Government/Policy

January 26, 2024

December marks second slowest month for imports in 2023

Written by Laura Miller

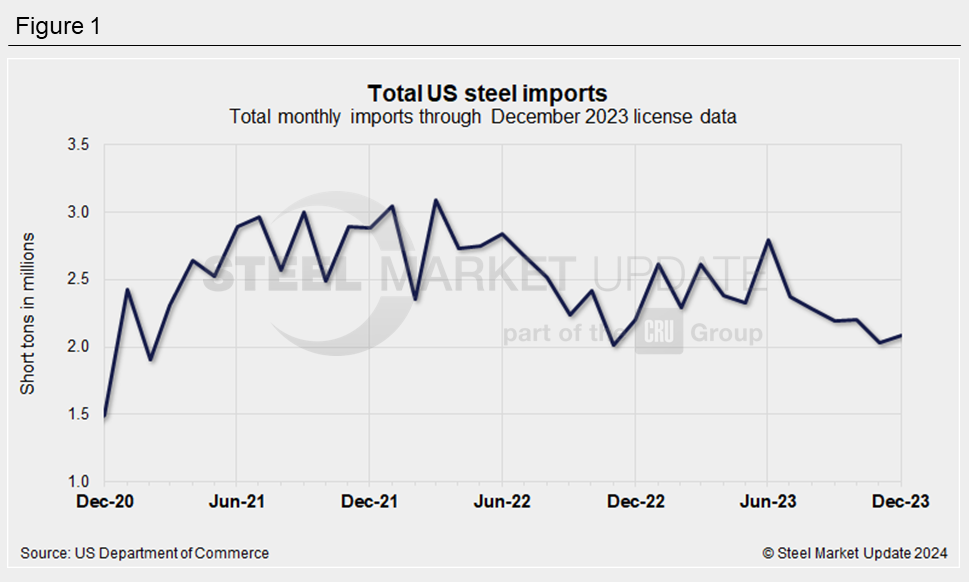

December’s import level was slightly lower than an earlier license count had suggested, resulting in December marking the second-slowest month for imports in 2023.

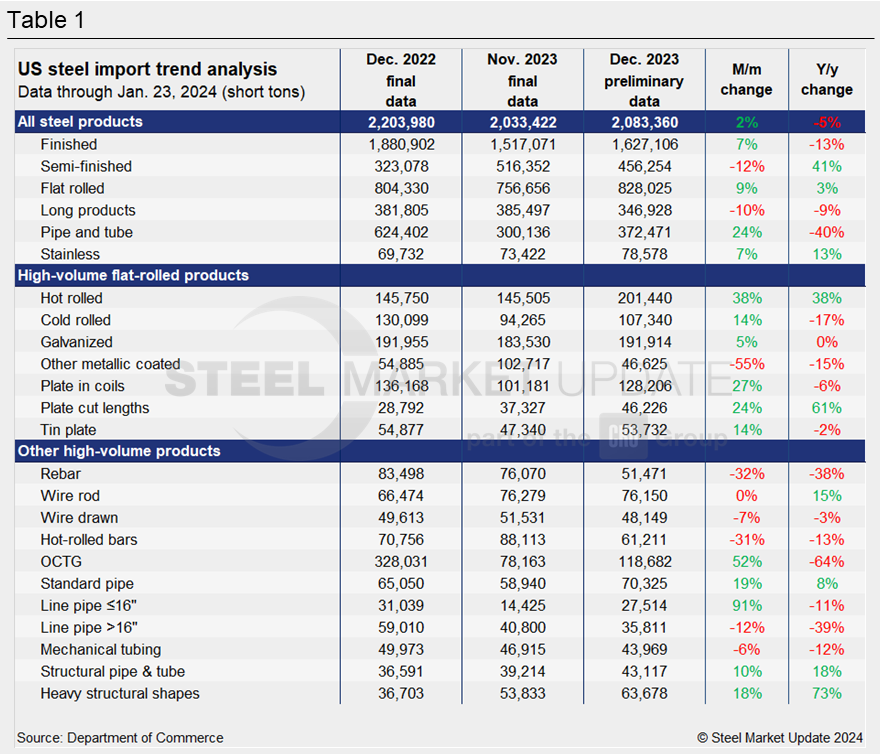

The US Commerce Department’s preliminary count shows 2,083,360 short tons (st) of steel products entered the country in the last month of 2023. This was a 2% increase from November’s final tally of 2,033,422 st, but a 5% drop from December 2022.

