Market Data

June 25, 2023

SMU Steel Demand Index Down Further, Hits Seven-Month Low

Written by David Schollaert

Editor’s note: Steel Market Update is pleased to share this Premium content with Executive members. For information on how to upgrade to a Premium-level subscription, contact Lindsey Fox at lindsey@steelmarketupdate.com.

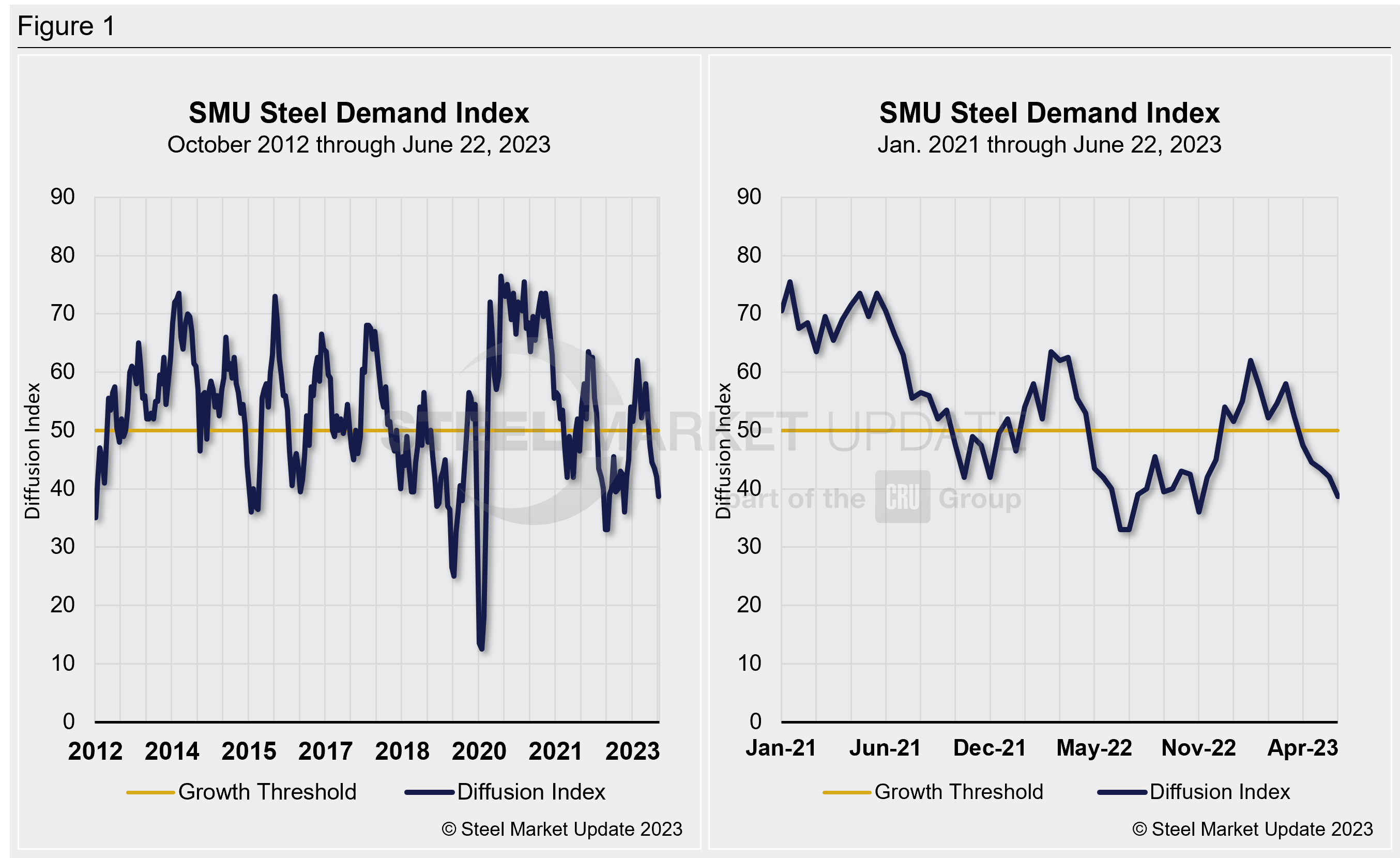

Steel Market Update’s Demand Index reached a seven-month low this past week, according to the latest survey data. Apparent demand for flat-rolled steel in the US has now been in contraction territory since late April and trending down.

SMU’s Steel Demand Index now stands at 38.7, down 3.4 points from the reading earlier in June, and down 23.3 points from the recent high of 62 reached in February. It has now declined repeatedly since the start of April, and sits at the lowest total since registering 36 last November when hot-rolled coil pricing bottomed out at $616 per ton ($30.80 per cwt).

