable, while 29% noted declining demand and just 13% are seeing improving demand.

By Laura Miller, Laura@SteelMarketUpdate.com