Imports as a 3MMA

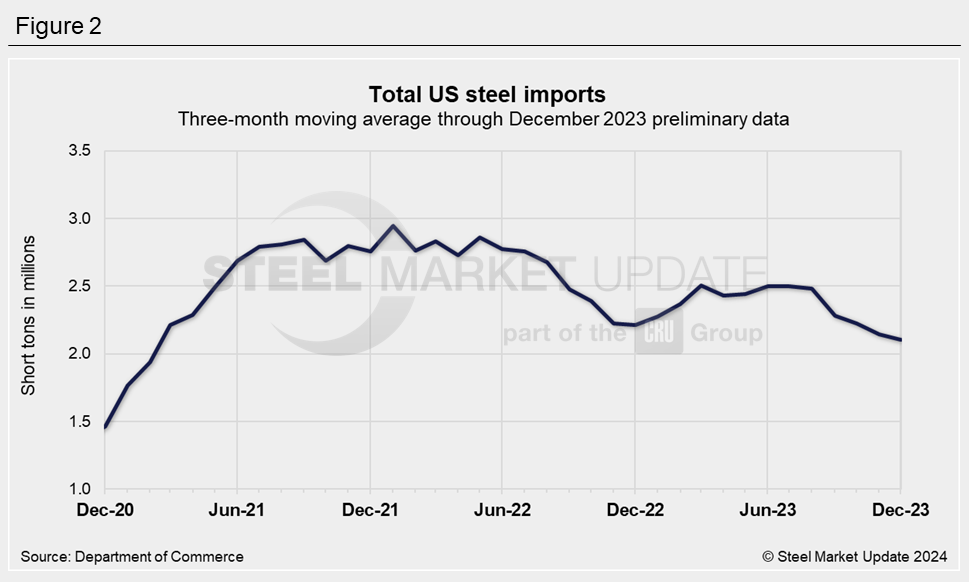

Looking at imports on a three-month moving average (3MMA) basis to smooth out the variability in monthly readings, we can see imports slowing in the latter part of 2023.

Semi-finished and finished steel

Imports of semi-finished steel slowed 11% from November to 456,254 st in December. While slab shipments from Brazil declined to a four-month low of 179,658 st, slab imports from Mexico were at a three-month high of 63,255 st. Of note in the data is 11,379 st of slab imports from Japan in December compared to no slabs coming from that Asian country in the prior four months.

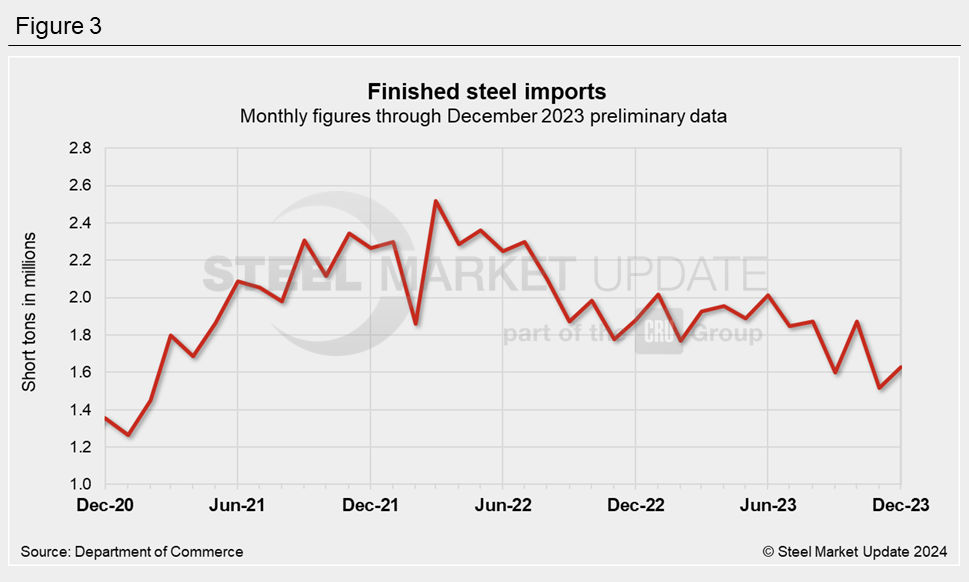

Meanwhile, finished steel imports, at 1,627,106 st in December, increased 7% month on month (m/m) from November’s 33-month low.

The American Iron and Steel Institute (AISI) estimated the finished steel import market share to be 20% in December and 21% for all of 2023.

