Prices

March 9, 2023

HR Futures, Spot Prices Move Higher As Lead Times Extend

Written by Jack Marshall

What a difference a month makes in light of a difficult forecast environment for hot rolled (HR) prices. The mills have been raising HR spot prices faster than folks can track, and the futures appear to be in lockstep as lead times continue to extend. While steel capacity utilization rate seems stuck in the mid-70% range, HR production at a number of mills appears to be fairly robust. This suggests that demand is stronger than expected and even as supply is healthy.

The latest HR index pushed HR over $1,000/short ton (ST), but that is still lagging the latest $1,150/ST HR spot price being offered for spot from a number of the mills. Open interest in HR futures are starting to push higher in the last few days as new entrants put on positions/hedges. As of Thursday, open interest in HR was 26,550 lots, which is up from 24,250 lots just the previous Friday.

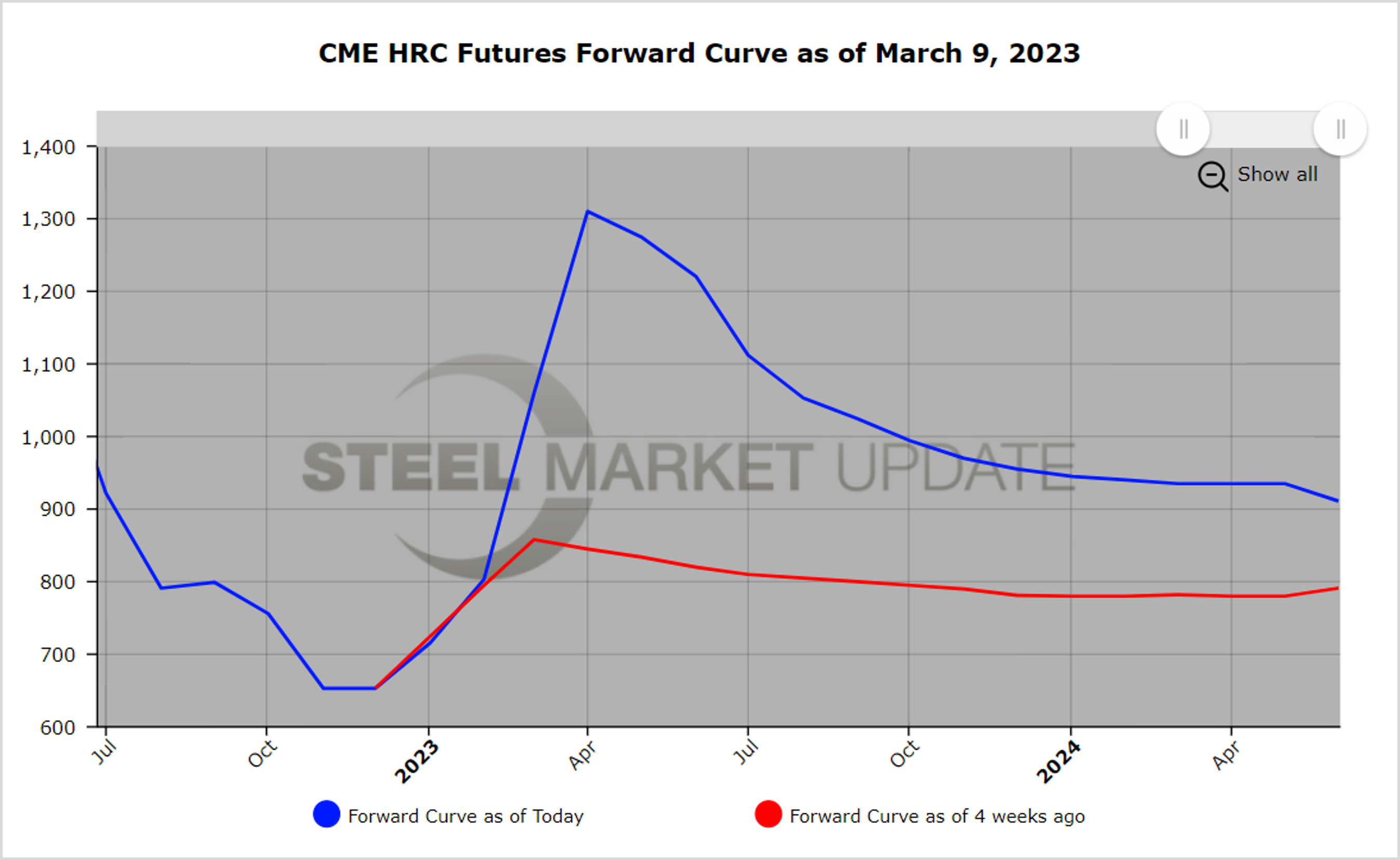

The futures curve is moving higher pretty quickly. For reference, Q2’23 HR settled at an average price of $833/ST on Feb. 9, and today, a month later, settled at $1,268/ST, up $435/ST. Q3’23 HR settled at an average price of $805/ST and today settled at $1,063/ST, up $258/ST. However, with this strong price surge in the nearby months the backwardation in the futures curve based on settles points to a market expectation that prices will retreat significantly by Q4’23. On Friday, the Q2’23 HR vs. Q4’23 HR settles put the spread at $295/ST back ( Q2’23 -$1,268/Q4’23 -$973). So far, picking a top in HR prices has proven to be a fool’s errand.

