Analysis

December 12, 2023

Final thoughts

Written by Michael Cowden

Steel is up again this week. Scrap is up by a lot this month: $85 per gross ton for busheling, by our calculations.

Let’s put that huge gain in December scrap prices context.

Cleveland-Cliffs sparked the current bull market for sheet when it announced it was seeking a minimum of $750 per ton hot-rolled coil (HRC) on Sept. 27. The steelmaker announced just last week that it was seeking $1,100 per ton for hot band. (You can follow along with SMU’s price increase calendar.)

That’s a targeted gain of $350 per ton. And you could make the case that it’s more like $450 per ton given that our HRC price was $645 per ton on average when that first September increase was announced.

So, yes, scrap is up a lot. But steel is up a lot more. And even if higher coil costs are largely why scrap has gone up by so much, I wouldn’t be shocked if we see those very costs used to justify additional sheet increases.

And make no mistake, mills are dug in around $1,100/ton for HRC and $1,300/ton for cold-rolled and coated. Buyers might say, “Yes, but there are few tons transacting at those levels.” Mills might say, “Not yet. But just wait until buyers are ready to commit to booking February HRC.”

In other words, I wouldn’t be surprised if Ethan Bernard’s holiday poem about steel prices proves to be an accurate forecast of steel prices for Christmas and New Year’s.

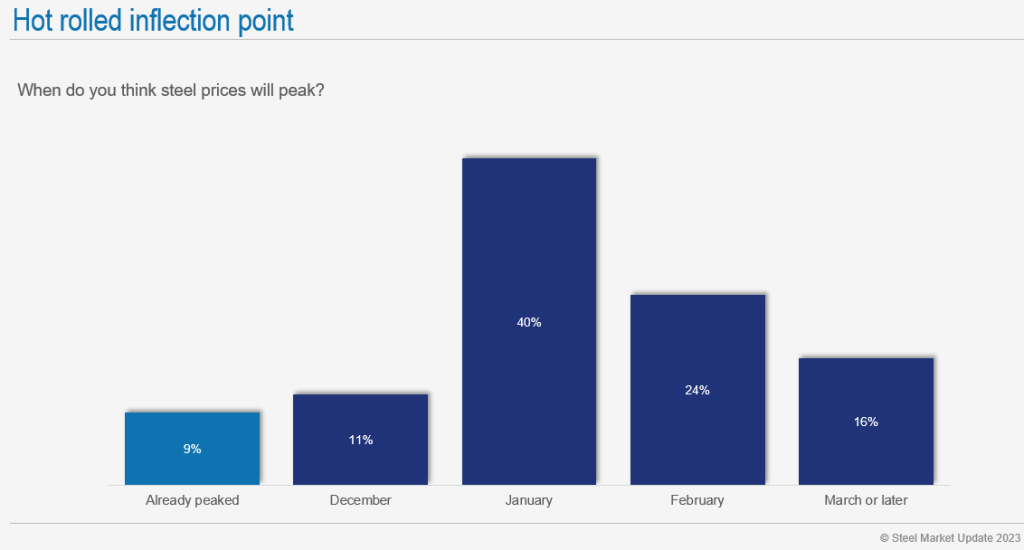

But I continue to hear from some of you that prices might peak in Q1. That’s also what our latest survey results reflect:

Most people think prices will peak in January or February. That makes some sense.

