Analysis

June 23, 2023

CRU: Weak Demand, Imports Push European Sheet Tags Down

European sheet prices have declined sharply by €112-146 per metric ton ($110-144 per net ton) month-on-month (MoM), around 12-18% across all sheet products.

In CRU’s latest assessment, German hot-rolled coil decreased by €125 MoM to €689 per metric ton ($680 per net ton), while Italian HR coil saw a drop of €146 to €657 per metric ton ($648 per net ton). Prices have fallen by 20-23% since their peak in mid-April.

Market participants anticipate a significant increase in imports over the coming months as buyers take advantage of competitive import offers. Earlier this month, HRC import offers from Egypt, Turkey, and Vietnam were around $640 per metric ton ($632 per net ton) CFR for September delivery, but these offers have now increased to approximately $700 per metric ton ($691 per net ton) CFR in reaction to higher Chinese prices.

Demand in Europe has weakened significantly, with limited spot transactions observed over the past month. Buyers are adopting a cautious approach, anticipating further price declines in the near term.

European Steel Prices Approach Potential Bottom Amid Chinese Price Hikes

European mills have been forced to decrease their prices to remain competitive against cheaper import offers. While it remains uncertain when the market will reach a bottom, market participants noted the recent Chinese HRC price hikes and subsequent rise in iron ore prices may provide a level of support for prices.

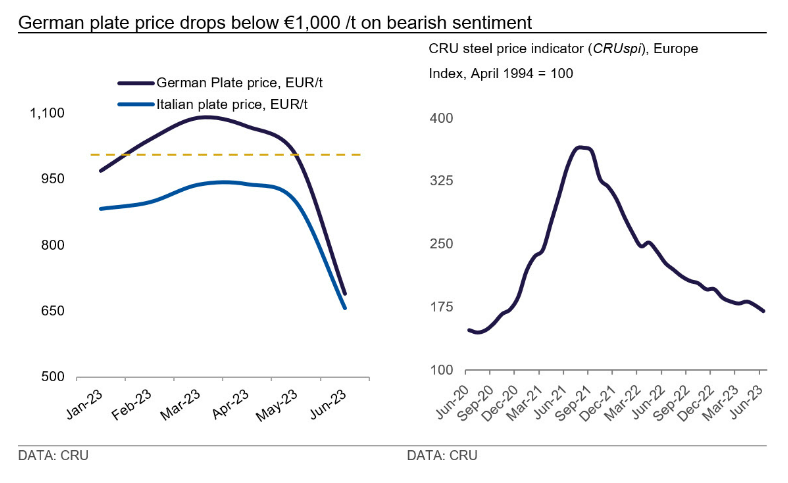

Bearish Market Sentiment Drives Decline in Plate Prices

Plate prices in Europe have fallen sharply by €99 and €127 per metric ton MoM in Germany and Italy, respectively. Market sentiment is bearish as buyers purchase hand-to-mouth as they anticipate further price declines. German prices have fallen below €1,000 per metric ton for the first time since their peak in mid-March to €905 per metric ton ($894 per net ton). Meanwhile, the Italian market continues to experience weak demand with the latest price at €771 per metric ton ($762 per net ton).

Longs Prices Pressured by Weak Construction Demand

Weak demand in Europe drove prices further down for long products as well. Rebar and structural prices declined MoM due to struggles in the construction sector. Average rebar in Central and Southern Europe were assessed at €610-655 per metric ton, with reports of trades as low as €590 per metric ton. Merchant bars traded between €780 and €830 per metric ton delivered, while LC wire rod prices were assessed at €620 to €660 per metric ton delivered. Mills have high inventory levels, and stockholders hold more than sufficient inventory relative to demand.

This article was originally published on June 21, 2023, by SMU’s parent company CRU in its Steel Monitor.

By Arismende Dos Santos, CRU research analyst