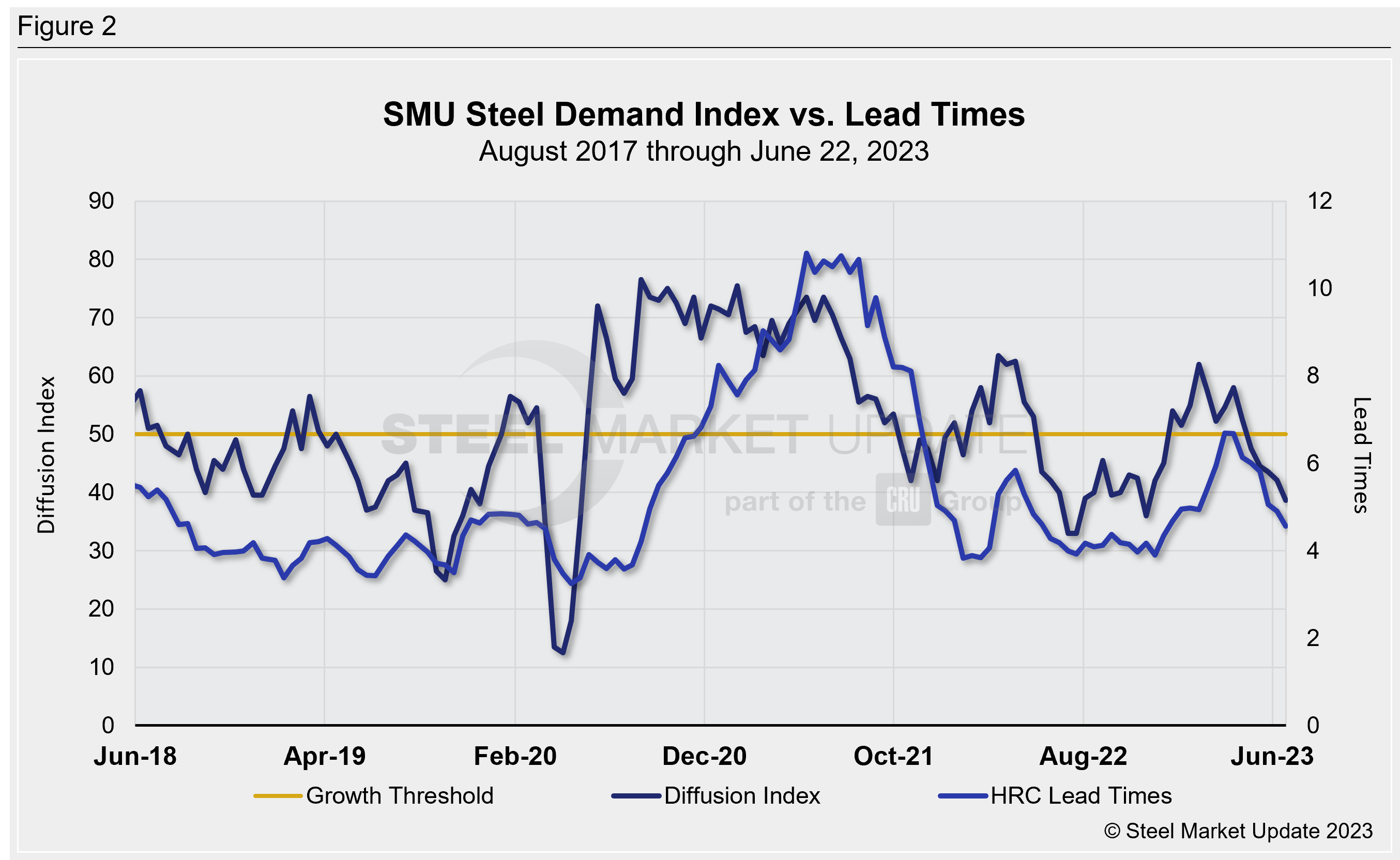

The index, which compares lead times and demand, is a diffusion index derived from our bi-weekly market surveys. This index has historically preceded lead times, which is interesting given that lead times are often a leading indicator of steel price moves.

Consider the data below. As noted above, an index score higher than 50 indicates an increase in demand and a score below 50 indicates a decrease. Detailed side-by-side in Figure 1 are both the historical views and the latest Steel Demand Index.

The reading is especially notable given that sheet prices have continued to fall due to discounting ahead of a round of mill price hikes announced nearly two weeks ago.

Market talk is mixed on whether the price hike carousel of $50 per ton ($2.50 per cwt) would stick, but it has not yet produced a shift in the demand index.