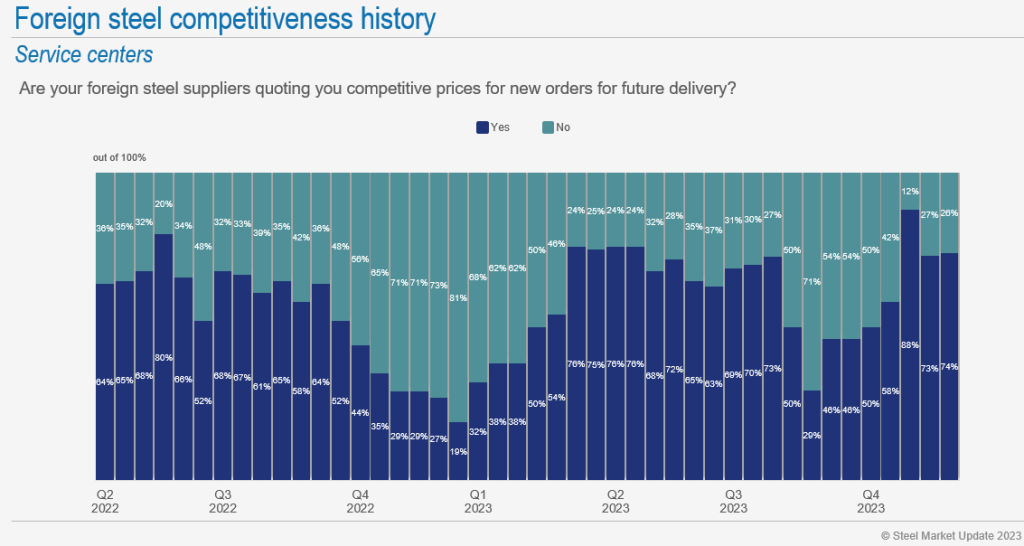

Imports fell to their lowest level in nearly three years in November. That’s probably supporting high domestic prices now. But imports arriving last month would have been ordered in September. That’s when US prices were among the lowest in the world, which explains why not much arrived from abroad last month.

We’ve seen more interest in imports over the last six weeks or so, especially as the gap has widened between US sheet prices and those abroad:

So why do people think US sheet prices will peak in January-February? Tack current lead times onto a date in January or February – and that puts you into Q2. Q2 is also when US mills could come under pressure from competitively priced imports slated to arrive in roughly March-May.

Maybe imports ordered for spring delivery will start to eat into mill order intake at some point in Q1. I can’t tell you how many tons of imports might arrive in Q1 and Q2. I think it’s safe to assume that material from Asia might not make a significant impact in Q1. That’s especially true with congestion in the Panama Canal adding approximately two weeks, I’m told, to lead times for imports from the region.

That said, I’m also told to keep an eye on import licenses starting in late December and in January. My understanding is that some US buyers bought material from Europe in October – and that should start showing up in import license data in late December and January.

We should also see material ordered this fall – whether from domestic mills or from foreign producers – arriving into service center inventories. We’ll release figures for November service center inventories to our premium subscribers on Dec. 15. Could we see inventories tick upward for the first time since July? We’ll see.

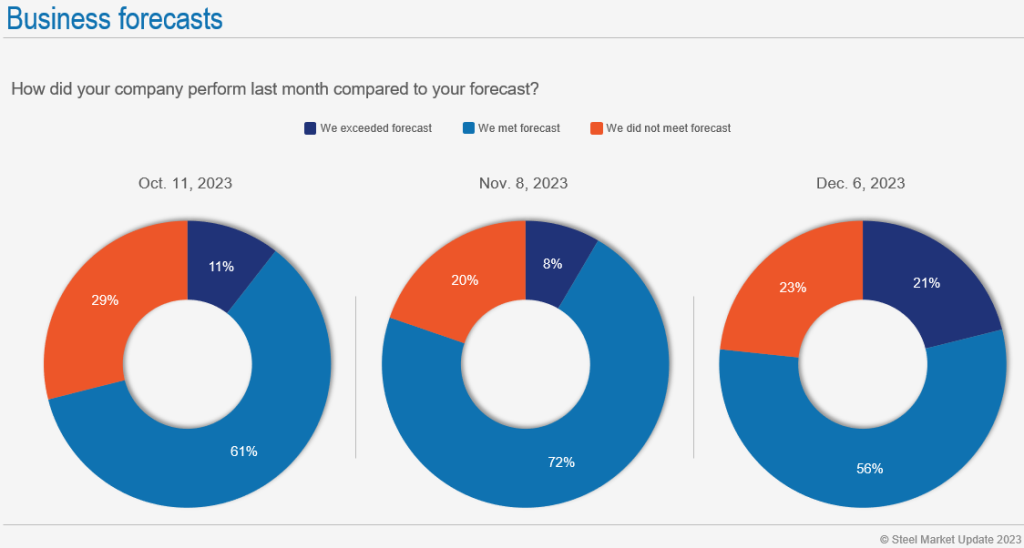

The good news? Most of you continue to report that you’re meeting or exceeding forecast:

And that’s remained true despite some worrisome big-picture data points – like the ISM Manufacturing PMI being in contraction since October 2022, and the ABI declining for five consecutive months.

My Christmas wish is that the trend of meeting or exceeding forecast continues for all of us!

What’s in store for 2024?

SMU doesn’t do forecasts. So we’ve asked our readers to say what the New Year might bring.

We’ve had some good responses to date. If you haven’t added your voice yet, it’s not too late. We’ll keep the survey open until the end of this week.

Tampa Steel Conference

Don’t forget to register for the Tampa Steel Conference before the end of the year. It will be held on Jan. 28-30, 2024, at the JW Marriott Tampa Water Street.

We’re on track to beat last year’s record attendance. And our room blocks are almost entirely sold out.

If you can’t find a room at the conference hotel, consider some of these alternatives:

Embassy Suites – Convention Center