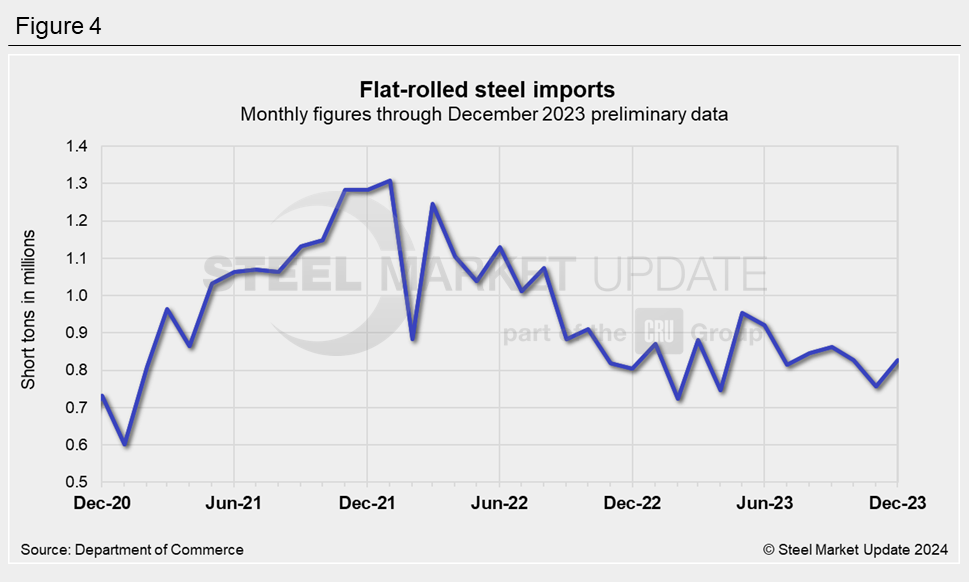

Flat-rolled steel

After falling to a seven-month low in November, flat-rolled steel imports bounced back to 828,025 st in December – a three-month high.

Hot-rolled sheet imports were also at a three-month high on noticeably higher shipments from Canada, South Korea, and Brazil. Canada’s hot rolled shipments to the US were at a six-month high of 105,408 st.

Significant suppliers of cold-rolled sheet in December included Canada, Australia, South Korea, Brazil, and the Netherlands. Shipments from Mexico, meanwhile, were at a recent low of just 3,001 st.

December imports of galvanized sheet and strip were at a seven-month high of 191,914 st. The countries supplying the most galvanized in December were Canada, Mexico, South Korea, Brazil, and South Africa.

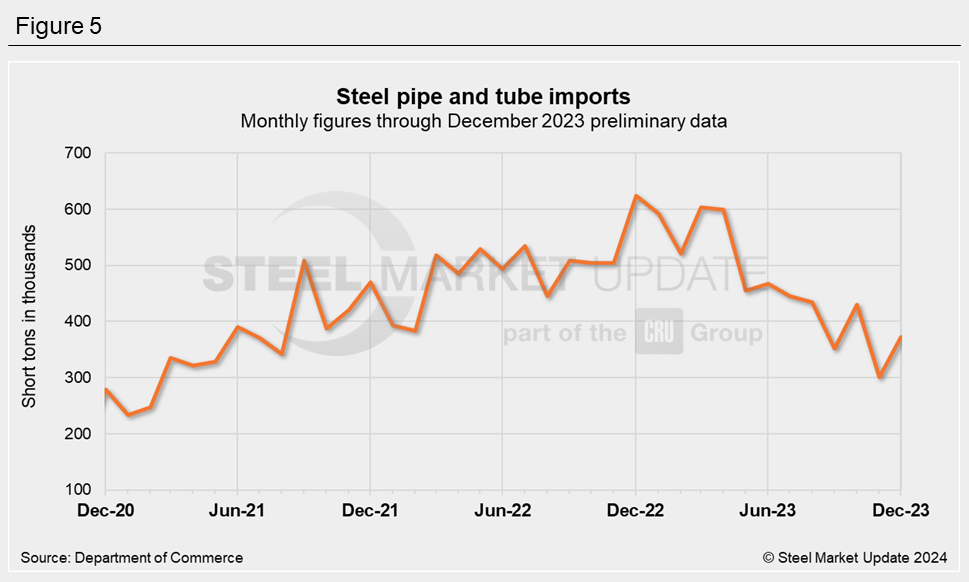

Pipe & tube

December’s preliminary count of pipe and tube imports, at 372,471 st, was 8% lower than the license count of 405,705 st.

After hitting a three-year low of 78,163 st in November, OCTG imports jumped to 118,682 st in the last month of the year. Shipments from South Korea, Austria, and Brazil were considerably higher.

Imports by product

The chart below provides further detail into imports by product, highlighting high-volume steel products.