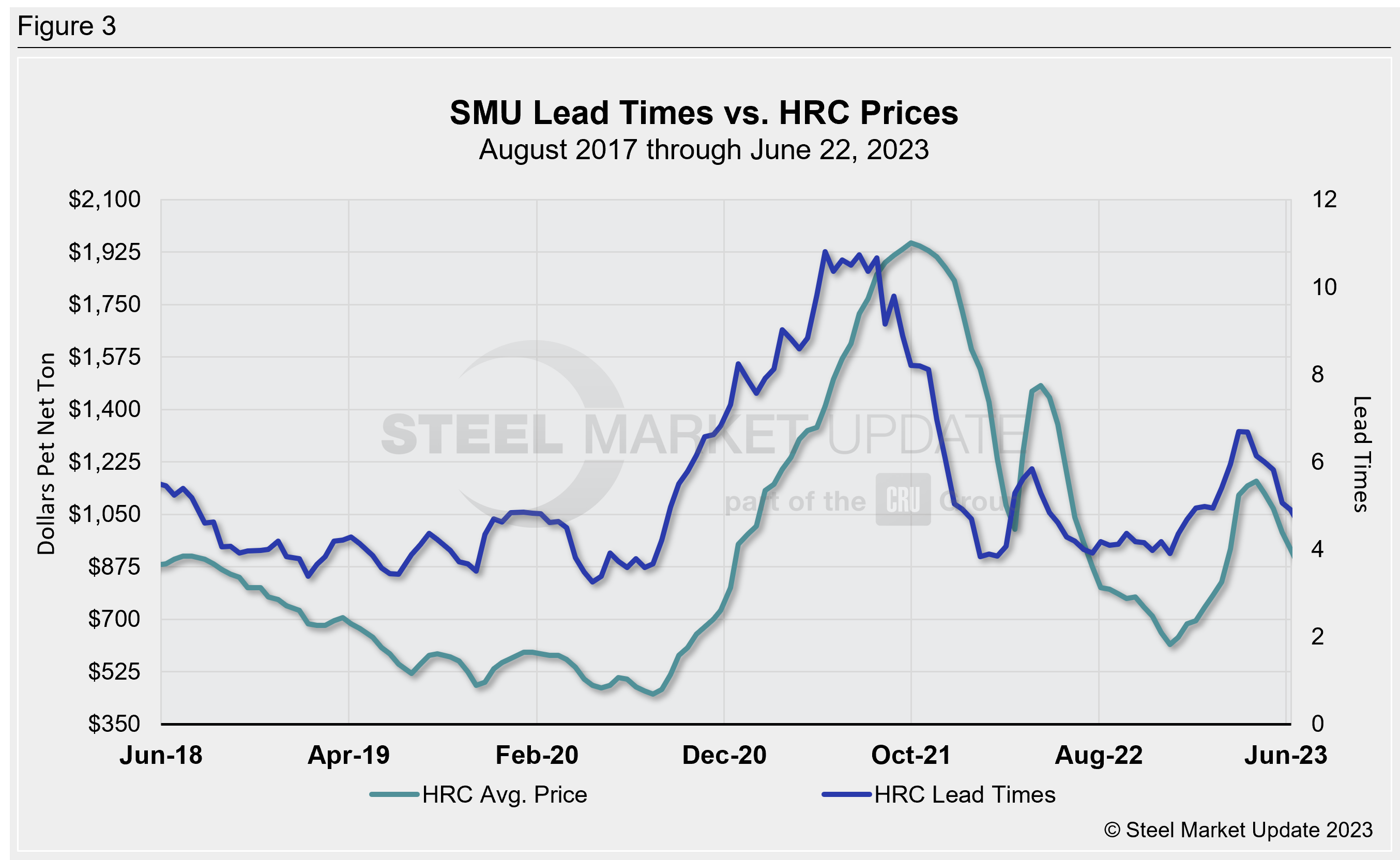

SMU’s latest check of the market on June 20 places HRC at $875 per ton ($43.75 per cwt) on average FOB mill, east of the Rockies, according to our interactive pricing tool. Hot band is now down $285 per ton since reaching the recent high of $1,160 per ton in mid-April.

There are still questions on whether low inventory levels and steady demand could provide some support to mills’ position. Yet the timing is curious, according to others, given June scrap settling lower and short mill lead times.

SMU’s demand diffusion index has, for nearly a decade, preceded moves in steel mill lead times. (Figure 2 shows the past five years.) Historically, SMU’s lead times have also been a leading indicator for flat-rolled steel prices, and HRC prices in particular. (Figure 3 features the past five years.)

Our hot-rolled lead times average approximately 4.5 weeks, down from 4.9 weeks in early June and off from a recent high of 6.7 weeks in mid-March.

The takeaway: Mills seem to have drawn a line, trying to set a base price for flat-rolled products, potentially putting a stop to price erosion. Market indicators from our survey respondents, steel buyers—mainly OEMs and service centers—are still trending down. These readings, however, might not have yet captured the ripple effects from the latest round of mill price hikes. We will closely monitor our forthcoming survey results in early July to see if the move made by North American mills indeed provides some lift to prices, or if fundamental demand is in fact trending down ahead of a slower summer market. Time will tell.

Note: Demand, lead times and prices are based on the average data from manufacturers and steel service centers who participate in SMU market trends analysis surveys. Our demand and lead times do not predict prices but are leading indicators of overall market dynamics and potential pricing dynamics. Look to your mill rep for actual lead times and prices.

By David Schollaert, david@steelmarketupdate.com