Since the HR price low in December, (Dec’23 CME settle $653/ST) the market price has risen almost $310/ST on the basis of March 2023’s current average. Given the current settles in the futures curve, the price reflects an inflection in the April-to-May period.

One thing to keep in mind is that momentum in a market typically overshoots most attempts to pick a turn. The last 18 months of HR market volatility highlights the difficulty in predicting the price and timing of market swings. And lately, high-velocity price moves have proven how difficult it is to forecast and hedge given the typical time it takes for businesses to make a decision about risk. Having a risk-management strategy in place that does not concern itself with predicting price swings but is ongoing and consistent within some predetermined parameters will likely be the center of many conversations going forward.

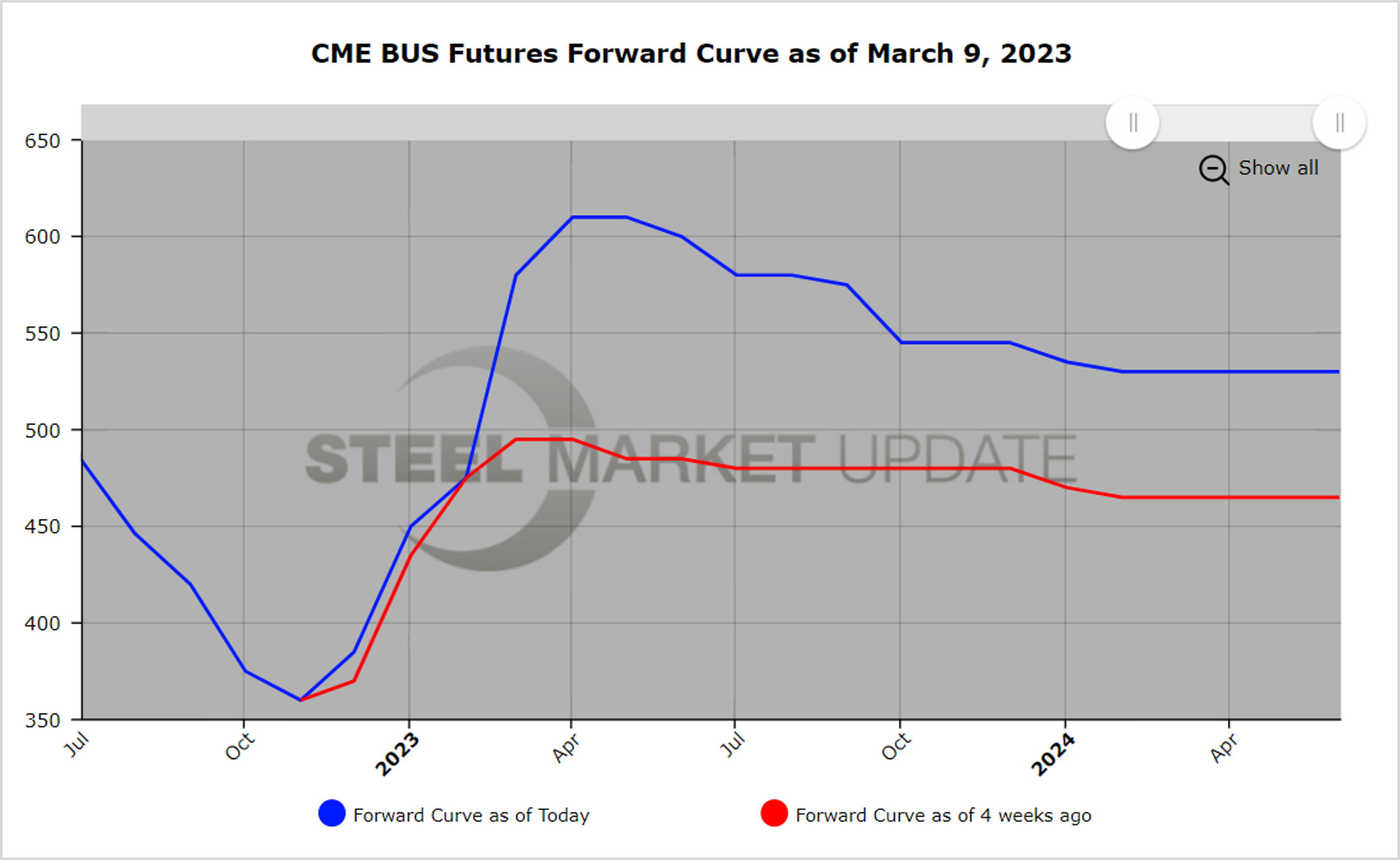

BUS is being pulled up by HR futures. Demand for prime scrap has not abated even as we enter March. Metallic dislocations continue to create shifts in demand. While the spread between prime scrap and obsolete scrap looks likely to widen back to more normal levels, strong mill demand has kept a floor under BUS. Mar’23 BUS will likely be up $80/gross ton (GT) from $475/GT Feb’23 settle given the late buying surge and better demand for 80/20 scrap for the export market. The low capacity utilization for steel does not appear to align with demand for prime scrap, which is likely due to a shift from pig iron.

By Jack Marshall of Crunch Risk LLC